A Mid-Month Check-In 📅

It’s mid-September, and I’m back with a quick portfolio update. If you’re reading my blog, chances are you’re seriously interested in the financial markets. As you know, markets are incredibly dynamic, and we always need to stay alert to changes.

Just about two weeks after my last set of trades, I found myself making a few more adjustments. In my previous post, I mentioned that I wanted to reduce my exposure to the telecom sector, since the allocation had grown too large (29.1%). Recently, I got the chance to do exactly that—though from an unexpected place. Let me walk you through the trades and then we’ll take a look at the portfolio as a whole.

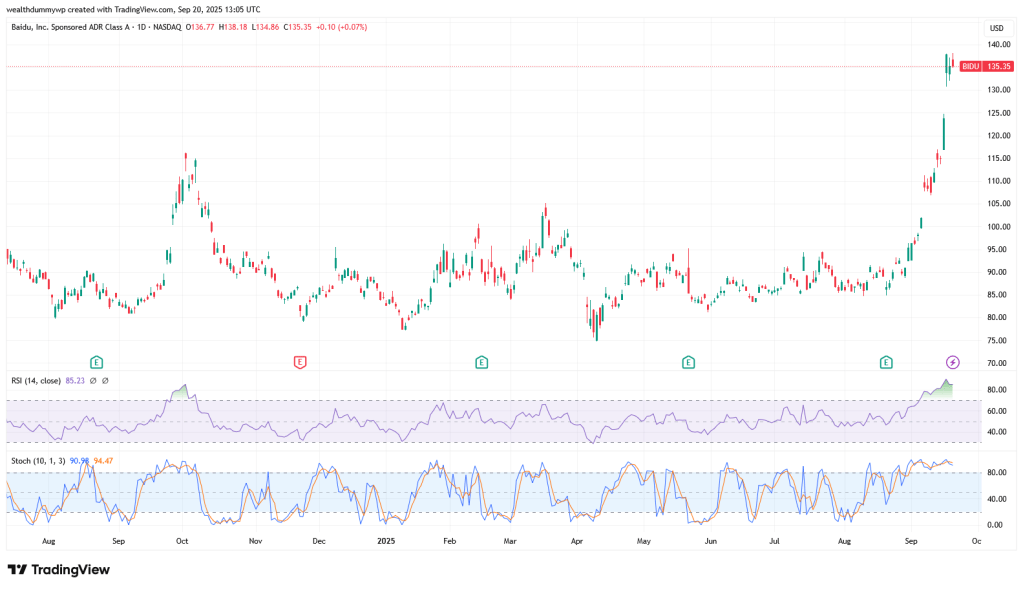

Selling Baidu 📈

Yes, that’s right—I reduced my telecom exposure this month by selling part of my Baidu (BIDU) position. To be honest, I didn’t expect this opportunity to come from Baidu. Since I started buying shares, the stock had been moving sideways, and I thought it would stay that way until the company’s latest initiatives started to bear fruit. As usual, the market surprised me.

On September 17, 2025, I sold about 56% of my Baidu shares at $133.94. My average purchase price was $88.25, which means I locked in a gain of just under 52%. Considering my first buy was back in January, I’m pleased with that result.

Reinforcing Existing Positions 🔄

True to my style, I immediately reinvested the proceeds into positions I already held. This is something I see as a weakness in my investing approach—I often feel compelled to put money back to work right away. It’s an area I’d like to improve on. Still, here’s what I did:

- Comcast (CMCSA): Increased my position by about 25% at $32.62 per share. My average cost is now $32.52. At Friday’s close, the price was slightly under $32, putting me at a small unrealized loss (~–2%). On the bright side, the ex-dividend date is coming up, so I’ll likely hold through that.

- TotalEnergies (TTE): Added nearly 43% more to my position at $61.90 per share. My new average is $62.15. The stock closed at $60.54, so I’m slightly in the red here too.

- LexinFintech (LX): Nearly doubled my small position (+89%) at $5.79 per share, lowering my average cost to $5.96. The stock closed at $5.77, meaning another small unrealized loss. Sometimes it feels like every stock I buy dips right afterward—but as I’ve said before, timing isn’t my strongest suit.

A New Broker Account 🆕

This month, I also opened an account with a new broker (I won’t mention the name to avoid advertising). They had a promotion: invite a friend, and both of you receive free shares after registration. I joined through a friend’s referral, deposited a small amount, and got some free stocks. Then I invited friends myself and received even more.

That’s why you’ll now see small new positions like Klarna, Fresh Del Monte Produce Inc, Kaspi, and BMW in my portfolio breakdown. For now, these are tiny allocations—not worth deep analysis yet. If I increase them later, I’ll write more detailed posts. As for the broker itself, I’m still testing whether I could use it as a main platform, but so far it looks decent.

Portfolio Overview 📊

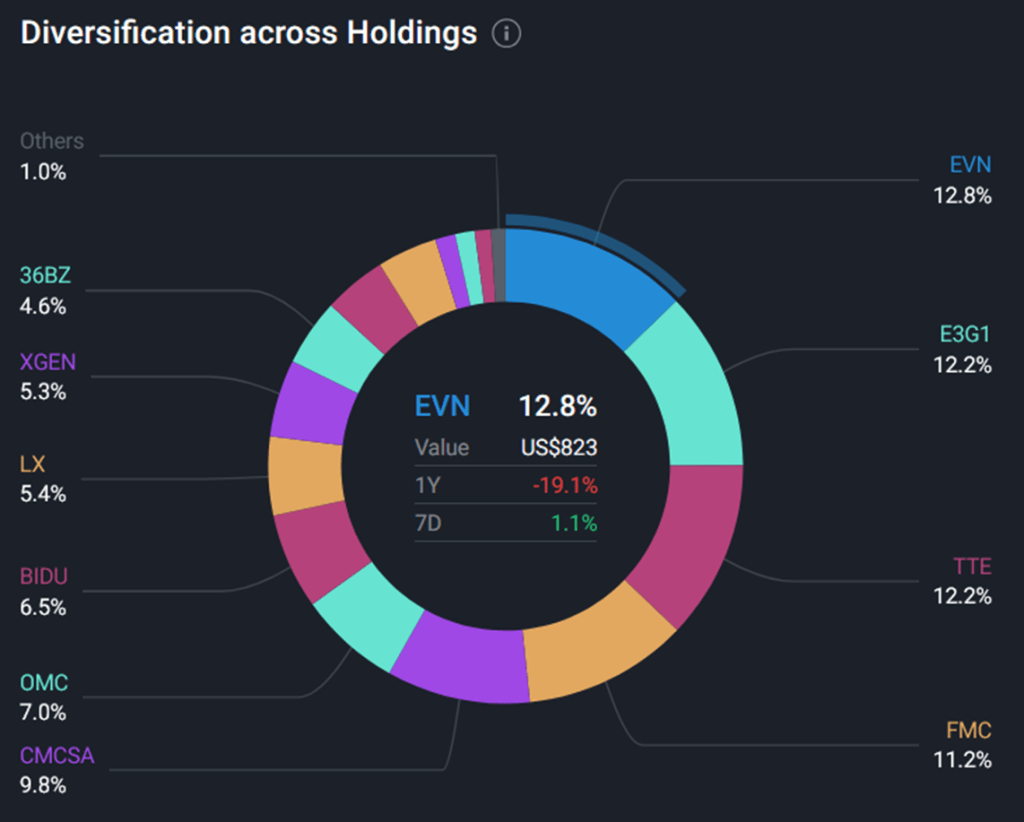

As always, I use Simply Wall St to track and visualize my portfolio.

- EVN AG (EVN) remains my largest holding, though its weight has dropped from 13.5% to 12.8%.

- Evolution AB has moved up to second place.

- TotalEnergies (TTE) jumped from fifth to third after my recent additions.

- FMC and Comcast now sit in fourth and fifth, respectively.

- Baidu (BIDU) slipped to seventh place, down from fourth in the last review, which makes sense given my partial sale.

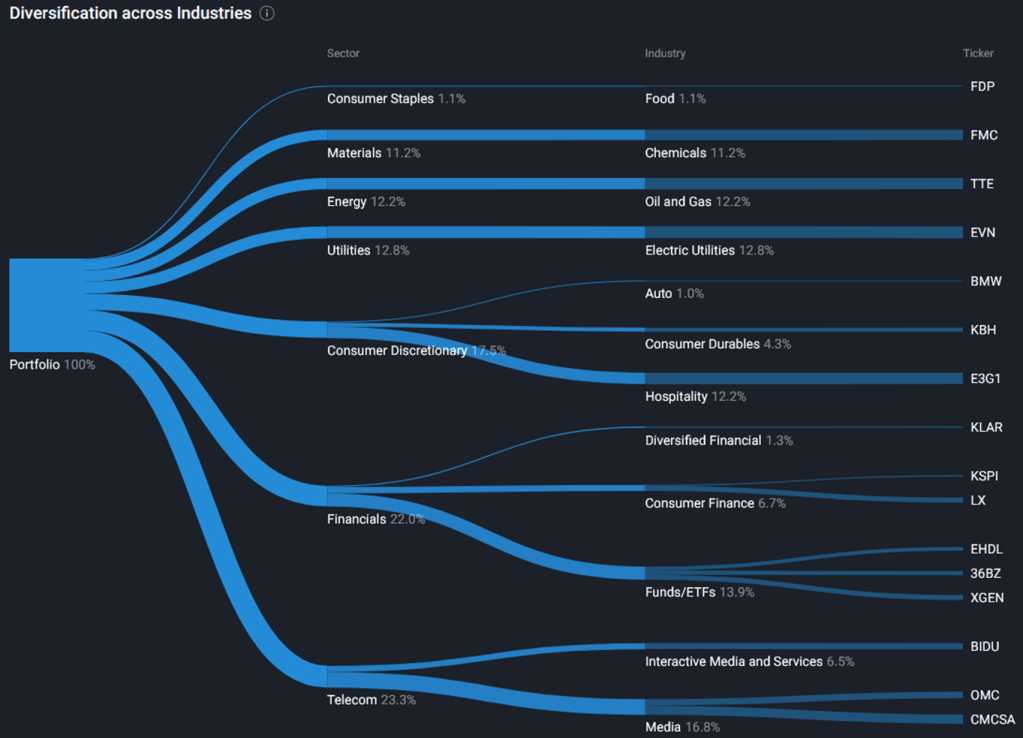

Sector Allocation 🔎

- Telecom: Down from 29.1% to 23.3%, thanks to trimming Baidu. I still feel this sector could use further reduction.

- Energy: Pure-play energy stocks now make up 12.2%. I’m comfortable with this level and don’t plan to add or reduce further for now.

- Defensive tilt: About 30% of my portfolio is in Materials, Energy, and Utilities, which gives me a slightly defensive stance. That makes me feel comfortable, though time will tell if it’s good for long-term performance.

- Gaps: I’m still light on Food, Consumer Durables, and Autos, which I’d like to improve over time.

Future Moves 🔮

- If Baidu climbs closer to $150, I may sell the rest of the position and shift into KB Home (KBH). That would further reduce telecom exposure while boosting consumer durables.

- With my next paycheck, I’d like to increase my small BMW position—assuming the price stays stable or dips. Yes, I know the auto sector faces challenges, but I think the fears may be exaggerated. Plus, I drive a BMW myself, so there’s a bit of sentimental bias involved (which usually isn’t a good thing, but we’ll see).

- I’m considering adding more to my small position in Klarna (KLAR), despite normally avoiding post-IPO stocks. The business model looks interesting, though I recognize the risks.

- I’m still undecided about Fresh Del Monte Produce (FDP) and Kaspi (KSPI), but I do want more exposure to the food industry overall.

This morning I woke up thinking of selling the entire so-called public portfolio and waiting for more attractive valuations. Especially after the Fed’s recent decision on interest rates, the market feels overly optimistic to me. I know that might just be my perception, and selling everything probably isn’t a great idea—especially since market timing isn’t my strength. For now, I’ve decided against it. Instead, I’ll try to make the portfolio slightly more defensive while staying invested. At the end of the day, I value quality sleep as much as returns.

Reading Corner 📚

On a personal note, I finally started reading One Up on Wall Street by Peter Lynch. I’ve admired his investing style for a long time, watched countless videos about his approach, but somehow delayed reading the book. Now that I’m about a third of the way in, I regret not starting sooner. It’s easy to read, full of examples, and best of all—it inspires confidence that even non-professional investors can do reasonably well.

If you’re interested in investing, I highly recommend giving it a read.

Final Thoughts 🌱

That’s all for this update. I hope you found it interesting and maybe even useful as you think about your own investment journey.

As always—I wish you many successful investments, and I’ll see you in the next post!

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: stock investing, portfolio update, Baidu stock, Comcast, TotalEnergies, LexinFintech, EVN AG, Klarna IPO, retail investors, sector allocation, portfolio diversification, long-term investing

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment