It is time for another update on what I have been doing with my portfolio since our last post. Looking back at November, it was a relatively calm month for my positions. Volatility was not too intense and I did not make many adjustments. Still, a few changes took place and I would love to walk you through them. I will also share which stocks I bought with my new monthly contribution.

This year, I stayed consistent. Every month I set aside part of my salary and invested it in the markets. I strongly believe that this is the right long term approach to building wealth. Of course, I made mistakes along the way, and I learned from them. I have a separate post planned for the beginning of 2026 where I will look back at the full year and talk about what worked, what did not, and what I learned.

But for now, let us focus on what changed in the portfolio recently.

🏁 Selling Phase: Portfolio Cleanup

I wanted to make my portfolio a bit more focused and optimized. Because of that, I decided to close several smaller or less convincing positions.

ETF

I sold the majority of my ETFs. There was nothing particularly wrong with them, but I saw better opportunities in individual stocks and wanted more concentration. I did keep one ETF though. Stay with me until the end to see which one remained.

Mobileye (MBLY)

A small position that I sold at a loss mainly for tax harvesting purposes and to reallocate the capital into stronger ideas.

- Buy price: 12.77 USD

- Sell price: 10.87 USD

FMC Corporation (FMC)

A painful one. This was a complete exit at a significant loss that pretty much offset the gains in my public portfolio.

- Buy price: just under 42 USD

- Average sell price: 13.82 USD

Not a pleasant outcome, but good lessons learned.

LexinFintech Holding (LX)

I closed half of the position again for tax reasons. I still hold the other half and have not decided whether to keep it or close the remaining part.

- Average buy price: 4.96 USD

- Sell price: 3.31 USD

Nomad Foods (NOMD)

A complete exit at a small profit. Nothing major, but still a green number.

- Buy price: 11.23 USD

- Sell price: 12.20 USD

At this point, the selling part is done. It might look like quite a list, but it helped me restructure the portfolio into something I feel more comfortable with. Now let us move to the exciting part.

📈 New Additions to the Portfolio

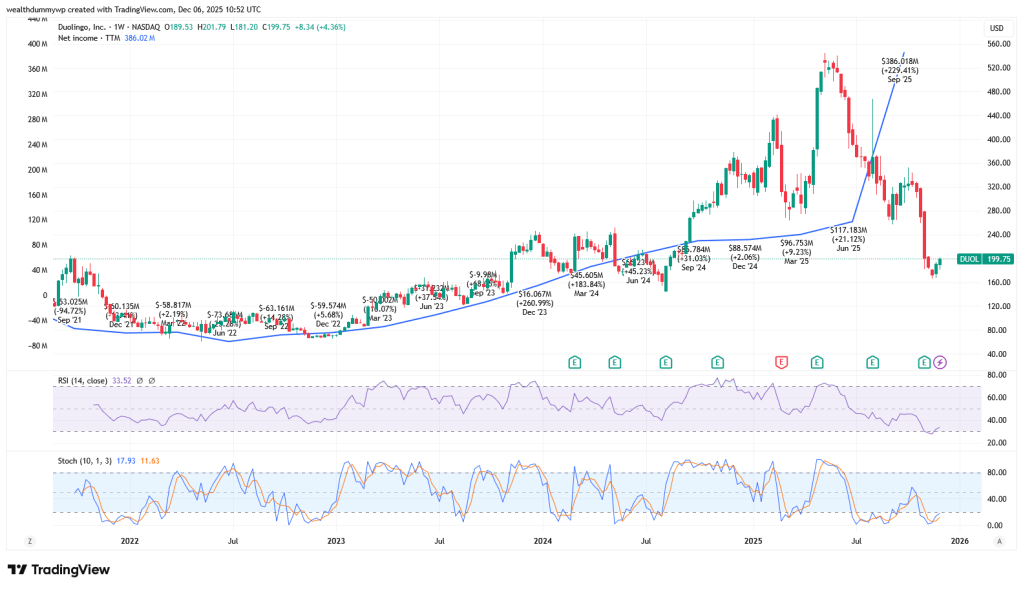

Duolingo (DUOL)

In the previous post (the one about Lululemon) I mentioned that the capital freed from FMC would be reinvested elsewhere. Duolingo was the result. The first buy was funded by the FMC sale, and the second by selling Nomad Foods and Mobileye.

Fundamentally the stock looks expensive on metrics like P/E, but visually on the chart it appeared oversold and that gave me confidence to enter.

The main reason however was personal experience. I heard my girlfriend’s daughter saying “Duolingo is angry that I did not log in today, I need to do my exercises”, which made me curious. I created an account and quickly got hooked. I am currently learning Italian and already have a 23 day streak. I have watched plenty of ads to get energy and I am even considering getting a subscription. That alone is a bullish signal to me.

- Average buy price: ~178 USD

- Current price around writing: ~198 USD

So far so good.

Concentrix (CNXC)

This position was built using the remaining FMC capital and half of LX. Later I increased it even further.

- Average buy price: 37.15 USD

- Current price around writing: ~37.70 USD

The valuation (P/E ~7.5) looked attractive. I did detailed research which I plan to share in a dedicated post. Not everything is perfect, especially the debt levels, but rarely do we get perfection in investing. I accepted the compromise and entered the stock.

Comcast (CMCSA)

About 30 percent of my fresh salary contribution went into Comcast. The price had declined in recent months which gave me a good opportunity to average down.

- New buy price: 27.34 USD

- Average cost: 29.67 USD

- Current price around writing: 27.41 USD

Currently I am at an unrealized loss, but I plan to hold and collect dividends.

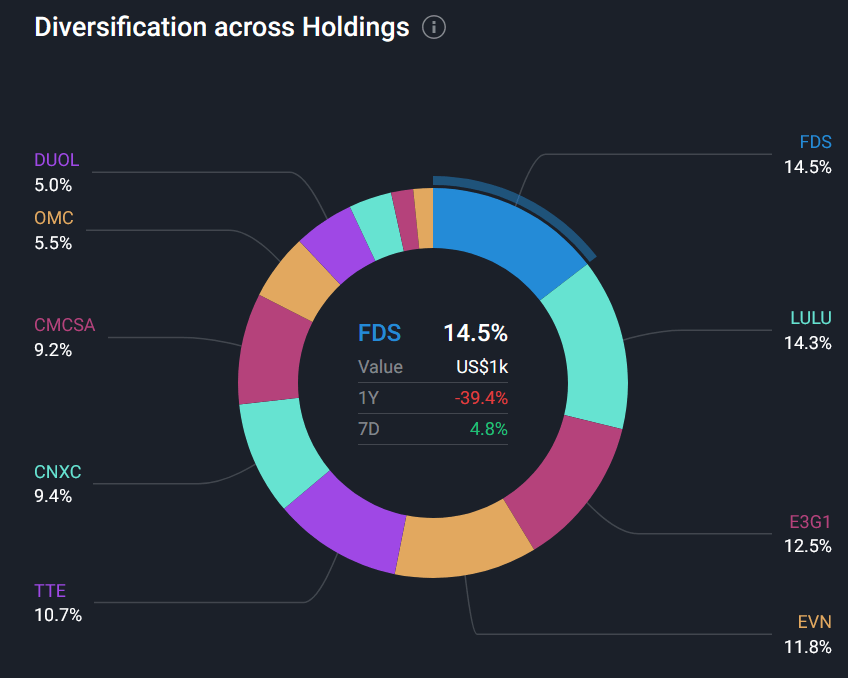

📊 Portfolio Overview

As always, I use Simply Wall St to track my performance. Below is my affiliate link for anyone who wants to try it. I personally use the Premium plan and find it valuable.

The banner contains my affiliate link. Check this post for additional information.

Now back to the portfolio.

My top three positions are FactSet (FDS), Lululemon (LULU) and Evolution AB (E3G1). The first two are currently in profit. Evolution AB is around minus 15 percent. I could trim it, but something tells me that long term I might regret it, so I will most likely leave it untouched.

Next is the energy exposure: EVN AG (EVN) and TotalEnergies (TTE). Both are up 15 percent and 9 percent respectively. I like the long term outlook of energy and do not plan to reduce. If prices drop meaningfully I would consider adding more.

After the recent buy, Comcast now sits in sixth place. It fits nicely in the portfolio and I might add more on dips.

The newcomers Concentrix and Duolingo sit in seventh and ninth place. I am happy with their size for now. I only regret not buying more Duolingo when it was closer to my cost basis, but at least I managed to get in before the price moved higher.

🧩 The Only ETF Left

The last holding to reveal is the only ETF I kept and also the smallest position. I previously held four ETFs but decided to leave just one.

SPDR S&P Global Dividend Aristocrats (ZPRG)

I like that it is global, has a solid dividend and distributes it. The plan is to increase this position slowly over time. No immediate plans to add more ETFs, but if something great appears I would not hesitate.

🎄 Final Thoughts

As you can see, I make mistakes and I make good decisions. What matters is consistency and long term mindset. This year, I invested monthly and kept publishing regularly. This is post number 51 which means almost one post per week. For a beginner blogger, I am proud of that.

With the holiday season approaching, I might take a break from posting until the new year. I want to rest, recharge and spend time with my family. My goal for 2026 is to continue improving both my investing and this blog. If I post something earlier, feel free to subscribe so you do not miss it.

If this is the last article for the year, I wish you wonderful holidays.

As always, wishing you successful and meaningful investments.

See you soon 🙂

Keywords: portfolio update, stock portfolio blog, Duolingo stock buy, Concentrix CNXC analysis, Comcast investment, dividend ETF, ZPRG, long term investing, monthly portfolio review

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment