📘 Introduction

At the beginning of October, I published my usual update about what I bought with my most recent paycheck. That post was a bit different from my regular ones, as I didn’t do a complete portfolio review.

As I mentioned then, the reason was that I had decided to transfer my public portfolio to a new broker, and at that time, the process wasn’t fully complete. Let me just say — I don’t think I’ll ever do that again. It took much longer than expected and cost me time I could’ve used more productively.

But the good news is that the transfer is finally done! So now we can take a full look at the portfolio in its new form.

💼 Portfolio Overview

As you probably know, I use Simply Wall St to track my portfolio’s performance and allocation.

A quick reminder — until October 31, 2025, there’s a 40% discount on Simply Wall St’s paid plans. If you’d like to take advantage of it (or share it with someone who might), just click the banner below — it contains my affiliate link:

The banner contains my affiliate link. Check this post for additional information.

Now, let’s move on to what’s been happening inside the portfolio.

In my previous post, I mentioned that I had sold all of my ETF holdings (EHDL, XGEN, and 36BZ) and also exited my position in Baidu (BIDU).

My average selling price for Baidu was $137.15. As of the time I’m writing this (October 20, 2025), the stock trades just below $120 — so far, my decision doesn’t look bad.

You won’t see Baidu on the chart below since the position is now closed.

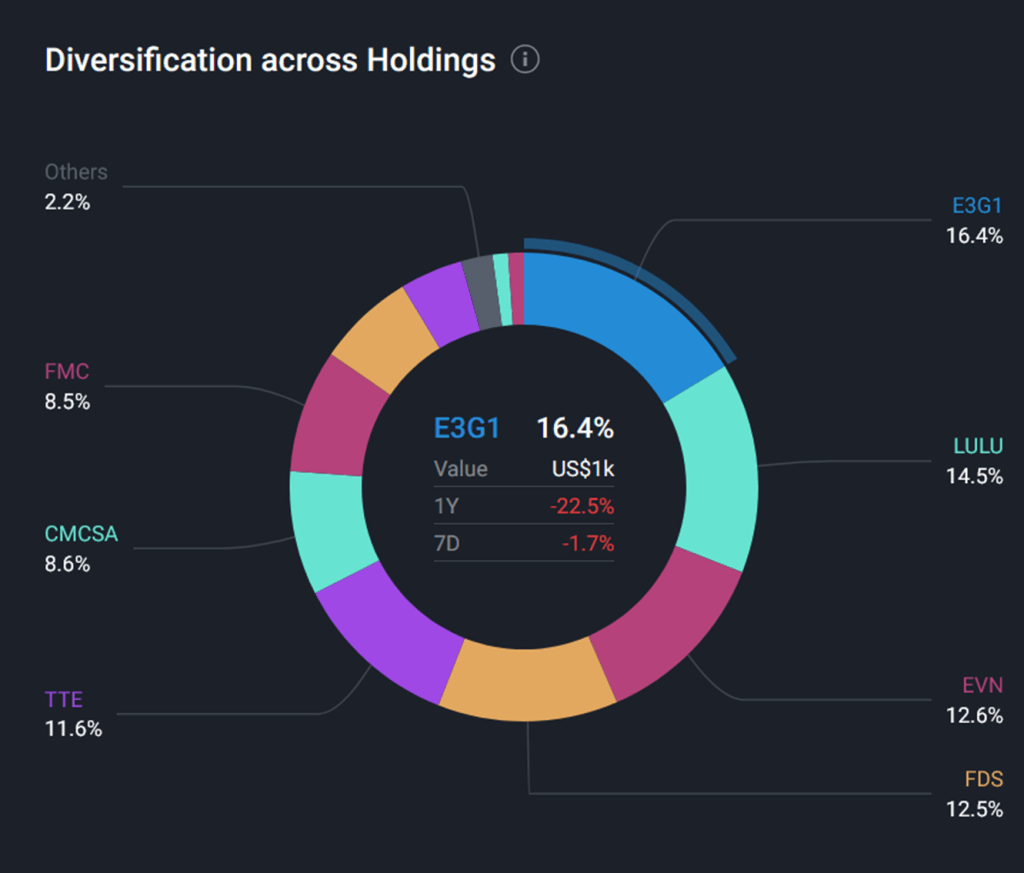

Let’s take a look at how the portfolio stands as of October 20, 2025.

📊 Major Positions

The largest position in my portfolio right now is Evolution AB (E3G1). In addition to transferring the original position, I took advantage of a price drop and added more shares at €65.50.

I’m not sure if it’s ideal to hold such a large position in this company, but at the very least, it still feels fairly valued to me.

My second-largest position is Lululemon (LULU) — a new addition.

If you go back to my earlier posts, you’ll see it wasn’t part of the portfolio then.

In my October “purchases” update, I mentioned that I had started buying shares, and, well… I may have gone a bit overboard because it’s now my second-biggest holding.

My average cost basis here is $174.20.

The third position in size is EVN — one of the holdings I transferred over.

I kept the original size; I didn’t add or trim any shares.

Another new name is FactSet (FDS). I also mentioned this one in my October purchases post. Ideally, I’d like it to be a larger part of the portfolio, but I held back because its current P/E ratio is a bit higher than I’d like. It’s not unreasonably high, but it’s enough to keep me cautious. If the price drops, I’d happily add more.

My average buy price is $283.80.

The fifth-largest holding is TotalEnergies (TTE).

Here, I kept the original position size — the only change I made was swapping the USD-traded shares for the EUR-listed version.

Both Comcast (CMCSA) and FMC (FMC) remain unchanged.

I have mixed feelings about FMC, but I keep reminding myself that it’s a cyclical stock — so for now, I’m holding.

I also continue to hold a small position in LexinFintech (LX).

📈 ETF Exposure

As I mentioned earlier, I sold my initial ETFs but wanted to maintain some level of ETF exposure.

So, I built a small mix of several ETFs.

We won’t go into details here, since I plan to cover them in a dedicated post soon.

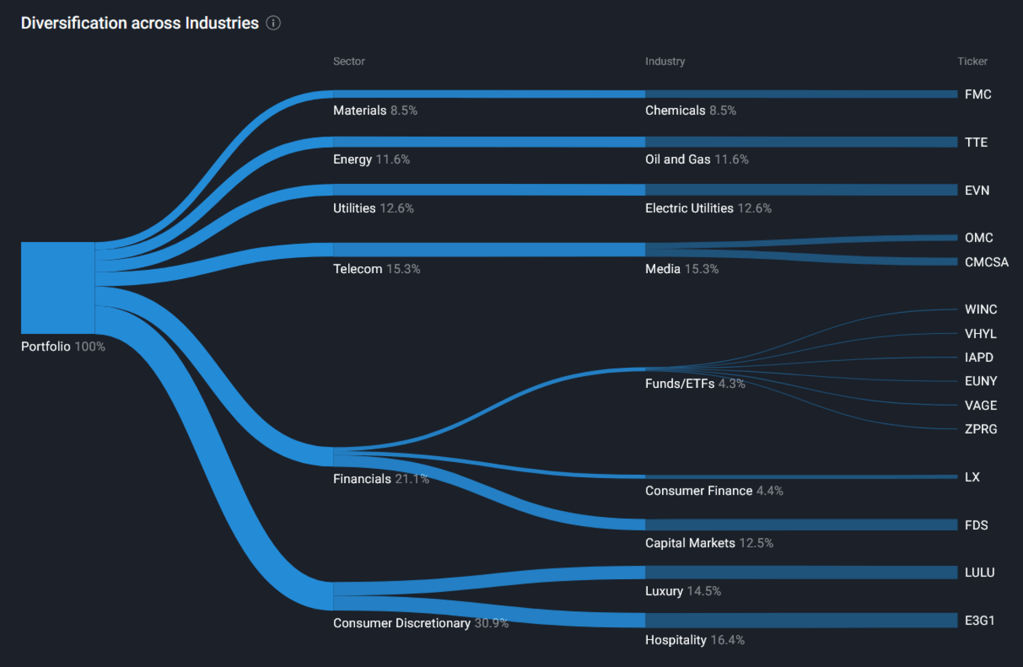

However, you can see their ticker symbols below in the sector diversification chart.

🧩 Sector Diversification

Looking at the sector breakdown, I can see it’s far from perfect.

In the previous portfolio review, the Telecom sector had quite a high weighting.

After selling Baidu, it now makes up just over 15%, which I’m comfortable with.

In the current allocation, Consumer Discretionary has become slightly overweight — mainly due to my additions to Evolution AB and Lululemon.

For now, I’m okay with that, as I see value in both companies.

If their prices rise to levels I consider overvalued, I’ll likely trim the positions — but for now, I’ll leave them as they are.

The rest of the allocation looks fine to me — I don’t think it needs adjustments.

One thing that bothers me a bit is that I still don’t have exposure to the food industry.

I’m honestly annoyed that I passed on Nestlé.

The main reason was that the Swiss franc (CHF) felt expensive compared to the euro at the time. Ironically, CHF has become even stronger since, and Nestlé’s stock has also gone up.

In hindsight — not my smartest decision.

Another area for improvement is my ETF allocation.

I’d like to increase it so that ETFs represent around 10–15% of my portfolio.

That’s something I’ll be working on in the coming months.

🔎 Closing Thoughts

That wraps up this portfolio review.

I hope it gave you a sense of how I think about portfolio construction — where value comes first, followed by sector diversification.

I don’t know if it’s the “right” approach, but it’s the one that makes the most sense to me right now.

Looking ahead — if stock prices remain at current levels, I’ll probably skip new additions in November.

Instead, I might allocate funds to what I call my “main portfolio” (as opposed to the public one I share here). There’s a position there that looks attractive, and I’d like to add to it.

Even if I don’t add to this portfolio in November, there will be new posts coming soon — including a breakdown of my ETF mix and, hopefully, an analysis of my new holdings.

If you’d like to get those updates as soon as they’re published, don’t forget to subscribe to the blog.

Wishing you all successful and thoughtful investing — see you in the next post!

Keywords: October 2025 portfolio update, investing blog, stock portfolio review, sector diversification, Lululemon stock, FactSet investment, ETF allocation, Evolution AB, TotalEnergies

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment