Samsung Electronics, Ltd. Currently, the largest position in my portfolio. In this post I would like to share with you my stock analysis and my view on the company. Is it a buy or a sell for me?

Let me start by saying that I am a long time Apple user. And currently I am holding Samsung shares, instead of Apple`s. I believe that this could give you a hint on where I will be going with my analysis. Don`t get me wrong. I still love Apple, I love their products and the company as a whole. But in my investing views everything comes to valuation.

I started buying shares in Samsung Electronics in December 2024. There were three transactions by which I have acquired my current holdings. As I have mentioned in my previous posts I like to build my positions gradually. I have achieved an average price of 762 EUR. I am trading the ticker SSUN and that is the reason why the price is in EUR. The current price of the stock, at the time of writing, is 800 EUR. This results for me in about 5% unrealized gain.

Before getting into the analysis, let`s have a proper introduction of the company:

Samsung Electronics is a global leader in technology and consumer electronics. Founded in 1969, the company operates in various sectors, including semiconductor manufacturing, consumer electronics, and telecommunications.

The company produces a wide range of products, including smartphones, tablets, televisions, home appliances, and semiconductors. It is particularly renowned for its mobile devices, occupying a substantial share of the global smartphone market.

The company’s semiconductor division is a key revenue driver. It supplies essential components, such as memory chips and processors, to other technology manufacturers. This segment solidifies Samsung’s position in the supply chain. It also enhances its profitability through high demand in various tech markets.

From the description above we can see that Samsung is a well diversified business, operating in the Consumer Electronics sector. I do like this industry, because in my opinion we will be using more electronics in the future. But as a company operating in this segment the performance can be cyclical, so there will be ups and downs. I don`t mind the downs, since they are giving me an opportunity to acquire more shares at a lower price.

Let`s start with some valuation metrics for Samsung Electronics:

- Current P/E ratio is 11.79

- Current P/S ratio is 1.31

- Current P/B ratio is 1.01

- Current ratio is 2.44

Let me get a bit off-topic for a second. I realized that not everybody that is reading my blog is familiar with these ratios. So, I have decided to integrate links, which will take you to Investopedia. There you can learn more about the topic. It`s not sponsored, I just want to be as helpful as possible. Just click on the ratio that you want to learn more about and it will get you there.

Now, let`s go back to the valuation statistics. I love to see a P/E ratio below 15. And Samsung`s P/E is 11.79, which in my opinion is very good. Of course, a P/E ratio alone, doesn`t give us the full picture, but it`s a good place to start. P/S and P/B ratios are at low levels too. A reading of 2.44 for the current ratio is also very good. Usually, I`m looking for a current ratio above 2. The latest Gross Margin is 36.82 and the Net Profit Margin is at 10.00. For sure, it`s not something stellar, but it shows that Samsung is a good, profit generating business. Based on these metric, I believe that the stock is a good value investing play.

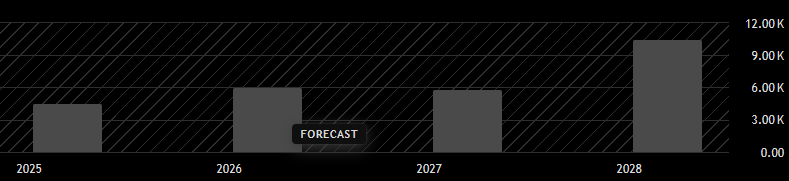

We`ve already looked enough in the current statistics. Let`s try to see what the future holds. Below is a graph, showing a forecast of Samsung`s Earnings per share:

The Earnings per share are shown in the KRW currency. Even that I`m trading the ticker in EUR, I am looking at the financials in the original currency. I believe that this way I`m able to get more insights.

The analysts are predicting slightly lower EPS for 2025, compared to 2024. In 2024 the EPS was 4.95k KRW and in 2025 is expected to be 4.46k. Then, we can see that the forecasts are showing improvement in the earning per share over the coming years. In 2028 the EPS is expected to come at 10.45k KRW.

Let`s do some simple math. If the analysts predictions are correct and Samsung manages to deliver an earnings per share of 10.45k KRW, this means that the company will double it`s 2024 EPS. If we assume that the P/E multiple will remain the same (11.79) in 2028, this means that the stock price would need to double to reflect the new higher earnings. If so, an investor could get a 100% total return for the period from now till 2028. Not too bad.

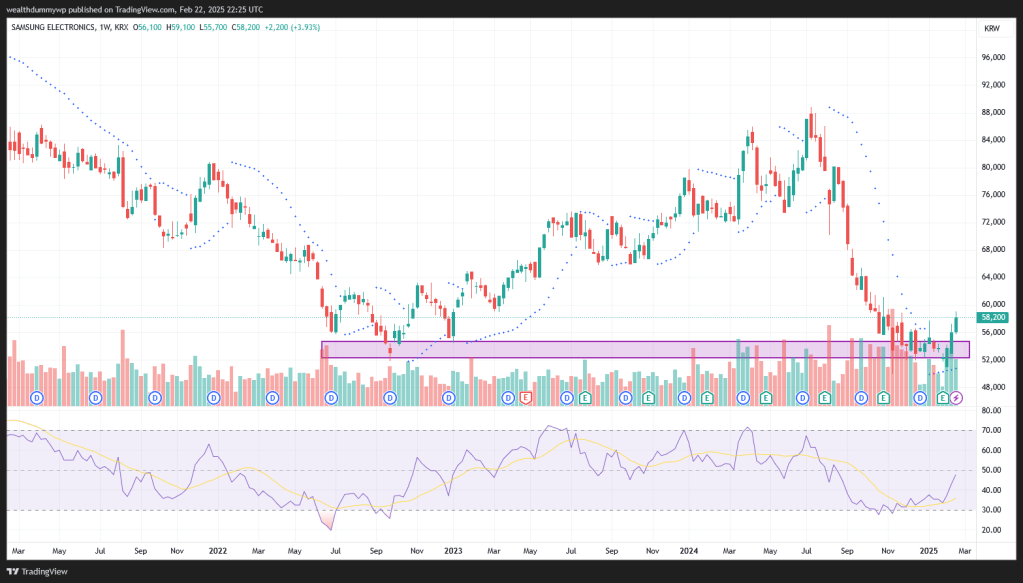

To have the full picture of a stock analysis we would need to check also the stock price chart:

The chart is created on TradingView

As we can see on the weekly chart, the stock is currently trading at levels seen in 2022. It`s near its 52 week low, which was at 49 900 KRW. This compared to the current price of 58 200 KRW, means that we are about 16% up from the 52 week low. The stock is trading far way from the 52 week high, which was achieved in July 2024. During this period the price has reached about 88 800 KRW. This means that the we are at almost 35% below the 52 week high. Usually, this comparison doesn`t give us much information. We can at least see where we are in the recent price range.

We can see that recently the RSI has gone up from it`s lower readings. This could be indicating that we can see some upward movement. The other indicator that I am using is the Parabolic SAR. It also shows that we can see some trend reversal. I will be watching closely the price chart action. It`s important for me to see if the stock will be able to pass the resistance levels. A crucial price level for me is at 65 000 KRW. If the stock breaks through this level, it may indicate that a more significant upward movement is possible.

Now we get to the most important question – is the Samsung stock a buy or a sell for me. I certainly like the company`s business model and products. Recently, I was watching reviews about the new products that they are launching. In my opinion there are some good updates, especially when it comes to integrating AI. I`m assuming that this could drive up the sales numbers.

In terms of fundamental metrics – I definitely like the valuation. It`s hard to find a company of this magnitude trading at such levels. We see a P/E ratio of 11.79 for the stock. We can compare that to the Apple`s (ticker AAPL) current P/E ratio of 39.08. Both companies are operating in the Consumer Electronics Sector.

And then, there is the dividend. I love dividend paying stocks. For 2024 Samsung has paid 1.45k KRW in dividends. This compared to the current stock price of 58 200 KRW, will result in about 2.49% dividend yield. There are also the buybacks. In November 2024 Samsung announced that they will initiate stock buybacks. This action is adding to the shareholder value.

In conclusion – I really like the stock and in my opinion it`s fairly valued. I believe that this is obvious, since I bought shares. Will I continue buying? It depends. Mainly on the price. I have built a position with an average price of 762 EUR (on the ticker SSUN). So I am not eager to buy additional shares above 800 EUR. If the stock price gets closer to my average price, I`ll try to add more to my position. As of now, I am planning to hold my position and I`ll be watching closely the future developments in the company.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Data sources: for the fundamentals data (stock statistics, EPS, dividends, etc.) and the chart I have used tradingview.com. The numbers I have posted are taken from the mentioned source at the time of writing.

Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment