In my ongoing search for portfolio growth opportunities, I recently came across a company with a relatively small market cap. I tend to gravitate toward small-cap stocks — they carry more risk, yes, but also offer more room for upside. When part of a well-diversified portfolio, I believe the added volatility is worth it.

The company I’m looking at today operates in the semiconductor sector — one I’ve written about before and remain bullish on. Let’s jump into the analysis of this intriguing business: ACM Research (ticker: ACMR).

My Initial Investment in ACMR

On May 1, 2025, I bought a small amount of ACMR shares at $19.50. Why only a small amount? The only reason is that I didn’t have much free capital at that moment — it was essentially a reinvestment of dividends.

Will I add more to the position? We’ll answer that by the end of this post, after we walk through the company’s fundamentals together.

All the visuals for the fundamental analysis are provided by:

Revenue & Net Income Growth

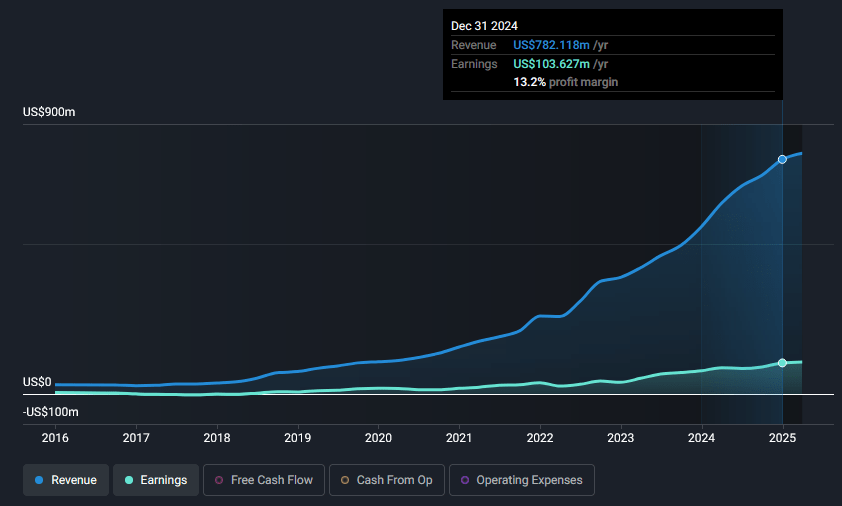

As always, we begin with a look at revenue and net income, covering the period from 2015 to the end of 2024.

In 2015, ACMR reported $31.21 million in revenue and $5.38 million in net income. By the end of 2024, revenue had surged to $782 million, with net income at $103.63 million.

That’s a 2,405% increase in revenue and a 1,826% increase in net income — impressive numbers by any measure.

But how does this business growth compare to the stock price performance?

Stock Price Performance vs. Fundamentals

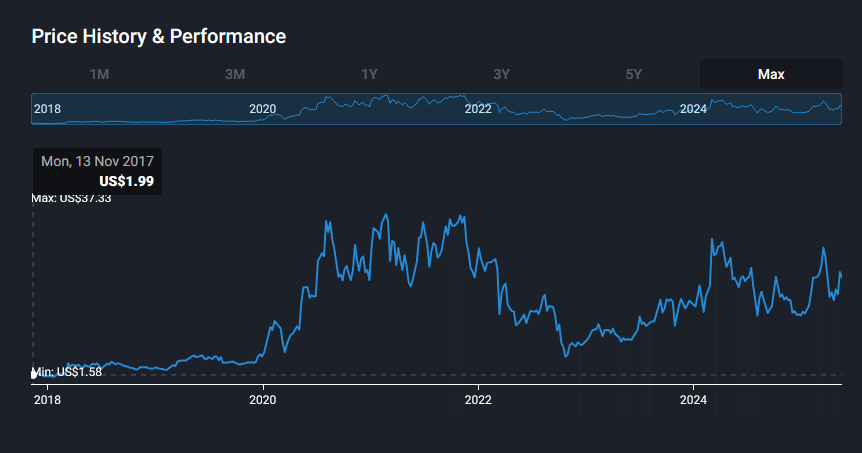

The earliest price data we have is from November 13, 2017, when the stock traded at $1.99. As of writing, it’s at $22.60 — a 1,035% return.

While that’s excellent, it lags behind the business’s revenue and profit growth, which could suggest the market is underpricing the stock. It’s not a guarantee — but certainly something worth noting.

Revenue and Expense Breakdown

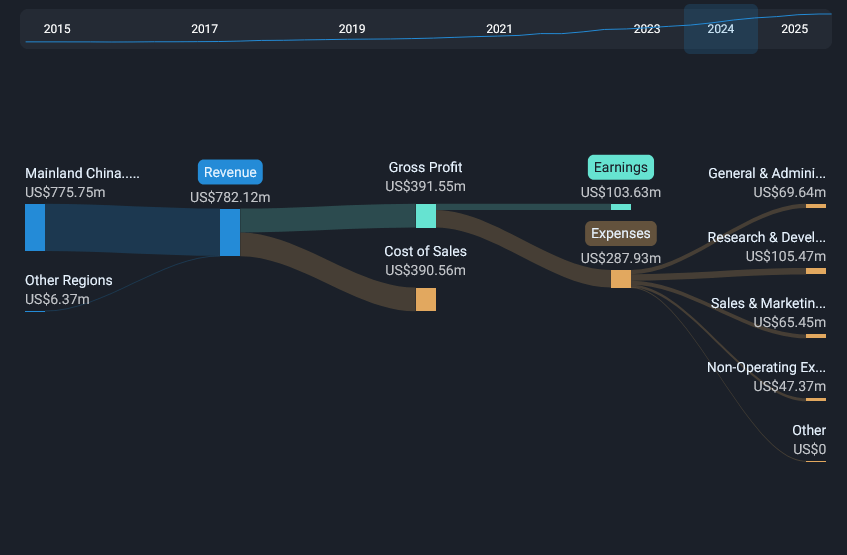

A large portion of ACMR’s revenue comes from China. For investors, that means being mindful of developments in the Chinese economy and regulatory environment.

Personally, I’m okay with some exposure to Chinese business — especially since this is still a small part of my diversified portfolio.

Profitability Metrics

In 2024, ACMR posted a gross profit of $391.55 million on $782.12 million in revenue — resulting in a Gross Margin of 50%. That’s healthy, especially given that I generally look for gross margins above 40%.

Net income came in at $103.63 million, which gives a Net Profit Margin of 13.2% — also solid.

Now let’s look at:

- ROE (Return on Equity): 11.6% (close to sector average of 11.8%)

- ROA (Return on Assets): 5.2% (below sector average of 7.2%)

- ROCE (Return on Capital Employed): 11.6%, up from 3.1% just three years ago

These numbers suggest ACMR is improving in capital efficiency, although ROA is an area I’ll continue to watch.

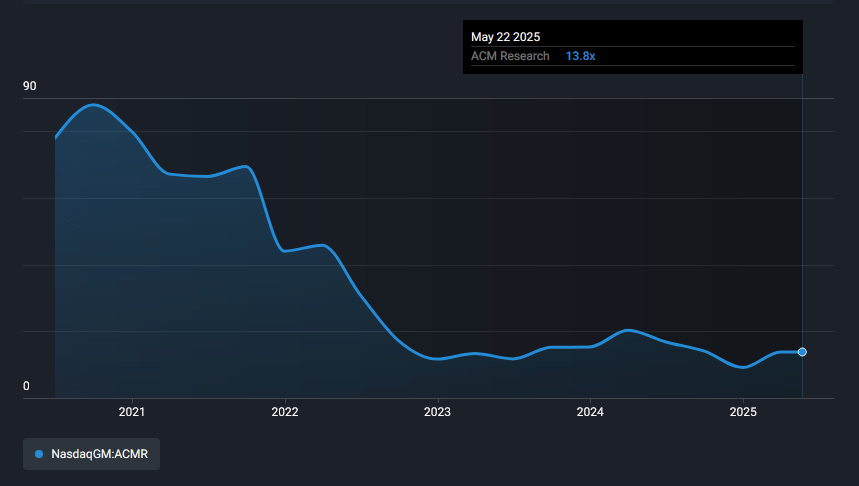

Valuation Overview

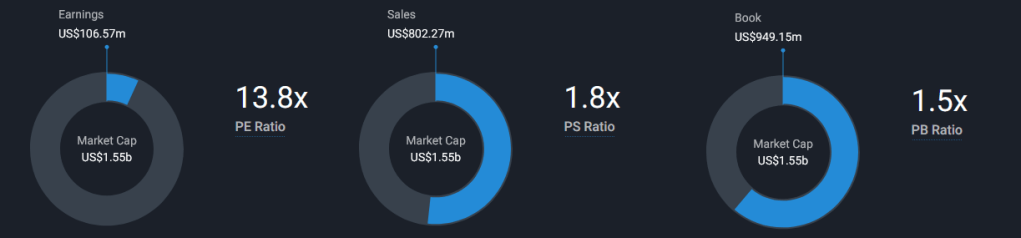

Let’s be honest — the valuation numbers look quite attractive.

- P/E ratio: 13.8x — below my personal threshold of 15, inspired by Benjamin Graham’s The Intelligent Investor

- Forward P/E: 11.2x, with 29% projected earnings growth

- P/S ratio: 1.8x

- P/B ratio: 1.5x

ACMR is trading near its historical lows in terms of P/E. At the end of 2024, it had a P/E of just 9.1x — with the stock price around $15. That was a prime buying opportunity I missed, but as they say, “better late than never.”

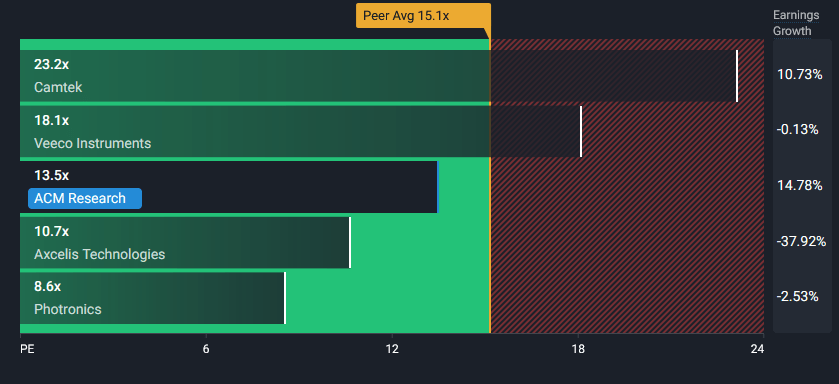

Valuation vs. Peers & Industry

- Average P/E of competitors: 15.1x

- ACMR’s P/E: 13.5x

Only two companies in the peer group show earnings growth: ACMR and Camtek. Camtek has a 10.73% earnings growth rate and a P/E of 23.2x, while ACMR boasts 14.78% earnings growth at a P/E of 13.5x.

Against the broader semiconductor industry, which trades at an average P/E of 23.5x, ACMR again looks undervalued.

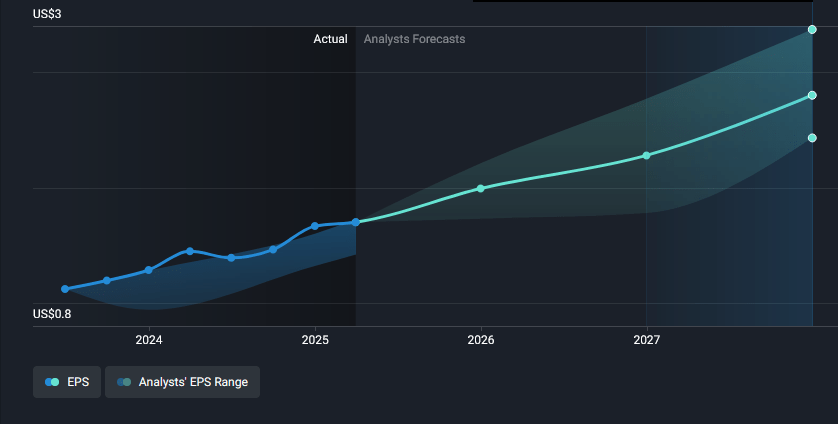

Looking Ahead: Analyst Expectations

Analysts expect ACMR’s earnings to keep growing through 2027. The consensus EPS for 2027 is $2.80 (range: $2.43–$3.37). Historically, the company often beats the upper range of estimates.

Assuming a P/E of 15x in 2027, we get a projected share price of:

$2.80 x 15 = $42

Compared to the current $22.60, that implies a potential 85% return — if projections hold true.

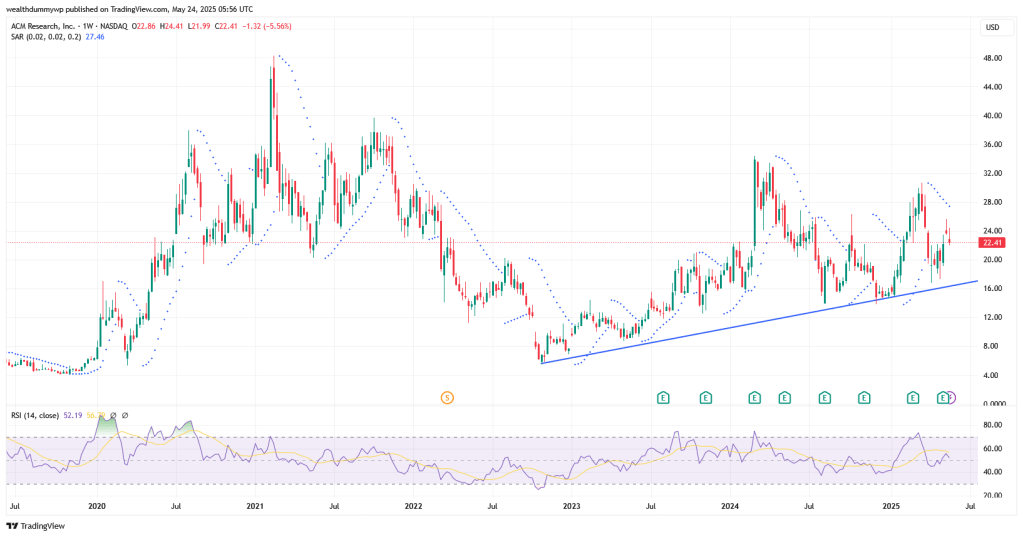

Technical Analysis Snapshot

Since October 2022, ACMR’s price has been in an upward trend. Currently, it’s near the middle of its 52-week range, with the RSI in a neutral zone.

There’s a chance the stock might pull back slightly, which could offer a better entry point. Personally, I’d welcome a dip — I’m focused on long-term growth and would use it to improve my cost basis.

Final Thoughts and My Plan Going Forward

ACMR has shown strong historical growth, solid profitability, and appears undervalued both historically and relative to peers and the industry.

Yes, risks remain — especially given its exposure to China and the macroeconomic environment — but the growth potential makes the tradeoff worthwhile, in my view.

My plan is to continue building my position gradually, using a Dollar Cost Averaging (DCA) approach. If the stock reaches $24 or higher, I’ll likely pause buying, as the risk/reward profile would shift.

Thanks for reading — I hope this analysis helped you gain insights into ACM Research and how I think about investing. Always do your own due diligence before making any investment decisions.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog or follow me on social media. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: ACM Research stock analysis, ACMR forecast 2025, best semiconductor stocks to buy, small-cap growth stocks 2025, undervalued semiconductor companies, investing in China semiconductor stocks, ACMR vs competitors, DCA investing strategy, long-term stock picks

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog