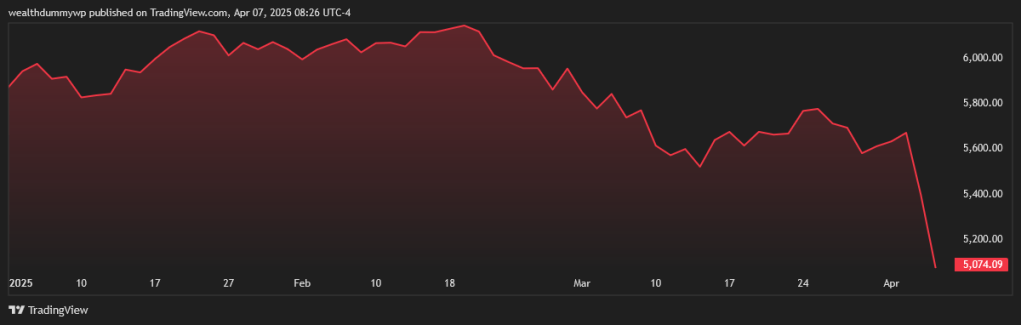

These days the stock markets are selling-off like crazy. All the tariff talks were a catalyst for the shares across the globe to go significantly lower. Let`s start our story with a snapshot of the year to date performance of the S&P 500:

At the time of writing the S&P 500 is down about 14% year to date. In my view, a very bad performance in the beginning of the year for the broader market. Such levels of market panic were achieved during the crisis of 2008 and during the pandemic. Is the current market behavior an overreaction? Currently, I don`t know. The time will tell. I won`t be making predictions. Instead, I will share with you the moves that I made within my portfolio.

Of course, my own portfolio is also down. Fortunately, my year to date performance is -9.15%. This means that I am slightly outperforming the index by almost 5%. It turns out that selling some of my US stocks at the end of last year was a good decision. In the beginning of 2025 I made some additional sales. Don`t get me wrong. I didn`t sold my entire US stock portfolio. I was just taking some profits off the table. I am still heavily invested in the US stock market.

In regards to the recent sell-off. I didn`t panic. I am a long term investor, so such events are opportunities in my view. However, it was a decent moment to check if my portfolio can benefit some rebalancing. I saw some opportunities and in this post I will share with you my moves. Without more further ado let`s start our discussion.

1. Ally Financial, ticker ALLY

I sold my position entirely. My average buying price was $25.70. I sold slightly above $30, so I was closing profits. I still like the company and its potential. I decided to sell for two reasons. First, the price chart:

On the ALLY`s monthly price chart, I am seeing a negative trend. For sure, I could`ve waited for some recovery, but I decided that I don`t want to take the risk. The second reason why I sold ALLY is the revenue sources. A big part of the company`s revenue comes from Automotive Finance. I do have some concerns regarding the future developments in the industry. Despite that, Ally Financial is a great business for me. It will be on my watchlist. If the price ever comes down I will try to build a position again at a lower level.

2. Kraft Heinz, ticker KHC

I invested the capital that I have received from selling ALLY into Kraft Heinz. This was not my first purchase of KHC shares. I was adding to my position. The reason why I swapped ALLY for KHC is that Kraft Heinz is a consumer defensive stock. With all the uncertainty in the markets I prefer adding to the conservative side of my portfolio. Also the KHC`s dividend yield is better than the ALLY`s. I wrote a detailed analysis on Kraft Heinz, which you can find in my blog.

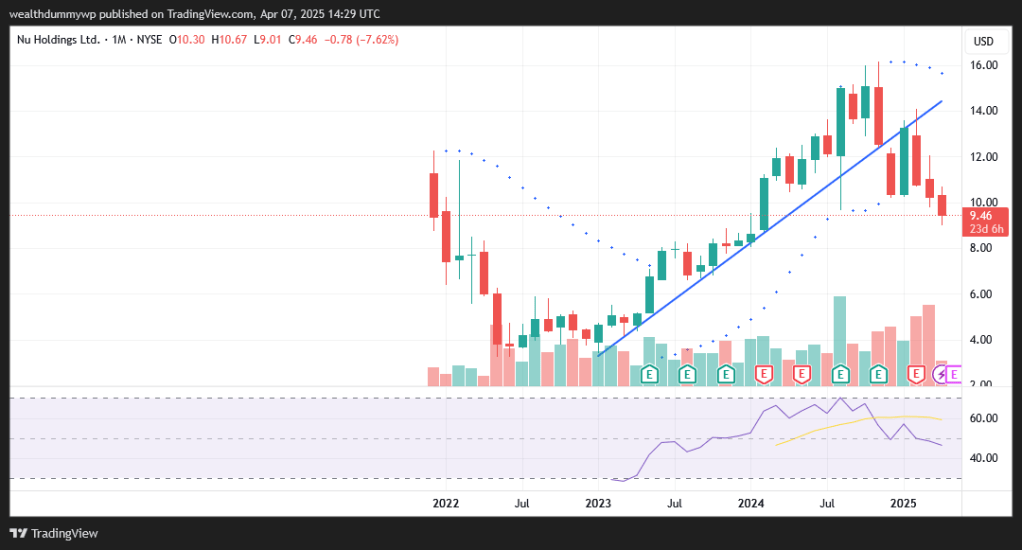

3. Nu Holdings, ticker NU

I sold my position entirely. My average buying price was $4.70. Today, I sold at $9.06. So, again, taking some profits. I still like the company and I believe that it performs well fundamentally. However, I decided to sell it since I needed to free some capital, which I can deploy in stocks that will perform better in my view. Also, by looking at the chart I am seeing that the price has broken its uptrend line:

If the stock goes down significantly I am thinking of buying it again. I still like the company, so it`s on my watchlist.

4. Match Group, ticker MTCH

I sold the entire position. My average buying price was $32.82. Today, I sold at $27. With this transaction I am writing off some of the capital gains that I have realized. To be honest, when I was buying the MTCH shares for my portfolio I wasn`t completely sure about the position. It was just an experimental purchase. And it was a small position. In terms of this I decided to sell it, so I can free some capital. The company might have some potential, but I am not thinking of buying again.

5. Pfizer, ticker PFE

I sold some of my shares. About 40% of my position. My average buying price was $27.59. I made the sell today at $22.40. I made the transaction because I needed to gather some more capital. I also decided to write off some of the capital gains. In addition to that, the Pfizer stock was too heavy (to my taste) in my portfolio. I still believe that the company has some good long term prospects. That`s why I kept around 60% of my position.

All of the freed capital from the sells of NU, MTCH and PFE was allocated to the following stocks:

6. Occidental Petroleum Corp, ticker OXY

This wasn`t my first purchase of OXY`s stock. I already had some shares, bought at a higher price. I have doubled my position with this buy. I really like energy companies. In today`s world the energy becomes more and more important. The company is trading at a decent P/E ratio and the margins for 2024 were good. There is one more reason why I like the stock – Buffett has it in his portfolio. Today, I bought OXY at $38.55. My current average buying price is $43.72.

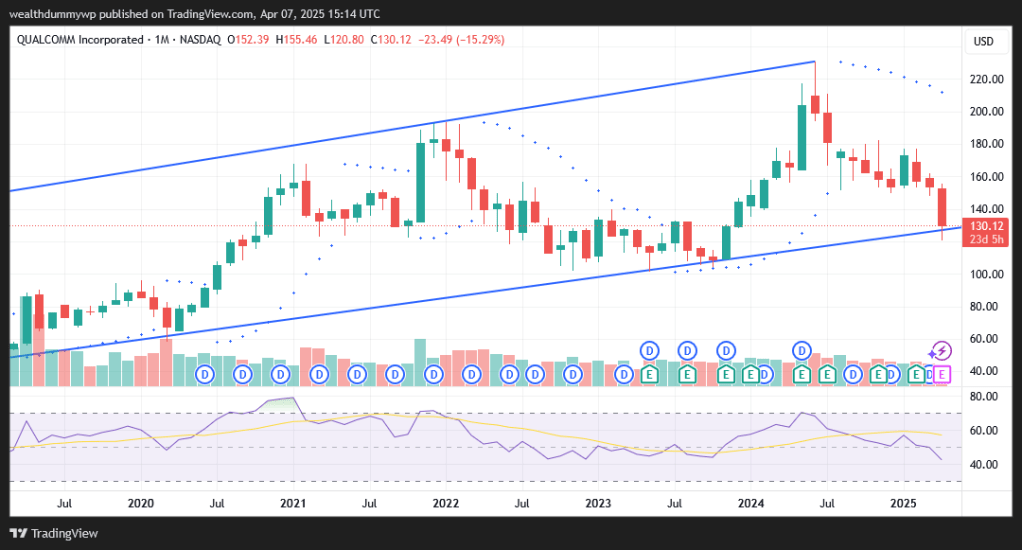

7. Qualcomm, ticker QCOM

This was an increase of my position in Qualcomm. Last year, I took some of my QCOM profits, with an average selling price around $175. Today I have decided to buy back some of the shares that I sold. I did that at $122.70. The chart looked good:

By looking at the chart I see that we are still in a uptrend. The price reached the support line. That is why I decided that it`s a good moment to jump back in. In terms of fundamentals I believe that the company has a bright future ahead, despite the uncertainties around it. I will make a post dedicated to my Qualcomm analysis. So, stay tuned.

This wraps up my portfolio rebalancing. As you can see the market sell-off, didn`t scare me. I wasn`t panic selling and getting out of the market. I believe that such market events are a good moment for a portfolio reevaluation and to see if there are better opportunities elsewhere. My investing philosophy is to buy companies with good fundamentals, to stay invested and to be focused on the long term.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a reply to Qualcomm Stock Analysis: Key Insights and Future Outlook – Wealthy Dummy Cancel reply