Introduction 🍂

Summer is slowly fading away, and we’re stepping into autumn—a season when I usually find myself less distracted and more focused on my investments. With the busier summer months behind me, I’m finally getting back to a routine that allows for deeper analysis and more consistent attention to my portfolio.

I owe you an apology for not posting sooner. As I mentioned in my previous update, this period has been a bit more hectic than usual. The good news? Starting in November, I expect to have much more time to dedicate to this blog, which means more regular updates and in-depth discussions about investing.

Since my last post, I’ve made some meaningful changes to my portfolio—several of which were already on my radar and hinted at in that earlier update. Now, those ideas have turned into real actions, and in this post, I’ll walk you through them. We’ll review the trades I executed, why I made them, and how my overall portfolio looks today.

Recent Trades and Portfolio Moves 💹

Following Through on Previous Plans ✅

In my last post, I shared a few ideas for potential portfolio adjustments. This time, I followed through on all of them—and even added one unplanned move along the way. Here’s how it played out:

Adding More TotalEnergies SE (TTE)

On August 18, 2025, I used the proceeds from my First Solar (FSLR) sale to increase my position in TotalEnergies SE (TTE) at an average price of $61.53 per share. So far, the stock hasn’t moved much in either direction, but I’m comfortable with the allocation. Energy remains a core sector I want exposure to, and this step strengthens that position.

Selling Clear Secure (YOU) and Buying Baidu (BIDU)

On the same day, August 18, I sold the remaining shares of Clear Secure (YOU) at $32.22 and reinvested the funds into Baidu (BIDU) at $90.44. This reallocation has worked out positively so far: since then, YOU has risen about +9.40%, while BIDU has climbed roughly +12.70%. Of course, short-term price swings aren’t the full story, but it’s encouraging to see that the move is paying off in the early days.

Unplanned Trade: Kraft Heinz (KHC) → KB Home (KBH)

On August 27, I made a transaction that wasn’t in my initial plans. I sold the remaining shares of Kraft Heinz (KHC) from my public portfolio at $27.69, and with the proceeds, I bought shares of KB Home (KBH) at $63.46. So far, this reallocation also looks promising: since the trade, KHC is down about –1.22%, while KBH is up roughly +7%.

Overall, I’m satisfied with these reallocations. They give my portfolio a structure that feels stronger and more balanced. Of course, time will tell whether these decisions truly pay off—but for now, I’m optimistic.

New Buys With Fresh Capital 💵

I’ve continued to stick to my plan of investing consistently each month. That said, I put a bit less money to work this time. The reason? It’s becoming harder to find stocks that, in my view, are trading at truly attractive prices. Still, I managed to make two meaningful purchases with my September paycheck.

Adding to EVN AG (EVN)

On September 5, 2025, I increased my position in EVN AG (EVN), buying shares at €22.90. This was the exact same number of shares as last month, but at a slightly lower price compared to my earlier purchase at €23.65. As a result, I managed to lower my average cost basis. Despite this, the position is still sitting at an unrealized loss of about 1.30%. With this buy, however, EVN has now become the largest holding in my portfolio—something I’m comfortable with given the company’s long-term potential.

Starting a New Position in LexinFintech Holdings (LX)

Also on September 5, I opened a new, small position in LexinFintech Holdings (LX) at $6.08 per share. For now, it’s the smallest position in my portfolio, currently showing a very slight unrealized loss of about –0.15%.

LexinFintech is a Chinese fintech company that focuses on online consumer finance, providing credit services and installment-based payment solutions through digital platforms. In short, it connects young consumers with financial products in an increasingly digital-first market. I haven’t decided yet whether I’ll add more to this position, but I’m hoping to take a deeper look at the company soon in a dedicated post.

Portfolio Review and Allocation Update 📊

According to my broker, my public portfolio (which I started at the beginning of this year) is currently showing a modest gain of +3.88%. Normally, I try to avoid making short-term comparisons, but I feel it’s worth noting that this performance lags behind the S&P 500, which is up more than 10% year-to-date. We’ll see how things develop in the long run, but perhaps this is yet another reminder of just how difficult it is to beat the index—especially for a retail investor like me.

As usual, I use Simply Wall St to track and visualize my portfolio’s performance.

Top 5 Holdings Update 🏆

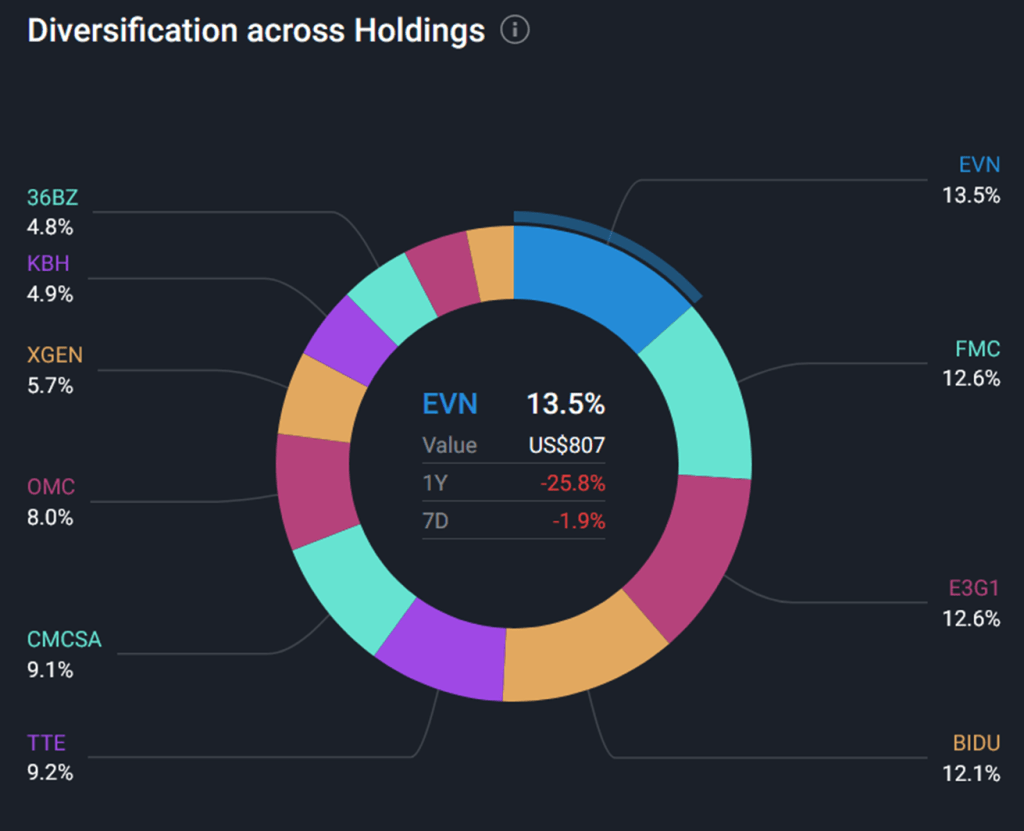

This time, there’s been some reshuffling in the top five positions of my portfolio:

- EVN AG (EVN) is now the largest holding, thanks to my recent additions.

- FMC Corporation (FMC) has moved up to the second spot.

- Evolution AB has slipped to third place, mainly due to a drop in its share price. (I haven’t sold any shares—the change is purely price-driven.)

- Baidu (BIDU) and TotalEnergies SE (TTE) now round out the top five. Their entry is the direct result of the reallocations I made after selling other positions.

In my previous portfolio review, Comcast (CMCSA) and Omnicom (OMC) were part of the top five. Since I haven’t added to those holdings, they’ve naturally fallen further down the list as other positions grew.

Sector Diversification Review 🔎

If we classify EVN AG under the energy allocation (since it belongs to the Electric Utilities sector), then my total exposure to energy stands at 22.70%. I feel comfortable with this level of concentration. For now, I don’t plan to reduce it—but I’m also not looking to add more.

From the chart, it’s clear that my portfolio has a relatively large weight in the Telecom sector. To be honest, I think it’s too high. I definitely won’t be adding here anytime soon. Instead, I’ll be looking for opportunities to trim my exposure if the time is right. I won’t rush, though—I’ll give telecom stocks time to develop, and if I see price increases that significantly outpace business fundamentals, that might be my cue to reduce.

On the other hand, the Financials sector feels underrepresented in my portfolio (excluding ETFs). Right now, I haven’t found any stocks in the sector that I believe offer attractive value, but if I do, I’d be more than happy to increase my allocation there.

As for the Food industry, currently I don’t have any representation. This is something I’d like to correct over time. I’m actively searching for attractive entry points in the sector and will add when the right opportunity appears.

Overall, I’m satisfied with how my portfolio is allocated. With a few exceptions, I believe it’s well-positioned for different market scenarios. Of course, I’ll continue monitoring the situation and making adjustments as needed—and as always, I’ll share those changes with you as quickly as I can.

Final Thoughts 🌱

I hope this update was both interesting and useful to you. Even though my schedule has been heavier lately, I still manage to track my portfolio almost daily—and I’ll do my best to keep it that way going forward.

I’d love to hear how you’re approaching your own portfolio decisions. Are you making changes, or sticking with your current allocation? Feel free to share your thoughts in the comments.

As we transition from summer into autumn, I wish you a smooth season change and, most importantly, many successful investments ahead. 🍁

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: stock investing, portfolio update, retail investors, EVN AG, Baidu stock, TotalEnergies SE, KB Home, LexinFintech, dividend investing, portfolio diversification, sector allocation, long-term investing

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment