August is here—the season of vacations, sunshine, and sizzling temperatures. Yet, my work schedule is as busy as ever, which means I can’t fully enjoy summer the way I’d like. What’s worse, I barely have time to write blog posts—something I truly enjoy and find relaxing. I keep reminding myself this pace won’t last forever, and soon I’ll be able to dedicate more energy to the things that recharge me—like sharing my thoughts with you, my readers.

I’m not here to complain, just to explain why my posts have been less frequent lately. But let’s get to the point of this article—what moves I made in my public portfolio last month. As you probably know, I try not to overtrade, keeping my focus on investing rather than short-term speculation. Still, August brought a few notable transactions. I’ll walk you through my latest buys and sells, and at the end, we’ll review the overall portfolio status—so stick around.

Last month, I recorded two stock purchases, two sales, and received a quarterly dividend from FMC. Let’s start with the sales.

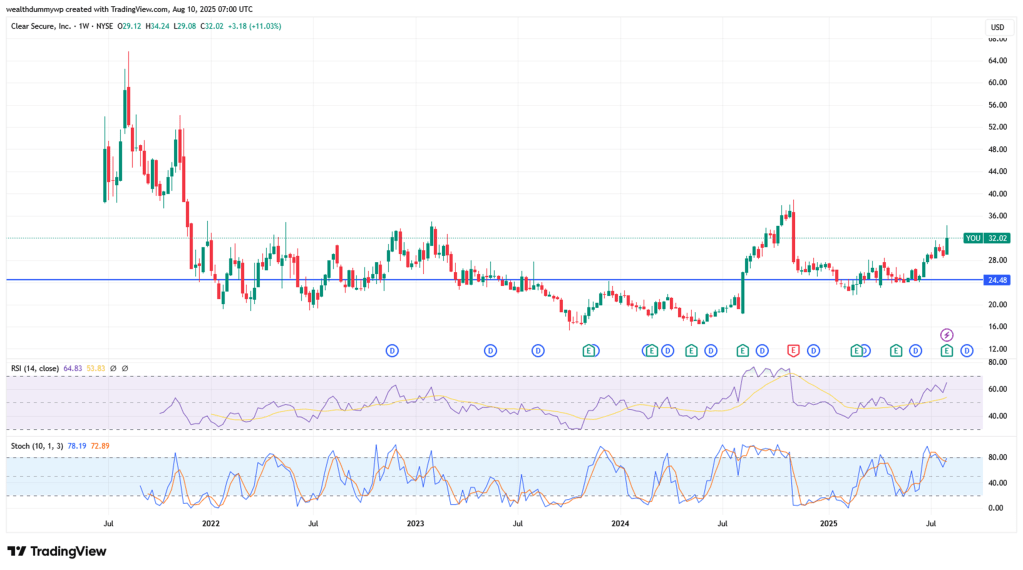

📈 Clear Secure (YOU)

On August 8, 2025, I sold 50% of my Clear Secure position at $32.14. My average buy price was $24.48, so I locked in a profit of just over 31%. I bought these shares on March 5, 2025, which means this return came in just five months—faster than expected. Initially, I projected a total return of about 45% over three years. Since the market gave me 30% in such a short time, plus some technical indicators signaling a peak, I decided to secure gains on half the position.

I still like Clear Secure’s business model, but valuation is getting stretched given analyst expectations. Honestly, I’m considering selling the rest and reallocating the capital elsewhere, though I haven’t decided yet.

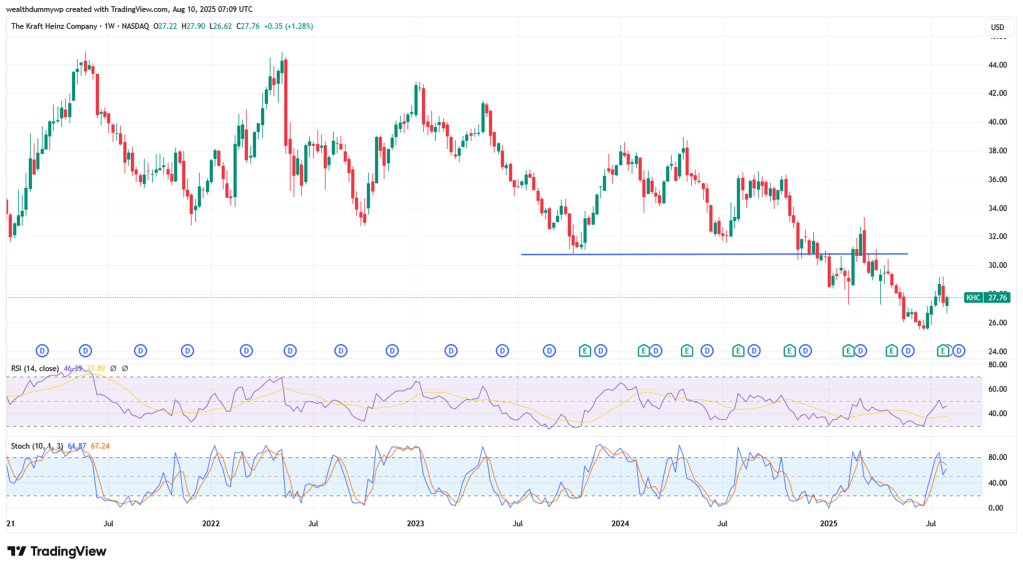

🧀 Kraft Heinz (KHC)

On August 5, 2025, I sold about 30% of my Kraft Heinz position in the public portfolio at $27. My cost basis for this portion was $30.91, so I took a small loss (around 13%). The sale freed up cash for new investments this month. I also hold KHC in my main portfolio, so from a diversification standpoint, it makes sense not to double up.

If KHC’s price recovers to my buy level, I might sell the remainder for the same reason. I’ll let you know if I do.

🆕 New Stock Buys in August

Both of my August purchases were new additions—I hadn’t held either before. Let’s go through them.

📢 Omnicom Group (OMC)

About the Company:

According to Simply Wall St:

Omnicom Group Inc., together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of media and advertising, precision marketing, public relations, healthcare, branding and retail commerce, experiential, execution, and support. The company’s services include advertising, branding, content marketing, corporate social responsibility consulting, crisis communications, custom publishing, data analytics, database management, digital/direct marketing and post-production, digital transformation consulting, entertainment marketing, experiential marketing, field marketing, sales support, financial/corporate business-to-business advertising, graphic arts/digital imaging, healthcare marketing and communications, and instore design services.

I had no exposure to this sector before and thought it was time to add it. OMC had been on my watchlist for a while, and at $72.12 per share (August 5, 2025), the price seemed fair. Fundamentally strong, with a decent technical setup—the ideal entry would have been in June around $68, but we’re still well below the 52-week high. I’m planning a separate, in-depth post on why I like this company.

📺 Comcast Corporation (CMCSA)

About the Company:

According to Simply Wall St:

Comcast Corporation operates as a media and technology company worldwide. It operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments. The Residential Connectivity & Platforms segment provides residential broadband and wireless connectivity services, residential and business video services, sky-branded entertainment television networks, and advertising.

This was another sector I hadn’t yet touched. With the stock near its 52-week low, attractive fundamentals, and a decent dividend, I bought in two tranches:

- August 5, 2025, at $32.74

- August 8, 2025, at $31.95 (using funds from the Clear Secure sale)

My average cost is $32.49, currently slightly in the red. I’ll share a detailed breakdown of why I like (and what concerns me about) Comcast in a future post.

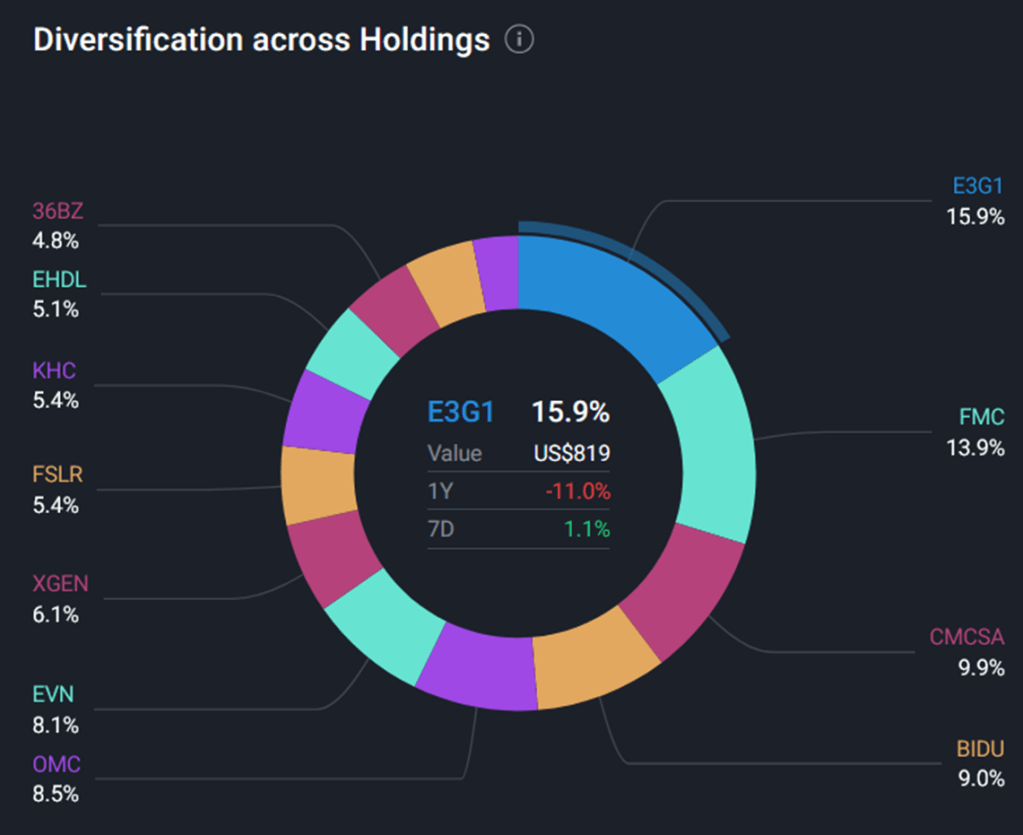

📊 Portfolio Overview – August 2025

As you might know I track my public portfolio with Simply Wall St.

Let’s start with holdings diversification:

As of August 10, 2025, my largest holding is Evolution AB, which recently overtook FMC—not because Evolution rallied, but because FMC dropped after the latest quarterly report. If FMC returns to my average cost, I’ll likely trim it to reduce weighting.

Comcast now ranks third at 9.9%, ahead of Baidu. While I’m not planning to add more CMCSA soon, I am considering increasing my Baidu position, given their recent business expansion plans. Omnicom ranks fifth, and if prices hold or dip, I may top up.

The new additions boosted Telecom’s weight to 27.4%—up from 10%. This wasn’t intentional, so I’ll avoid adding more in this sector for now. Instead, I plan to focus on Energy and Food sector opportunities in the coming months.

Even though summer’s in full swing and my schedule’s hectic, investing remains a passion and priority for me. I still carve out time for company research, and I hope to soon have more time to write here.

Wishing you a great end to summer and plenty of profitable investments—no matter the season!

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: stock market, investing in stocks, ETFs, dividend stocks, stock analysis, investing for beginners, long-term investing, energy stocks, portfolio diversification, stock buys and sells, investment strategies, August 2025 stock market update, retail investor portfolio review, best dividend stocks August 2025, new stock buys Comcast Omnicom August 2025,

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment