Hello friends! In my previous post, we discussed the trades I made with my latest capital. In this shorter article, I want to take a step back and look at how my portfolio looks as a whole at the moment.

Before we begin, I want to be very honest. Right now, I am not happy with the portfolio performance. Even though I cannot share impressive results, I felt it was important to publish this overview anyway. I promised myself and you that this blog would always reflect my investing journey honestly, regardless of the results.

While I did pick some solid companies over the past year, I still failed to achieve a satisfying overall return. I spent quite some time reflecting on this and reached several conclusions. One of the reasons I enjoy running this blog is the ability to look back, read my old thoughts and extract lessons. I believe I have identified my biggest mistakes from last year, and I will discuss them in a separate post dedicated entirely to what I did right and what I did wrong in 2025.

Now, let us focus on the portfolio itself.

📊 Portfolio Snapshot

As regular readers know, I use Simply Wall St to track my portfolio. If you think such a tool could be useful to you, feel free to use my affiliate link in the banner below. There is also a free version available, and using the paid plans helps support the blog.

The banner contains my affiliate link. Check this post for additional information.

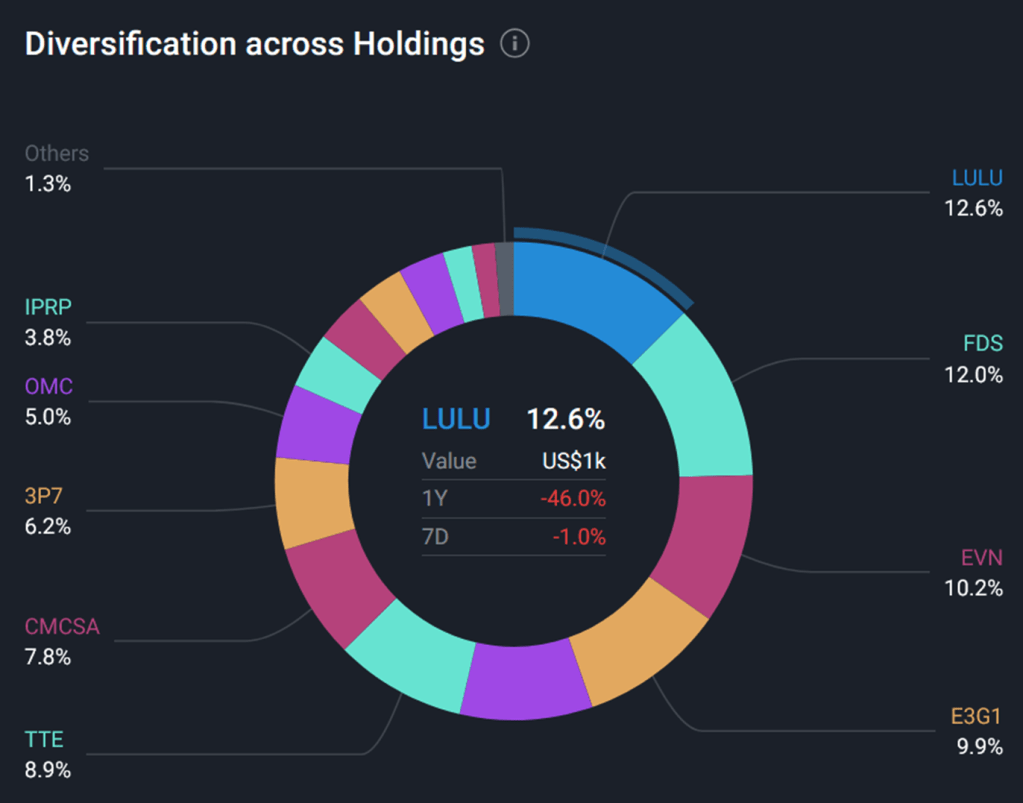

🏆 Largest Positions

Lululemon (LULU)

At the moment, my largest position is Lululemon. The unrealized gain is around 16 percent. Toward the end of last year, the return was slightly better, but I decided not to sell any shares. The position remains at its original size. For now, I do not plan to add more.

FactSet (FDS)

The second largest position is FactSet. I am still holding the original position I built last year. Currently, it is up a little over 3 percent. I am aware of the potential headwinds facing the company, but I continue to hold. When reading earnings reports and market commentary, I still see FactSet data being referenced frequently. This makes me believe that those headwinds may not materialize anytime soon. For now, I do not plan to buy more or sell.

EVN AG (EVN)

Third in the portfolio is EVN. This position has performed quite well. Since building it, the stock is up just under 20 percent. I plan to hold this long term. The dividend is solid, and I believe utility companies could perform reasonably well in the future, especially considering the growth of AI and infrastructure demand.

Evolution AB (E3G1)

Fourth place belongs to Evolution AB. Unfortunately, this has been one of the weaker performers. As of 17.01.2026, the position is down around 15 percent. Even though it is uncomfortable to see a large position underperform, I have not sold any shares and do not plan to. I am aware of the risks facing the company, which partly explains the price action, but I still believe there is potential for a turnaround. I am even considering adding to the position with my next salary if the price stays at these levels.

🧩 Diversification Overview

Overall, I believe the portfolio is reasonably well diversified. One thing that stands out is the higher concentration in Consumer Discretionary at 31.8 percent. This is an area where I may make changes.

As mentioned above, I might increase my investment in Evolution AB. At the same time, if prices correct further, I may consider selling Pandora (3P7) and Duolingo (DUOL). I like the products of both companies. My girlfriend shops at Pandora, and two thirds of our household actively use Duolingo. However, both positions are currently showing notable losses.

As of 17.01.2026:

- Pandora: -20.57 percent

- Duolingo: -15.23 percent

I have not made a final decision yet, but I wanted to openly share these thoughts.

📉 ETF Exposure

Another important topic is ETFs. At the moment, ETFs represent only 5.7 percent of my portfolio. This is something I want to change in 2026. I would like ETF exposure to play a more central role going forward. In the upcoming post about my mistakes and successes, I will explain the reasoning behind this decision in more detail.

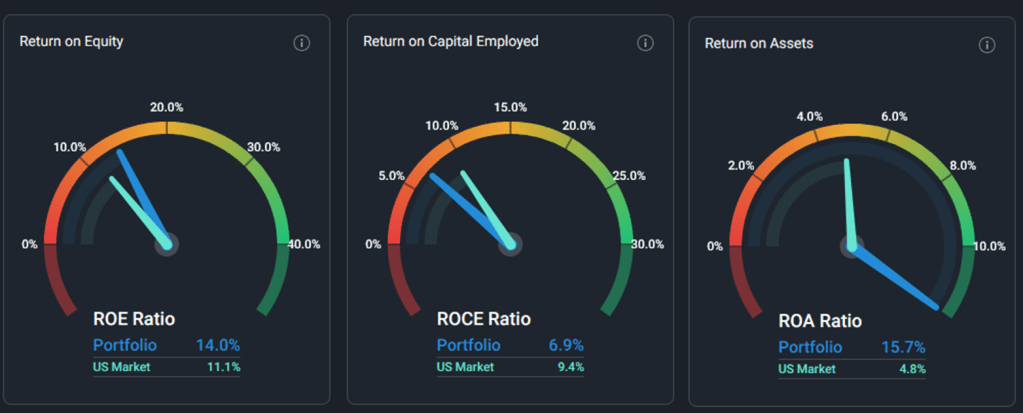

📐 Portfolio Metrics

From time to time, I also review metrics like ROE, ROA and ROCE in Simply Wall St to see how my portfolio compares to the broader market. Excluding ROCE, the portfolio scores better on these indicators. Of course, these are historical figures and not guarantees of future performance, but they provide a useful reference point regarding the overall quality of the companies I hold.

💰 Dividend Outlook

Finally, let us talk about dividends. According to Simply Wall St, my portfolio currently offers an expected yield on cost of around 3 percent. The current dividend yield is approximately 2.9 percent.

I consider 3 percent to be reasonable, especially when compared to the S&P 500, which currently yields under 1.5 percent. That said, for my personal goals, 3 percent still feels a bit low. I am seriously considering adjustments to increase this yield. If I manage to reach 4 percent by the end of the year, I would be satisfied.

🎯 Final Thoughts

That wraps up everything I wanted to cover in this portfolio overview. I hope to see you in my next post, where I will discuss the positive decisions I made last year as well as the obvious mistakes.

Until then, feel free to share your thoughts on my portfolio in the comments. I would also love to hear about your successful stock picks. You can subscribe to the blog and share this post with someone who might find it useful.

Wishing you successful and meaningful investments. See you soon.

Keywords: portfolio overview 2026, investment portfolio blog, stock portfolio analysis, diversification investing, ETF exposure, dividend portfolio, long term investing, January portfolio review

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment