Google. But the Chinese version of it. Baidu Inc is known to have a business model similar to Google. By this post I would like to share my stock analysis and my view on the company. I would also like to share with you why recently I bought stocks of the company, at what price I have bought and is it still a buy for me. But we`ll get to that part a bit later.

Now let`s have a look at a brief description of the company:

Baidu Inc. (ticker: BIDU) is a leading Chinese technology company specializing in internet services and products. Often referred to as “China’s Google,” Baidu operates the largest search engine in China, facilitating billions of searches each month.

The company’s business model is primarily driven by online advertising. Businesses can promote their products and services through Baidu’s search results. Additionally, Baidu has diversified its offerings. It invests heavily in various sectors such as artificial intelligence (AI), autonomous driving, cloud computing, and online video streaming.

Reading this description, we can see that the company is a well diversified online business. Revenue is being generated primarily by the online advertising. Which is very similar to Google`s income stream. Having in mind Google`s success there is no way for me not to love the business. Especially if acquiring a share in the company comes at a cheap price. Which leads me to the reason of my purchase.

Currently, I have purchased shares of the company just once. I like to build my positions over time. As I have mentioned in my previous posts, I`m terrible at timing the market. I`m more “time in the market” kind of guy. Now, back to my purchase. I bought shares of Baidu on 6th of January 2025. The price of my transaction was $85.39. The current price at the time of writing is about $91.28. I am now sitting at almost 7% unrealized gain. On 14th of February the stock price reached about $100. But I didn’t sell. Maybe I should have sold, since 17% return in one month is not a bad result. Anyway, I decided to hold since I believe that there is a potential in the position.

And then the earnings report came. On 18th of February Baidu reported earnings and the stock price dropped. In my opinion the report itself wasn’t too bad. But from trading at $100, 4-5 days ago, the price decreased to $87.01 on 19th of February. Of course, I didn’t do any panic selling. I`m still holding my original position. Unfortunately, I didn’t have available cash, so I wasn’t able to add more shares during that dip.

Since we are on the topic of the latest earnings report – I have read this nice Baidu Q4 Earnings Call Highlights. It was posted on Yahoo Finance. In this earnings report the most crucial piece of information for me was that the online marketing revenue decreased by 7% year over year in Q4. This shows some challenges in the advertising business. I believe that the reason for this can be the rising competition from ByteDance for example. I`m assuming that this number could be the reason for the significant selling pressure after the earnings report. But even with this 7% decrease in mind, I believe that the stock is cheap enough to compensate for the risk. So, I won’t be a seller. There was one more number that impressed me. AI cloud revenue grew by 26% year over year. As the world continues to evolve to AI centric business models, I believe that this portion of the revenue might be a lot more important in the future. For me, it was a good sign to see such improvement. Definitely, it will be interesting to see how the revenue mix will develop over time. Based on the earnings report, as a shareholder, I hope that for 2025 the advertising revenue will be at least steady. I would also love to see the AI Cloud revenue to keep growing at this pace.

Now let’s look at some fundamentals data:

- Baidu`s current P/E ratio is 9.41

- Current P/S ratio 1.69

- Current P/B ratio 0.88

- Current ratio 2.09

Looking at these statistics, the stock seems cheap to me. I believe that it`s hard to find a business of this magnitude at such price. The company also has decent Gross and Net Profit Margins. The current Gross profit margin is about 47%. The Net Profit Margin is around 15.22. It`s not something stellar, but it’s still a good, profit generating business.

Let’s try to imagine the future. As investors we care of what a business can deliver over the years. According to the earnings estimates that I have came across in 2025 the EPS will be pretty much the same as in 2024. For 2025 Baidu is expected to generate around $10 earnings per share. This number increases in 2026 to $11.12; $12.52 in 2027 and $16.57 in 2028.

I would like to do some simple math with these numbers. Let`s try to imagine the stock price levels in 2028. This is assuming that the analysts are predicting the EPS numbers correctly. If Baidu is able to deliver an EPS of $16.57 in 2028 and we assume that the P/E ratio remains the same as of now 9.41, this means that the price of the stock is supposed to be around $155 in 2028. This compared to the current price of $91.28 will result in about 69% return, total for the three years period. This is an average of 23% per year. Not bad in my opinion.

In addition to the above, if the analysts are correct, this means the company will continue delivering good results. It will also be able to invest more in growth opportunities. And if at some point there are no good investment opportunities, why not initiating a dividend. Currently, Baidu is not paying dividends.

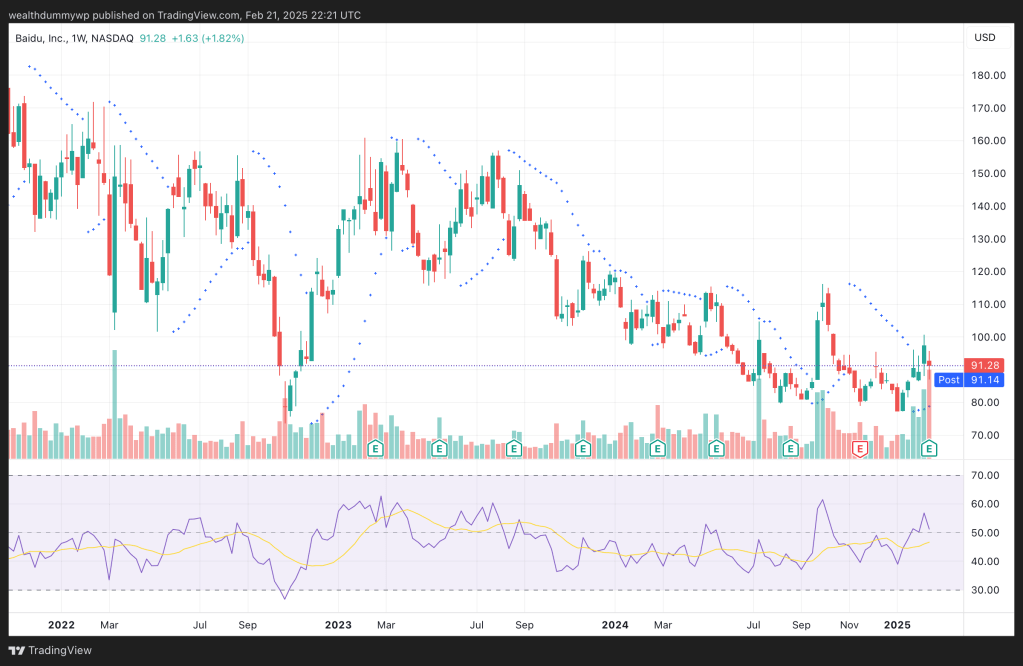

As usual it won’t be a good analysis without taking a look at the price chart:

The chart is created on TradingView

As we can see on Baidu`s price chart, the price isn`t far way from it`s 52 week lows ($77.20). The 52 week high is at about $116. The stock price needs to increase 27% in order to test the 52 week highs. The all time high of $354.85 was achieved in February 2021. I won`t even try to compare that to the current price, since it seems totally out of reach at the moment. In order to achieve this price of $354.85, we need to see a significant increase in the P/E ratio (assuming that the analysts predictions for the EPS are correct.

The RSI is sitting at around 51. This reading doesn`t scream extremely oversold stock. It at least tells us that it`s not overbought. On the chart I`m also using the Parabolic SAR indicator. Looking at its reading on the weekly chart it may indicates that we can see some upward movement.

To be completely honest, I`m using the technical analysis just as a fine-tuning tool. I am using it to see how my positioning relates to the overall trend. I find it useful when I`m watching at overbought and oversold levels. Sometimes, using this indicator I`m able to achieve a better price when building a position. The fundamentals of a company is the most important part in my decision making.

Now, let`s discuss the most important question. Is the Baidu stock a good buy? For me, it definitely is. The company shows a good, profit generating business model. It`s a good sign for me that Baidu tries to diversify its revenue streams. It has decent margins. The ratios (P/E, P/B, P/S) are at low levels. Of course, there are risks associated to the investment. There are risks specific to the company`s performance, risks associated to the macro environment, etc. But I`m willing to take them. Everyone should consider for himself/herself if the risk/reward is acceptable.

As per my next steps – I`ll continue buying shares of the company if the stock price is below $100. Buying below this price seems as good investment opportunity for me. I will be dedicating a portion of my March salary to add to my already existing position. If there aren`t any major changes in the company`s performance or in the market conditions in general, I am planning to hold my position at least for the medium term.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Data sources: for the fundamentals data (stock statistics, EPS, etc.) and the chart I have used tradingview.com. The numbers I have posted are taken from the mentioned source at the time of writing.

Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a reply to March 2025 Stock Market Moves: Investments in FMC, Baidu, and Clear Secure – WealthyDummy Cancel reply