In previous blog posts, I mentioned that my portfolio needed greater exposure to the energy sector. That’s exactly what I focused on with my July investments. I also wrote about my intention to increase my position in First Solar, particularly if the stock price remained below $165. However, when my paycheck hit, the price had already climbed far above that level — hovering around $185. So I missed the chance to buy more at that time.

Still, I may have found a convenient opportunity to add to my position later. Stick around until the end to see how that played out. But first, let’s dive into the actual investments I made in July.

✅ EVN AG – A Move into Energy Utilities

This was my first purchase for the month. As I said earlier, I was looking to boost my energy exposure. While EVN AG is more of a utility stock, it’s still in the energy space, so it made the shortlist. Here’s a brief overview of the company:

EVN AG provides energy and environmental services in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania. The company operates through Energy, Generation, Networks, South East Europe, Environmental, and All Other segments. It is involved in energy generation; operation of distribution networks; production and supply of electricity, natural gas, and heat to end customers, as well as investment activities.

Given this profile, it should be clear why EVN made my buy list. I won’t go into too much detail here, as I’m planning a separate deep dive into this company soon.

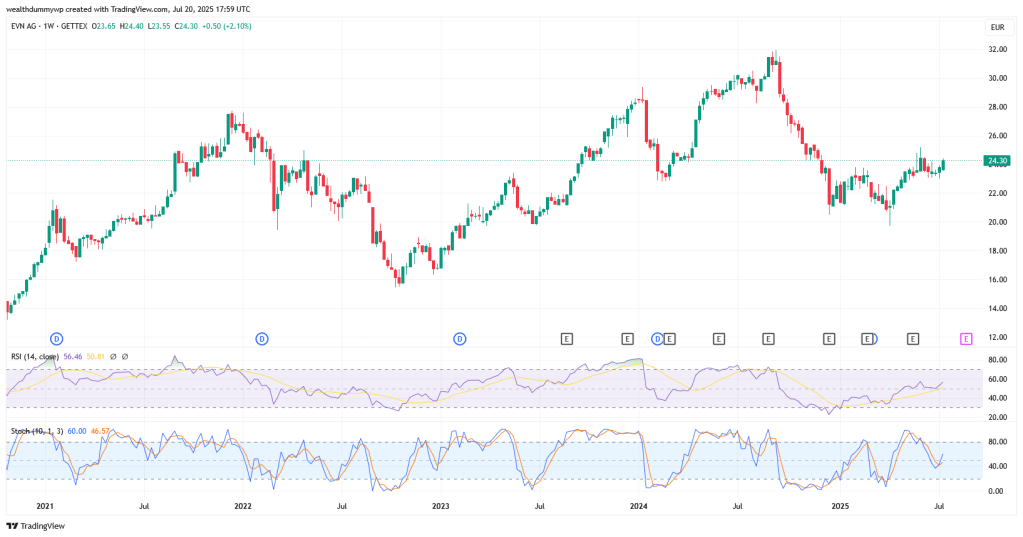

From a technical analysis standpoint, the timing wasn’t perfect. Earlier in the year, there were definitely more attractive entry points. Still, I took the “better late than never” approach. I plan to add more to this position if the price dips.

As for the purchase specifics: I allocated 58% of my July investment budget to EVN. I bought on July 4, 2025, at a price of €23.65 per share. As of the time of writing, the price is roughly the same. Fingers crossed that a dip gives me the chance to strengthen the position further.

💼 ETF Investments – Healthcare & Emerging Markets

The remaining 42% of my July budget was divided between two ETFs — both of which I’ve discussed in previous blog entries. This month, I simply added to those positions, dollar-cost averaging. For any new readers, here’s a quick refresher:

🧬 Xtrackers Healthcare Innovation (Ticker: XGEN)

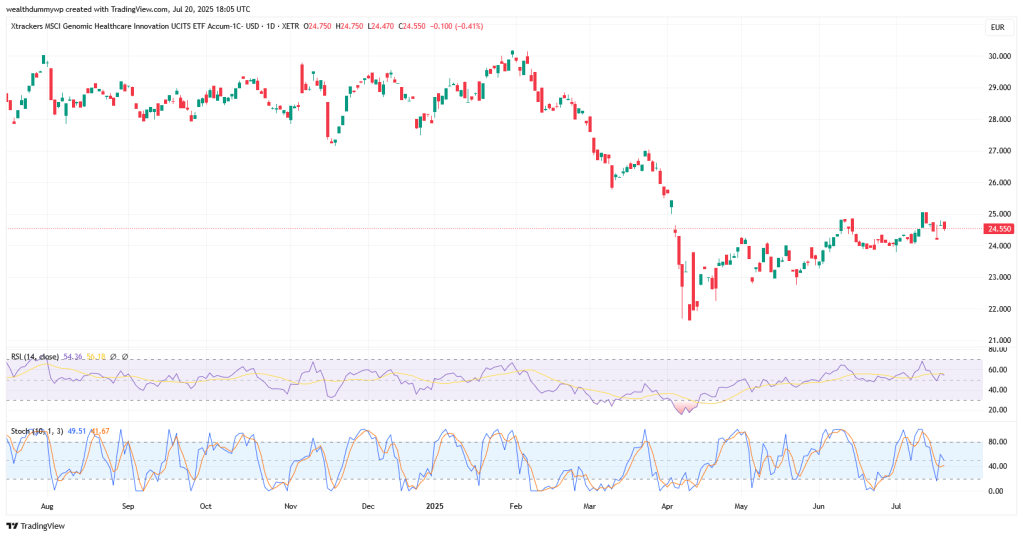

This ETF focuses on companies that are innovating in the healthcare space. I truly believe that medical innovation will be a core investment theme in the years ahead. I added to my position at €24.21 — slightly higher than my previous entry at €24.04. Not a huge difference, and the price is still hovering in the same range.

Now, a quick technical note: my comments are based on data from July 4, 2025, while this chart and post were finalized on July 20, 2025. From a technical perspective, it looked like a reasonable time to buy. Stochastic indicators hinted at a possible pullback, but the RSI was far from overbought — suggesting potential for upward movement. I remain confident in the healthcare sector and would gladly increase my stake if prices drop.

🌍 Invesco Emerging Markets Dividend ETF (Ticker: EHDL)

This ETF gives me exposure to emerging market equities — which I see as a mix of growth opportunity and attractive dividend yield. I bought additional shares this month at €21.81, just slightly above my June entry of €21.78.

So far, the price hasn’t moved much. That’s fine — the goal here is stable, dividend-driven returns. I also received a small quarterly dividend on June 24, 2025, which I immediately reinvested. If the price continues to dip and no better opportunities arise, I’d be open to expanding this position further.

🔄 Swapping ACM Research (ACMR) for First Solar (FSLR)

As I mentioned earlier, the price of First Solar was too high when I initially received my paycheck. But while drafting this post — and yes, it’s taken me a while due to a busy season — the price corrected to more favorable levels.

By that point, I had already invested my available funds. So, I made the decision to sell a portion of my ACM Research (ACMR) shares to free up capital.

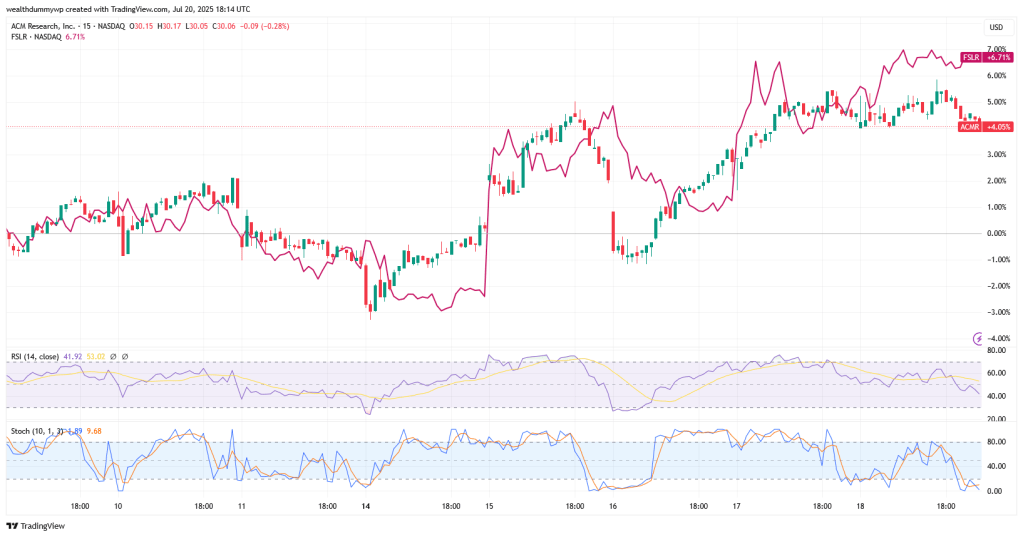

Specifically, I sold the public portfolio portion of my ACMR position — keeping the core shares in my main portfolio. I sold at $28.69, after buying at $23.23, booking a nice gain.

The main reason for the sale was that ACMR stock had run up quickly, and I feared a potential pullback. Plus, keeping it only in my core portfolio helped with diversification.

I used the proceeds to buy First Solar shares at $165.41 — both trades executed on July 9, 2025.

Looking back from July 14, it may seem like a questionable decision. ACMR remained stable, while FSLR dropped below my purchase price. Still, I don’t regret it. Timing the market is difficult, and my conviction in First Solar remains strong. If the price continues to dip before my next paycheck, I’ll happily buy more.

As a quick update (written on July 20, 2025): FSLR has now slightly outperformed ACMR. Since the trades, FSLR is up ~6.3%, while ACMR is up ~4.5%. It’s too soon to declare victory, but I’m feeling more confident in the move.

📊 My Portfolio as of July 20, 2025

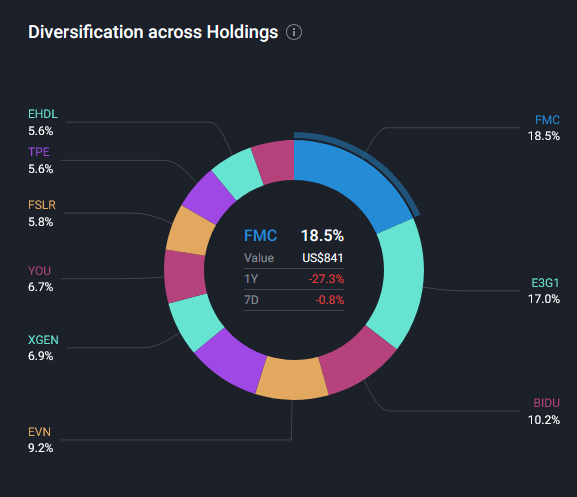

Let’s take a look at the overall portfolio after all these adjustments.

I use Simply Wall St to analyze stocks and track my holdings.

As you can see, my top three holdings are FMC (18.5%), Evolution AB (17%), and Baidu (10.2%). EVN comes in fourth at 9.2% after this month’s investment. XGEN is now 6.9%, and EHDL is 5.6%, despite the new buy.

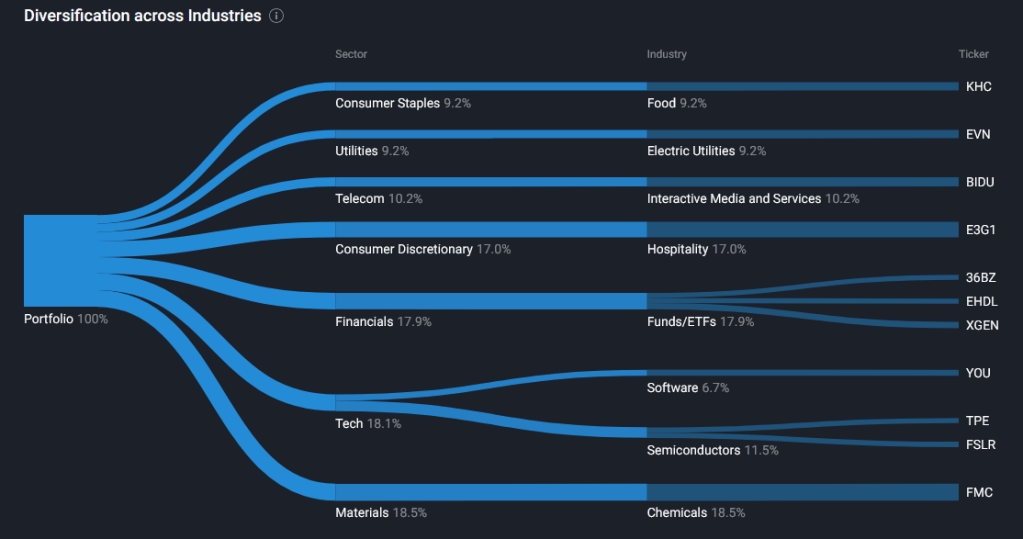

📈 Portfolio Sector Diversification

My largest sector exposure remains Chemicals, thanks to FMC. I’m comfortable with that, given the company’s conservative nature and solid dividend. However, if volatility rises and the stock price surges, I may trim the position.

Interestingly, ETFs now make up nearly 18% of my portfolio — up from nearly zero just a few months ago. I see real value in these instruments, especially during busy periods when I don’t have time to deeply analyze individual stocks. ETFs may play a bigger role in my strategy going forward.

⚡️ Energy Exposure Update

This month’s investment activity was heavily influenced by my goal to increase exposure to the energy sector. That’s why I made the moves into First Solar and EVN.

While Simply Wall St classifies First Solar as a Technology stock, I personally count it as clean energy exposure. As for EVN, it’s categorized under Utilities, which aligns with their operations — and I see it as a more defensive play within the energy space.

With these adjustments, about 15% of my portfolio is now tied to energy — 9.2% in EVN and 5.8% in FSLR. If market prices allow when my next paycheck arrives, I’d like to increase that to around 20%. That said, I’m a value-focused investor, so I won’t force any allocation if the prices don’t make sense.

Final Thoughts

That wraps up this month’s investment update. I hope you found it interesting and maybe even a little inspiring as you explore your own investing journey.

Thanks for your patience — this post took longer than usual due to a surprisingly hectic summer. I’m looking forward to returning to a more regular posting schedule soon.

Until next time — happy investing!

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: investing in energy stocks, best ETFs to buy, dividend ETF 2025, First Solar stock analysis, EVN AG utilities, portfolio diversification, how to invest in clean energy, emerging markets ETF, Xtrackers Healthcare Innovation, retail investor portfolio

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment