How are you feeling the market volatility over the past month? In my portfolio, it has been impossible to ignore. A large portion of the stocks I hold dropped significantly, and honestly, I feel deeply disappointed with the overall performance.

After several years in the market, I expected to be used to volatility. It turns out I am not. There were moments in January when I felt genuinely discouraged. At one point, I even considered shutting down the blog because I did not want to admit – especially to myself – the reality of the losses.

In the end, I decided to continue. This blog helps me reflect, analyze my mistakes, and move forward more thoughtfully. And as always, I truly value your opinions in the comments.

This post will briefly cover the latest transactions, but the real focus is different.

Today, I want to talk about the worst-performing stocks in my portfolio and what they are teaching me.

🔄 Recent Changes Since Our Last Update

I closed two profitable positions:

- Baidu (BIDU) sold at $157.77

- Constellation Brands (STZ) sold at $160

With the proceeds from STZ, I bought a bond-focused ETF (VAGE) and added to my dividend ETF (ZPRG).

This follows my plan to increase ETF exposure and adopt a slightly more defensive positioning during volatile markets.

Funds from Baidu – together with the sale of Klarna (closed at a loss due to rising volatility and emotional pressure) – were used to increase my position in Omnicom (OMC).

The price dropped further after my purchase, but the dividend provides some comfort while holding.

Looking back, the biggest mistake here was emotional decision-making.

That lesson is already clear.

📈 February Purchases

This month I focused more on ETFs for broader market exposure.

- Added to iShares European Property Yield (IPRP)

- Average price: 30.855 EUR

- Current return: +2.7%

- Opened a position in CoinShares Physical Top 10 Crypto Market (CTEN)

- Average price: 20.919 EUR

- Current return: -7.17%

- Entered too early after a crypto decline, but I plan to hold and possibly add later.

I also added to several underperforming individual stocks:

- Duolingo (DUOL)

- FactSet (FDS)

- Evolution AB (E3G1)

All are currently below my purchase price.

That explains much of the frustration I felt in January.

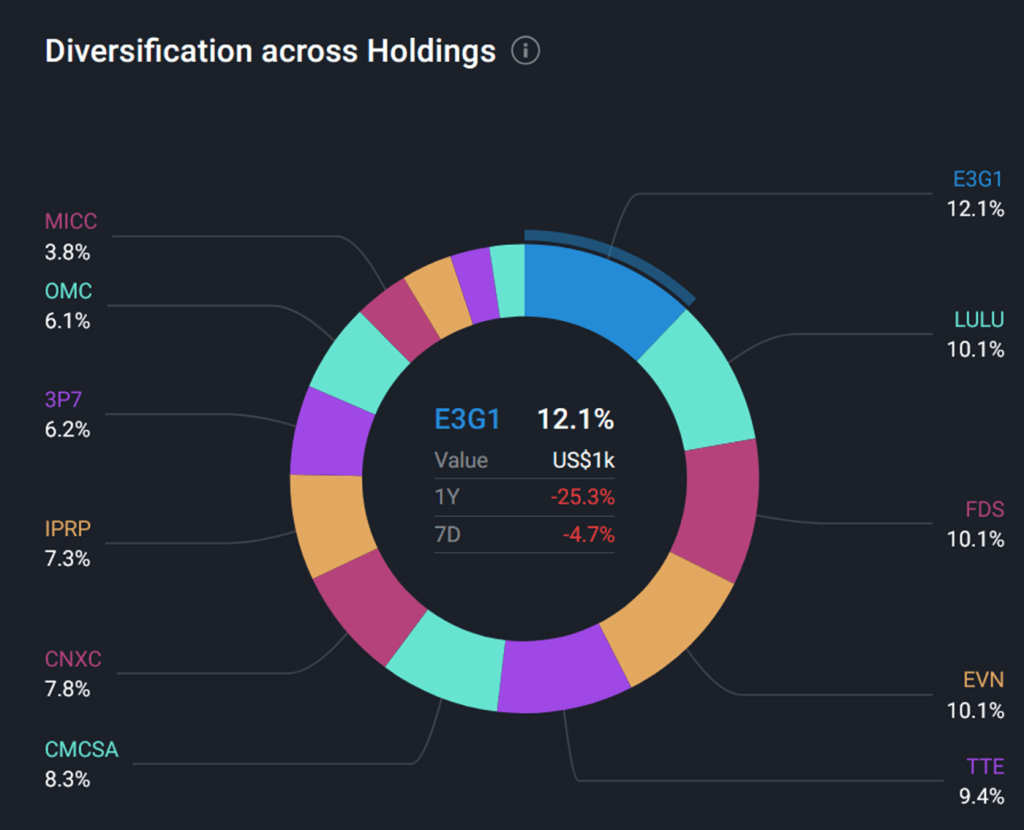

📊 Portfolio Snapshot

As usual, I track everything using Simply Wall St.

The banner contains my affiliate link. Check this post for additional information.

My five largest positions are now:

- Evolution AB

- Lululemon

- FactSet

- EVN AG

- TotalEnergies

⚖️ Performance of Key Positions

To better understand the current state of the portfolio, it helps to look beyond the overall return and focus on the individual positions that are driving the result.

Right now, performance is clearly divided into two groups – a few strong winners and several meaningful underperformers.

Loss-making leaders

- Evolution AB – about -17% unrealized

- FactSet – around -23%

- Lululemon – currently a small personal loss, despite that the stock is showing roughly -18% year-to-date

These positions matter because of their size in the portfolio.

Even when the underlying businesses remain solid, large negative moves in major holdings have a disproportionate impact on total performance and on investor psychology.

What makes this more difficult is that my original investment theses have not fully broken.

The businesses still generate value, remain relevant in their industries, and in some cases continue to grow.

This creates a challenging mental situation – the price action looks discouraging, but the long-term story is not clearly damaged.

Learning to navigate this gap between price and conviction is one of the hardest parts of investing, and this period is forcing me to confront it directly.

Positive contributors

- EVN AG – roughly +24%

- TotalEnergies – around +21%

Both winning positions share an important common factor:

I had a clear thesis, strong understanding of the business model, and confidence in long-term fundamentals.

However, there is also an uncomfortable realization.

Despite this conviction, I did not allocate enough capital to these ideas compared to some weaker positions.

This highlights a key portfolio construction lesson:

Good ideas alone are not enough – position sizing matters just as much.

Going forward, I want my allocation decisions to reflect depth of understanding and conviction, not only valuation or short-term opportunity.

📉 Worst-Performing Stocks in 2026 So Far

According to Simply Wall St, the weakest performers in my portfolio this year are:

- FactSet

- Lululemon

- Pandora

- Duolingo

- Evolution AB

Seeing several core holdings on this list is emotionally difficult, but it is also extremely valuable from a learning perspective.

Periods like this reveal whether an investment decision was based on real understanding or simply on optimism and market momentum.

What is driving the weakness

The current declines are largely connected to broader market fears rather than sudden business collapse:

- AI disruption concerns – affecting companies like FactSet and Duolingo, where investors question long-term competitive positioning

- Consumer weakness – weighing on Lululemon and Pandora

None of these factors automatically invalidate the long-term thesis.

But they do increase uncertainty, which the market tends to price in aggressively.

Why I am still holding

Despite the negative performance, I continue to hold all of these positions.

The main reason is simple: my core investment logic has not fundamentally changed.

Selling purely because of falling prices would mean letting short-term emotion override long-term reasoning – a mistake I have already made in the past and want to avoid repeating.

At the same time, holding does not mean ignoring reality.

This period is forcing me to reassess:

- whether my original assumptions were strong enough

- whether position sizes were appropriate

- and whether diversification was balanced correctly

In that sense, the current losses are not just painful – they are instructive.

And if I truly learn from them, they may become one of the most valuable experiences in my investing journey so far.

💰 Dividend Progress

My dividend yield has improved slightly:

- Previous: ~2.9%

- Current: ~3.1%

The increase is small, but it is a step forward.

My goal remains 4% yield by year-end.

🧠 What This Volatile Period Is Teaching Me

The biggest lesson is simple:

Conviction and understanding should guide allocation – not price drops or emotions.

Cheap stocks can always become cheaper.

Strong theses deserve stronger positioning.

I hope this lesson stays with me.

🎯 Final Thoughts

I am not satisfied with the portfolio performance.

But I am proud that I stayed honest – with myself and with you.

That honesty is how we improve as investors.

Thank you for being part of this journey.

Feel free to share your thoughts, lessons, or best ideas in the comments – and subscribe if you would like to follow the path of a retail investor learning in real time.

Wishing you thoughtful and successful investing.

See you soon.

Keywords: portfolio update 2026, investment blog, stock market volatility, worst performing stocks, dividend portfolio progress, retail investor journey, February portfolio review

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment