In previous posts, I’ve admitted that timing the market has never been my strong suit. Just recently, I had another reminder of that fact. This time, the real issue wasn’t about missing the “perfect” market entry or exit—it was about letting emotions drive my decision-making. And as we all know, emotions are rarely a good advisor when it comes to investing.

The purpose of this post is to share the recent changes I made to my portfolio, the thought process behind them, and the mistakes I believe I made along the way. I’ll also discuss my plans for future moves. Think of this post less as a technical analysis packed with charts, and more like a personal story of wins, losses, and lessons learned.

Selling PVA TePla (TPE): An Emotional Trade 😬

Earlier this year, I shared that I had bought shares of PVA TePla (TPE). It wasn’t a large position, but I planned to hold it for the long term. Well… that plan didn’t last.

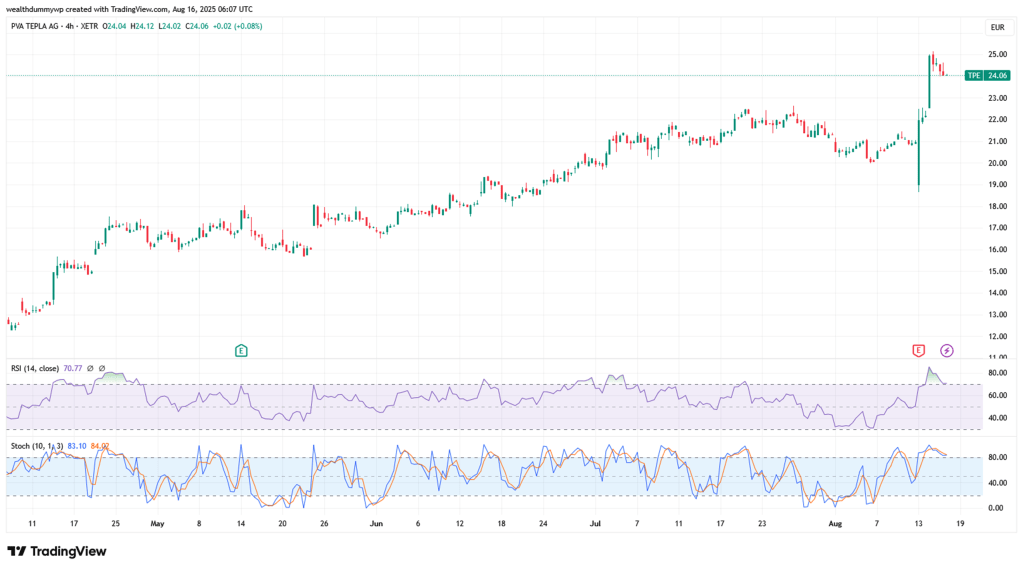

On Wednesday, August 13, 2025, the company reported earnings. The day before, the stock closed at €20.90. At market open on earnings day, the stock plunged to €18.65—a significant drop, especially considering that just a few weeks earlier, in late July, shares were trading slightly above €22.

At first, I thought: “If it keeps dropping, maybe this is a chance to buy more.” But what actually happened was the complete opposite. Within hours, the stock rebounded sharply, first returning to the previous day’s close, then climbing back to its late-July highs.

In the heat of the moment, I skimmed the earnings release, glanced at the chart, and decided it was the perfect time to sell. I exited my entire position at €22.46. Since my average cost basis was €16.70, I locked in a return of just over 34% in about three months.

Not bad, right? Except the next day, the stock went even higher—topping €25. That means I left roughly another 12% in gains on the table. I wasn’t upset about missing those extra returns. What really frustrated me was that I had sold purely out of fear—fear of losing my existing gains—rather than making a calm, well-analyzed decision.

Looking back, I probably still would have sold, but it would have been for the right reasons. Instead, it was an emotional exit. And that’s why I’m not fully satisfied with this trade, despite the decent profit.

Thoughtful Trades: TotalEnergies and First Solar 💡

Not all my recent moves were emotional. Some were well thought out, regardless of whether they ultimately prove “right” or “wrong.”

Buying TotalEnergies SE (TTE) ⚡

After selling PVA TePla, I converted the euros into U.S. dollars and purchased shares of TotalEnergies SE (TTE) on Friday, August 15, 2025, at an average price of $62.56 per share.

Why TotalEnergies? I’ve had the company on my watchlist for a while. It offers a reliable dividend, operates in the energy sector (which I’ve wanted to increase exposure to), and trades at what I consider to be a fair valuation. Even if it’s not deeply undervalued, I see it as a solid addition to my long-term portfolio.

Selling First Solar (FSLR) ☀️

The same Friday, I also sold shares of First Solar (FSLR) from my so-called “public portfolio.” My plan had been to sell if the price returned to $200. And that’s exactly what happened—I sold the shares at $203.42, and I exited with an average entry price of $161.47. That’s nearly 26% profit in less than two months.

To be transparent: I only sold FSLR in the public portfolio. I still hold it in my core portfolio. The sale was more about diversification and avoiding duplicate holdings across two portfolios.

📊Portfolio Review and Next Steps

Here’s a snapshot of my updated portfolio from Simply Wall St:

The top five holdings remain unchanged, though Evolution AB has slipped slightly due to a price decline. The bigger changes are the disappearance of PVA TePla and First Solar, and the addition of TotalEnergies SE (TTE), which now accounts for 5.2% of the portfolio.

Looking ahead, here are my next possible moves:

- Increase TotalEnergies SE (TTE): I may use the funds from the FSLR sale to add more TTE shares, keeping my energy sector allocation balanced. I’m waiting to see if the price dips a bit before committing.

- Sell Clear Secure (YOU): While I still like the company’s business model, I believe the stock looks overvalued from a technical perspective.

- Buy More Baidu (BIDU): If I sell Clear Secure, I’ll likely reinvest into Baidu. Yes, it’s a bit risky given their upcoming earnings report, but I see Baidu as fairly valued with solid long-term potential.

As always, the market will tell me if I’m right or wrong.

🌱Final Thoughts

That wraps up the latest changes in my portfolio and my thoughts on what comes next. I hope this post gives you something to reflect on—especially about the balance between logic and emotion in investing.

No matter how much I try to stay rational, I occasionally let emotions sneak in. What matters is recognizing those moments, learning from them, and continually striving to improve.

I probably won’t have time for another update until early or mid-September. Until then, I wish you all a great end to summer—filled with both joyful moments and smart, rational investments.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: stock investing, portfolio management, emotional investing, PVA TePla, TotalEnergies SE, First Solar, Baidu stock, dividend stocks, long-term investing, retail investors

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment