Like many retail investors, I have some exposure to cryptocurrencies. And just like most people interested in the space, I’ve always been curious to explore deeper. That’s exactly why I decided to write this blog post — to share my journey into the world of Web3 and crypto. Let me take you back to the beginning.

From Centralized Exchanges to a Web3 Wallet

Until recently, I used only a centralized crypto exchange for trading. It served me well, but I knew there was more to the crypto world than just that. So, I decided to set up a Web3 wallet to gradually dive deeper into decentralized finance (DeFi).

For this experiment, I chose the Binance Web3 Wallet. It felt like a convenient starting point, mainly because I didn’t have to store a seed phrase manually — a small but important win for beginners. Just to be clear, this post is not sponsored, and I have no affiliate connection with Binance. I’m simply sharing my personal experience as a user.

First Steps in DeFi: Trading Memecoins on Solana

Once my Web3 wallet was ready, I transferred a small amount of Solana (SOL) — just 0.10 SOL, which was about $15 at the time of writing. A small investment, but perfect for testing the waters without much risk.

My first move? I jumped into the memecoin craze. I selected four different tokens on the Solana network. I tried doing some research beforehand, but information was scarce. Still, I went ahead with the purchase for the sake of the experiment. The transaction fees weren’t outrageous, but definitely higher than what I was used to on a centralized exchange.

Unfortunately, the outcome was what many would expect from memecoins — volatile and unpredictable. One of the tokens did go up in value, but not enough to offset the losses from the others. Overall, I lost about 50% of my initial investment.

Adjusting Strategy: A Second and Third Try

After liquidating my first batch of tokens, I decided to take a new approach. I picked three different tokens this time. Luckily, they performed much better, and I was able to recover my original investment.

Encouraged, I gave it another shot. I selected two new tokens and invested a portion of my balance. This round didn’t go well either. The prices never went up after I bought in, and after some time, I decided to cut my losses. Perhaps they’ll be successful in the long run, but I didn’t feel comfortable holding them due to the lack of available information.

Back to the Exchange, Lessons Learned

After selling the last batch of tokens, I moved the remaining SOL back to the exchange — a familiar environment where I feel more confident. To be fully transparent, the total amount I lost in this Web3 adventure was around $4.59. A small price to pay for a big learning experience.

To sum it up: Decentralized trading isn’t for me. In my case, buying unknown tokens felt more like scratching lottery tickets. I’m sure some people can thrive in this space, but I realized I prefer a more structured and informed approach to investing. That said, I’m still very interested in exploring other parts of the Web3 ecosystem — with smaller steps and controlled risk.

My Latest Trade: WalletConnect (WCT)

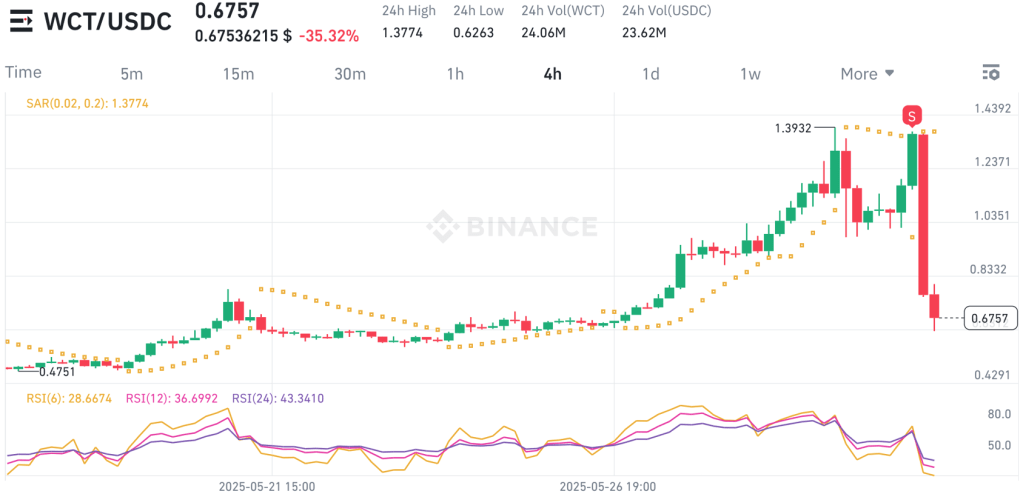

As I continue trading on centralized platforms, I’d make some portfolio updates — though they depend on certain price levels being reached. For now, I’ll share my most recent trade.

In a previous post, I mentioned opening a small position in WalletConnect (WCT). I bought in at $0.3350 and sold about 25% of my position at $1.3326 on May 31, 2025. As of writing, WCT/USDC is trading around $0.57.

I don’t plan to sell the rest of my WCT anytime soon. Having almost fully recovered my original capital from the partial sale, I’m now more curious to see how the project will develop — with less financial pressure.

A New Position: SIGN

With the funds from my WCT sale, I bought a small position in another token — SIGN — at $0.07759. It struck me as an interesting and ambitious project. That said, I view this as a high-risk investment and wouldn’t recommend it to everyone. I’m not giving any advice — just sharing what I’m doing and how I’m thinking.

Final Thoughts: Web3 Is a Universe Worth Exploring

To wrap things up — crypto is a vast universe, full of fascinating opportunities beyond just trading. While decentralized trading may not be my strong suit, I’m excited to continue exploring what Web3 has to offer. Slowly, carefully, and with a focus on managing risk.

Thanks for joining me on this part of the journey. If you found this post helpful, feel free to subscribe to my blog to follow my future updates. And if you’ve had your own experiences with Web3, I’d love to hear about them!

If you enjoy reading my posts and find them useful, please consider subscribing to my blog or follow me on social media. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: Web3 wallet, decentralized trading, crypto trading experience, Binance Web3 Wallet, memecoins Solana, WalletConnect WCT, SIGN crypto project, crypto investing journey, DeFi beginner guide, Web3 exploration

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment