November is here! New month, new paycheck, new investment budget. As usual, I stayed consistent and set aside the same amount from my salary to invest in stocks. This month, I focused on adding to one existing position and opening two or three smaller, more speculative ones.

In this short post, I’d like to share the latest updates in my portfolio. Recently, I noticed that my previous posts have been getting longer, so this time I’ll really try to keep it brief. Time is precious, so let’s dive straight into the key highlights — my latest trades and how the portfolio looks overall.

💸 FMC – My Big Miss of the Year

Before jumping into the new November buys, I want to start with one of my biggest investment mistakes this year — FMC Corporation (FMC). This company was actually one of the first I ever wrote about on the blog.

Earlier this year, I began buying FMC shares and kept adding to the position until it became the largest holding in my portfolio. Things looked fine — good dividend, solid fundamentals — and I felt comfortable holding it. But around mid-year, I started having doubts. I even mentioned in one of my posts that I’d sell if the price rebounded to my average cost basis. Well… that didn’t happen.

When the company reported disappointing earnings, the stock got hammered. As of writing, it trades just above $13, compared to my average buy price of $41.77. You can imagine the size of that unrealized loss. Clearly, I missed something in my screening process.

I’m still holding the position for now, hoping for at least a partial recovery before selling. I don’t expect it to reach my average price again, so I’ll likely take a loss — but I’ll be able to use that to offset other capital gains this year.

I wanted to start with this example because I believe in being honest with myself and my readers. Even though I’ve had some great picks this year — Baidu, ACM Research, Samsung, PVA TePla, First Solar, Clear Secure, and others — it’s important to also share the mistakes. This is a good reminder of why diversification matters and why everyone should always do their own research.

🛒 November Buys

After the FMC story (yes, I’m still annoyed about it), let’s move on to the actual trades I made this month.

FactSet (FDS) – Regular readers know I started buying FactSet in October. In November, I used part of my investment budget to add more since the price had dipped. My average cost is $278.80, and as of November 8th, it trades at $263.49 — about a 5% unrealized loss. Despite the drop, I’m confident in the company and decided to make it my largest position in the public portfolio.

Constellation Brands (STZ) – A brand-new position for me this month. During my screening process, the stock appeared technically oversold. After checking the reports, I found the fundamentals decent — and seeing that Warren Buffett’s Berkshire Hathaway owns shares gave me additional confidence. My average buy is $129.50, and it’s now trading around $127.29 (roughly -2%).

Nomad Foods (NOMD) – Another small new position. The stock looked oversold and fundamentally stable. I bought in at $11.23, and it’s now at $12.38 — around 10% unrealized profit.

Mobileye (MBLY) – This is currently my smallest individual holding and quite speculative. I’m applying a DCA strategy, keeping it light within the portfolio. My average cost is $12.93, with the stock now at $12.56 (around -2%).

📊 Portfolio Overview

With the new purchases covered, let’s now shift our focus to a review of the overall portfolio. Regular readers know that I use Simply Wall St to track my portfolio’s performance.

Below, I’ve included a banner with a link where you can create your own account and take advantage of their current promotion — an extended free trial of the Premium plan, plus 30% off your first paid subscription.

As far as I know, the campaign started on November 6th, 2025, but I’m not sure how long it will last. So if you’d like to take advantage of it, click below to explore Simply Wall St and start tracking your own portfolio performance:

The banner contains my affiliate link. Check this post for additional information.

Let’s go back to the portfolio overview:

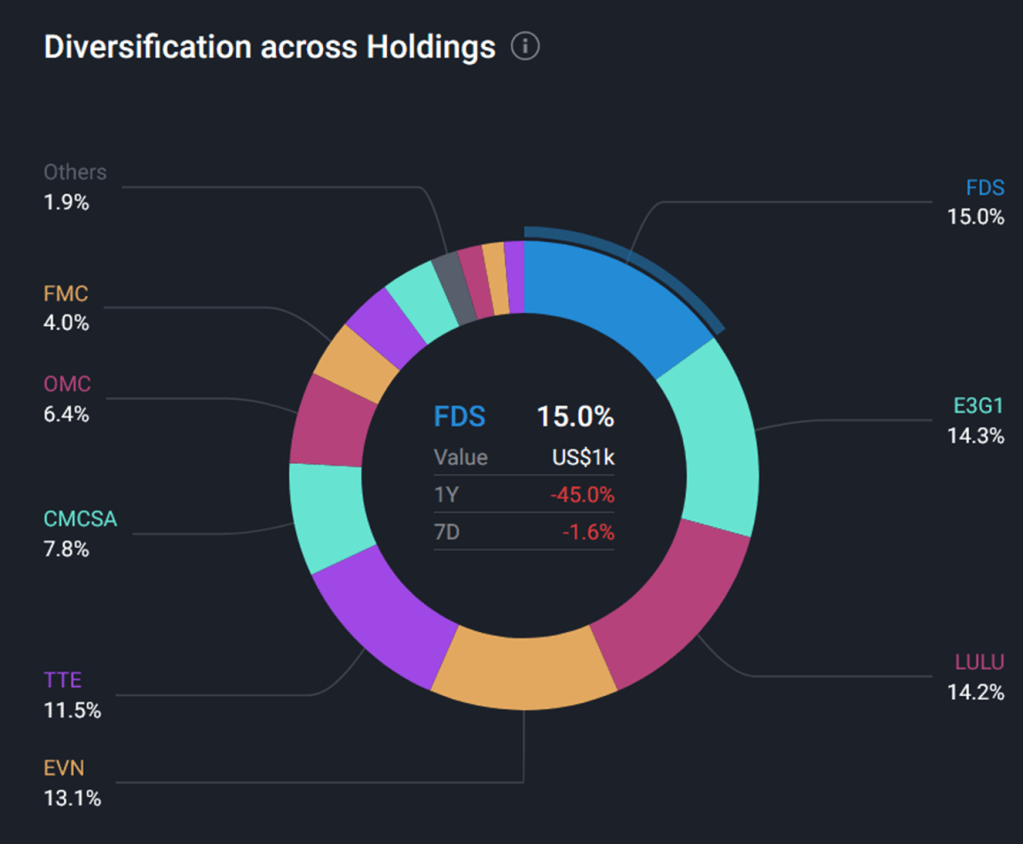

The top three holdings are FactSet (FDS), Evolution AB (E3G1), and Lululemon (LULU) — all currently showing single-digit unrealized losses (around 5%), except Evolution AB, which is down roughly 12%. Despite the decline, I still like all three and plan to hold them long-term.

Next are EVN AG (EVN) and TotalEnergies (TTE) — both in the green. TotalEnergies is up around 4%, and EVN AG about 13%. I’ll continue holding both.

Comcast (CMCSA) and Omnicom Group (OMC) are slightly down, with Comcast performing a bit worse. I’m keeping both for now and may even add more if prices drop further.

And then there’s FMC, which now makes up only about 4% of my portfolio — down from being the largest position earlier this year. As mentioned, I’m holding until a partial recovery to offset gains elsewhere.

A quick note on LexinFintech (LX) — a position not visible on the chart but previously discussed. The stock has been volatile lately without any clear reason. I’m down around 18% and still deciding what to do. It might end up being another “loss offset” case like FMC.

🧭 Sector Diversification

Now let’s review sector allocation.

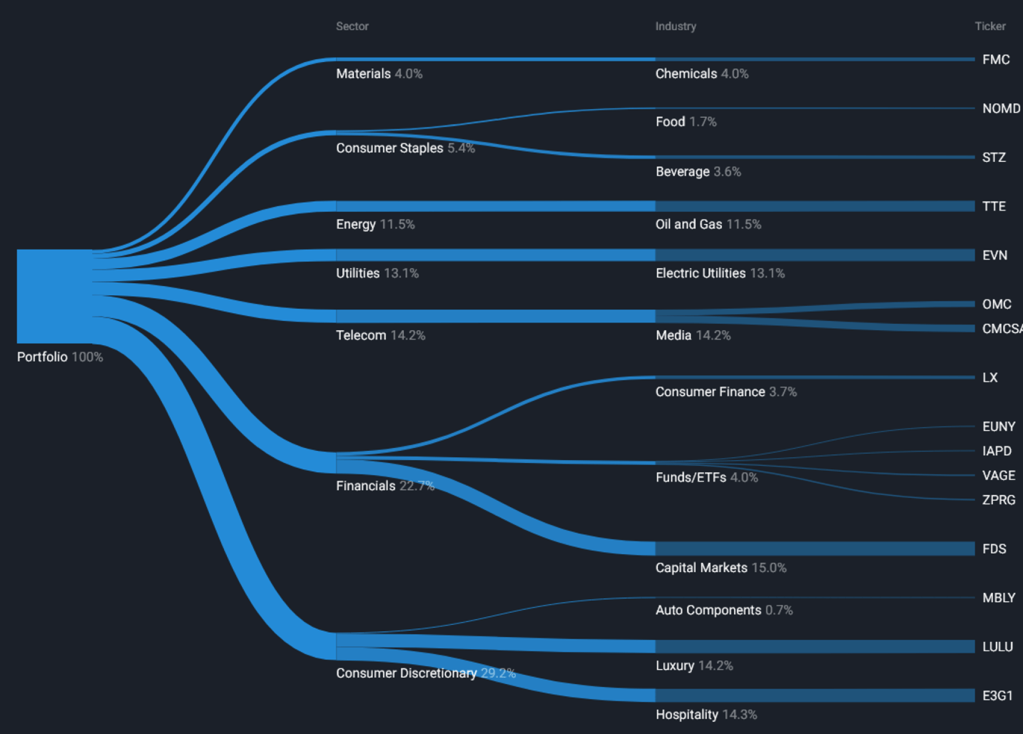

Consumer Discretionary remains the largest sector exposure. It feels slightly overweight, so I’ll look for ways to trim it — either by taking profits if prices rise or by cutting small portions to manage realized gains.

The Financials sector comes next, mainly driven by FactSet, which is currently my largest position. This sector also includes my ETFs. I’ve optimized them from six down to four and plan to keep three — EUNY, VAGE, and ZPRG — for good diversification and dividend yield. The ETF IAPD was delisted, so once my broker resolves that, I’ll reallocate its funds.

A new entry in this month’s breakdown is Consumer Staples, thanks to the new additions. It currently represents 5.4% of my portfolio, and I’d like to increase that weight in the future.

The remaining sectors look balanced, and I don’t plan any major changes for now.

💬 Final Thoughts

That wraps up this month’s update! I didn’t quite manage to keep it shorter, but I wanted to discuss all the important changes and reflections.

Coming back to FMC — the key takeaway for me is that investing is a dynamic process. Stories can change fast, and it’s crucial to stay alert. This experience was a great reminder to stay diversified, stay informed, and always do your own research — not just follow someone else’s opinion (unless it’s a professional advisor).

If you enjoyed this update, consider subscribing to the blog so you don’t miss new posts. I’d also love to hear your thoughts about my latest buys or portfolio composition in the comments below.

As always — wishing you successful and meaningful investing!

Keywords: portfolio update, investing mistakes, FMC stock, FactSet FDS, Constellation Brands STZ, Nomad Foods NOMD, Mobileye MBLY, stock analysis, sector diversification, value investing

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment