As June rolled in, it was time for one of my favorite types of blog posts: sharing what I bought with my latest paycheck. May turned out to be a solid month for the markets, and below you can see how the S&P 500 performed over the past month.

Stocks recovered quite a bit after the sell-offs in April. The S&P 500 gained just under 7% in the past month—pretty impressive, if you ask me. Tensions seemed to ease a bit too, which is great for those of us who didn’t panic-sell in April. I’m glad to say I’m among them. Apart from a minor rebalancing (which I shared in a previous post), I didn’t make any big changes. I stayed fully invested, with stocks still being the dominant part of my portfolio.

As a stockholder, I obviously love to see the market bounce back. But as someone who invests a part of each paycheck every month, this makes things a bit tricky. Valuations go up, and since I consider myself a value investor, it gets harder to find attractive additions to my portfolio.

That said, I did manage to spot some interesting opportunities this month and continued buying—definitely not following the old “Sell in May and Go Away” adage. My main focus this time was diversification and finding fundamentally strong businesses.

So, without further ado, let’s dive into what I bought in June.

All of the charts in this post are provided by:

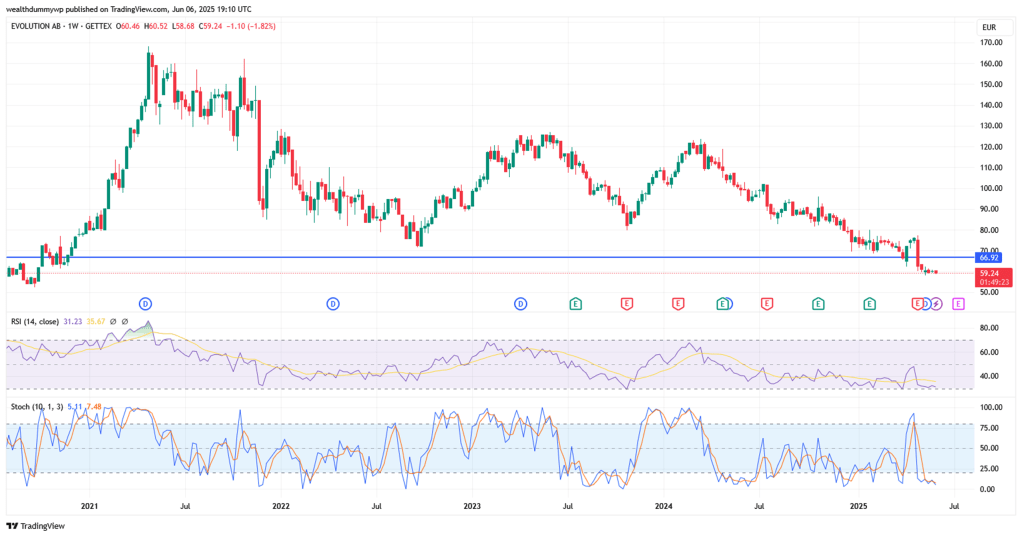

Evolution AB (Ticker: E3G1)

Evolution AB is a company I started buying earlier this year. June was my third purchase, gradually increasing the position to something more meaningful in my overall portfolio.

- First buy: Feb 5, 2025 @ €73.26

- Second buy: May 5, 2025 @ €62.62

- Third buy: June 5, 2025 @ €59.66

- Average cost basis: €66.92

Looking at the chart, the stock is now trading around levels last seen in 2020. The RSI is nearing oversold territory, and the Stochastic suggests the stock may be heavily sold off. I liked the fundamentals when I first analyzed the company, and these technical signals gave me more confidence to continue dollar-cost averaging (DCA) into it. I’m not sure we’ve seen the bottom yet, but I see real value here.

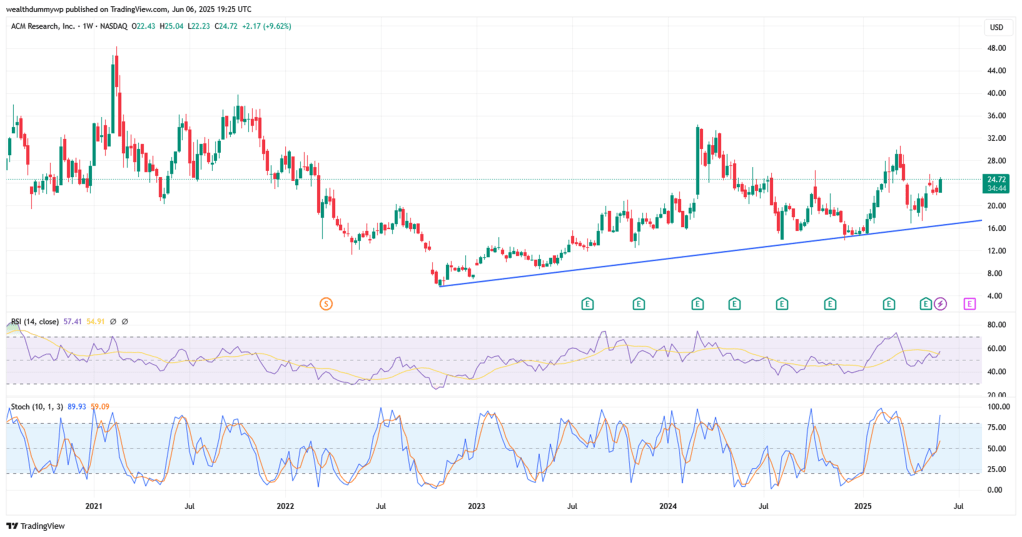

ACM Research (Ticker: ACMR)

Another name I’ve been buying since May.

- Initial purchase: May 1, 2025 @ $19.50

- Second buy: June 2025 @ $23.23

- Average cost basis: $20.74

I had previously said I wouldn’t buy more if the price exceeded $24. So at $23.23, I followed through and bought again—averaging up a bit, but still under my limit. As of writing, the stock trades at $24.72. The RSI is still in the neutral zone, so I’m not thinking of selling just yet, despite being up nearly 19% in about a month.

If the price keeps climbing rapidly, I may trim a bit. But for now, I still see long-term potential.

Baidu (Ticker: BIDU)

Baidu was another position I topped up, this time averaging down.

- Latest buy: June 5, 2025 @ $84.82

- Previous buys: $85.39 and $90.13

- Average cost basis: $87.27

The price is near levels last seen at the 2022 bottom. The long-term trend seems downward, and technical indicators (RSI, Stochastic) are neutral. While I’m not overly confident technically, I still believe the fundamentals are solid. If we get a sharp recovery and momentum indicators hit overbought levels, I’ll consider selling part or all of the position. Until then, I’m holding.

Getting Into ETFs – A Bit New for Me

I’ve generally preferred individual stocks over ETFs, believing I can uncover more upside that way. But this month, I focused on diversifying more effectively. So, I picked two ETFs that seemed promising.

Xtrackers MSCI Genomic Healthcare Innovation UCITS ETF (Ticker: XGEN)

This ETF tracks the MSCI ACWI IMI Genomic Innovation Select Screened 100 Index, focused on companies benefiting from genomic healthcare innovations. You can find more information about the fund on justETF.

- Expense ratio: 0.30%

- Distribution policy: Accumulating

- Purchase price: €24.04

- Current price: €24.26

The healthcare sector seems oversold, and I believe in its long-term importance. The ETF has just climbed out of oversold territory based on RSI and Stochastic. I may add to the position if prices hold steady or drop further. My approach here is long-term DCA, unless things get wildly overbought.

Invesco FTSE EM High Dividend Low Volatility UCITS ETF (Ticker: EHDL)

This ETF targets high-dividend, low-volatility stocks in emerging markets. I’m leaving a link to justETF for more information about this ETF.

- Expense ratio: 0.49%

- Dividend yield (per justETF): 6.03%

- Distribution frequency: Quarterly

- Purchase price: €21.78

- Current price: €21.83

- Ex-dividend date: June 12, 2025

Honestly, the chart made me hesitate—Stochastic shows we might be in overbought territory. But RSI is neutral, and the chart overall shows low volatility. That’s exactly what I want here: steady performance and attractive yield. I rushed the purchase slightly to catch the upcoming dividend, and since my position is still small, I plan to add more if the price drops.

Wrapping It Up

That’s it for my June purchases! As you can see, I continue to invest regularly—regardless of whether the market is going up or down. My strategy stays consistent: stay flexible, keep learning, and always look for value opportunities that fit my goals and time horizon.

Thanks for reading! I hope this post gave you some inspiration or ideas for your own investing journey. Feel free to share what you’ve been buying this month in the comments.

Until next time—happy investing! 🚀

If you enjoy reading my posts and find them useful, please consider subscribing to my blog or follow me on social media. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: best stocks to buy June 2025, long-term stock investing, ETF investing strategies, value investing opportunities, dividend ETFs, DCA strategy, stock market June 2025 analysis, portfolio diversification, retail investors stock picks, emerging markets ETF

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment