A Mid-Year Review of My “Public” Investment Portfolio (2025)

Back in January 2025, I opened a new brokerage account. Just a month later, in February, I launched this blog. The timing felt right, and it seemed like a great idea to discuss my trades made specifically in this portfolio. Mentally, I started referring to it as my “public portfolio.”

Until now, I’ve published individual stock analyses and posts about what I buy and sell. But recently, I realized I haven’t yet written a comprehensive update on what’s currently in the portfolio. Given that we’re nearly halfway through 2025, this feels like the perfect time to change that.

Why I Started This Portfolio

As mentioned, I opened this account to diversify my brokerage exposure. Every month, I try to allocate at least €500 from my salary to invest in assets I believe offer long-term value. If you’ve read previous blog posts, you know I consider myself a value investor. So naturally, most of the stocks in this portfolio reflect what I believe to be undervalued opportunities.

Tracking Portfolio Performance

In 2025, I started using the Premium version of Simply Wall St to analyze stocks and monitor performance. It’s been an invaluable tool — not just for research, but also for visualizing how my portfolio evolves over time.

Without further ado, let’s dive into the current state of my “public” investment portfolio.

Current Holdings (June 13, 2025)

We’ll go through each position, one by one, with a short explanation behind my investment thesis.

FMC Corporation (FMC)

Currently holding the highest weight in the portfolio, FMC is what I consider a cyclical stock. One of my earliest blog posts covered this company. My average cost basis is $41.77. While I may not have caught the absolute bottom, I’m comfortable holding the position until the cycle turns. Based on Simply Wall St, my dividend yield on cost is 5.60%, which makes the waiting game much easier. At the current price, I don’t plan to add more.

Evolution AB (E3G1)

Coming in second at 18% of the portfolio, Evolution AB is another stock I discussed early on. While the share price has dipped, the business fundamentals still look strong to me. Forecasts suggest some cooling in performance, but not enough to change my conviction. My average cost is €66.92 with a 4.1% dividend yield. I’m holding, not adding — and reminding myself that investing is a long game.

Baidu Inc. (BIDU)

Baidu holds the third spot at 13%. This is a stock I’ve been writing about since the early days. Despite falling prices, I continue to average down. I found it quite surprising that the stock dropped even after beating earnings expectations. I saw it as a gift and added to my position in June. My average cost is $87.27. No dividend here, but I view this as an asymmetric risk-reward opportunity. If the price stays low or drops further, I may add more.

Kraft Heinz (KHC)

Outside the top three, Kraft Heinz makes up 11.1% of the portfolio. This was a defensive play, motivated by rising macro uncertainty. I’ve published a detailed analysis on the blog. My dividend yield on cost is a solid 5.3%, and my average purchase price is $30.17 — higher than the current market price. If the price stays low by next paycheck, I might consider adding.

Clear Secure (YOU)

This stock represents my growth-at-a-reasonable-price (GARP) exposure. It accounts for 7.1% of the portfolio. I’ve also written a full analysis on it. My average cost is $24.59, and the 3% dividend yield is decent, especially for a company I see as growth-oriented. I’ll only consider adding if the stock drops by 20% from current levels.

PVA TePla AG (TPE)

A small-cap German tech company with long-term growth potential, PVA TePla makes up 5.8% of my portfolio. I’ve published a full write-up on why I bought it. My average cost is €16.70. With the current price at €18.11, I’m not comfortable buying more. But if the price dips below my average, I’d gladly increase my stake.

ETFs in My Portfolio

Recently, I started adding ETFs to this portfolio to improve diversification. Let’s take a look at which ones made the cut.

iShares MSCI China A UCITS ETF (36BZ)

I chose this ETF to gain broader exposure to the Chinese economy. Analyzing individual Chinese stocks can be tough, so this felt like the most effective and low-effort approach. My average entry price is €4.10. This is an accumulating ETF, meaning dividends are reinvested. It currently makes up 6.9% of my portfolio. If prices drop significantly, I’d be open to adding more.

Xtrackers MSCI Genomic Healthcare Innovation UCITS ETF (XGEN)

This ETF gives me exposure to innovations in healthcare. On one hand, I believe in the future of the sector. On the other, the ETF looked technically oversold at the time I bought in. My average price is €24.24. Like the China ETF, this one is accumulating. My plan is to hold it long term. I’d only add more if the price dips below my cost basis.

Invesco FTSE Emerging Markets High Dividend Low Volatility UCITS ETF

This ETF gives me exposure to emerging markets, with an attractive yield of around 6%. I was also drawn to its “low volatility” promise. Admittedly, the timing may not have been perfect from a technical perspective, but since my plan is to hold long term, I wasn’t overly concerned. My average purchase price is €21.98. If prices decline, I’ll continue averaging down.

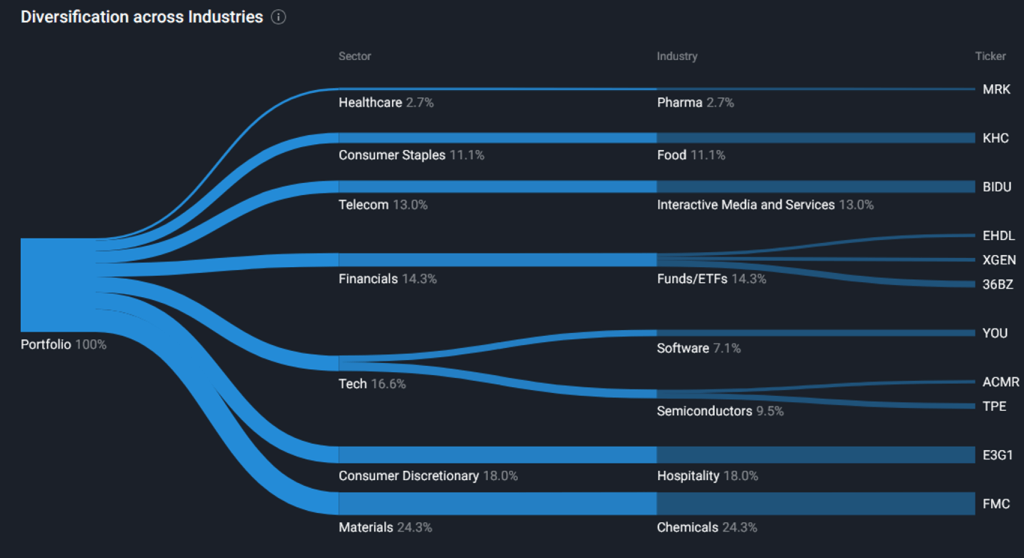

Sector Diversification: Where Am I Heavy?

As you can see from the chart above, my portfolio isn’t perfectly diversified by sector. That’s largely because I don’t start with sector targets when making investment decisions — I go where I see value.

That said, I do believe there’s room for improvement:

- Healthcare exposure is light. I currently hold a small position in Merck, and even when combined with the healthcare ETF, it still feels underweight.

- I also lack exposure to energy stocks, which I plan to address.

- Chemicals (mainly due to FMC) are probably overweight. I’ll only rebalance here once FMC recovers — if it does.

All in all, though, I’m reasonably happy with how the portfolio is positioned.

Final Thoughts

That wraps up the mid-year review of my “public” portfolio. I hope you found it insightful and maybe even got a few new ideas. From now on, whenever I write about trades — buys or sells — I’ll also include a quick snapshot of how the overall portfolio looks post-transaction. That should give you a clearer view of my strategy and help keep things transparent.

I’d love to hear your thoughts — What would you change? What’s working well in your own portfolio? I’m really hoping this blog can become a space for discussion, where retail investors can grow together and learn from each other.

Happy investing, and see you in the next post!

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: long-term investing, value investing, public investment portfolio, stock market blog, retail investor strategy, portfolio allocation, ETF investing, stock picks 2025, dividend investing, Simply Wall St review, FMC stock analysis, Evolution AB, Baidu investment, growth stocks vs value stocks

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment