As I promised in my previous post, it’s time to take a closer look at PVA TePla AG. I discovered this company only recently, and I really liked what I saw. At the beginning of May, I decided to buy a small number of shares. As I already mentioned in my May trades update, this is still a very small position for me. That doesn’t mean I have any concerns – I just prefer to build my positions gradually. That’s mainly because I rarely catch the perfect market timing. So, without further ado, let’s jump into the analysis.

Company Overview

PVA TePla AG is a German high-tech company specializing in the development and manufacturing of material processing and inspection systems used in industries like semiconductors, energy, optics, and medical technology. The company was founded in 1991, headquartered in Wettenberg, Germany. The company’s business model is built around two main segments: semiconductor systems and industrial systems.

Maybe you can guess what exactly caught my eye about PVA TePla AG. What I really liked was that a significant portion of its business model focuses on semiconductor systems. Considering the direction in which the world is heading, I believe this market segment has strong growth potential. PVA TePla AG is a small-cap company with a market cap under €400 million. If the management executes well, there’s considerable room for growth. I also appreciated the fact that the business has a degree of diversification. Its other source of revenue comes from industrial systems. In summary – what appealed to me is that it’s a diversified business, with its core operations in a sector I see as full of potential. The company’s small market cap offers an opportunity for faster-than-average growth.

All the visuals for the fundamental analysis are provided by:

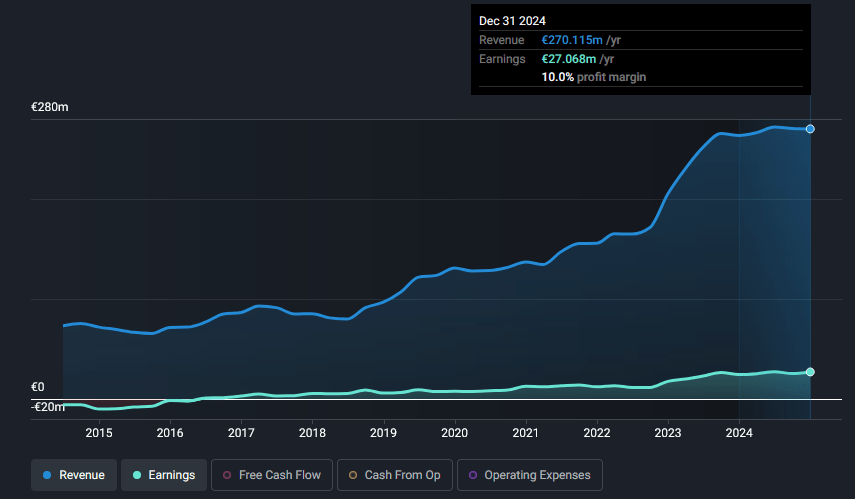

Revenue and Net Income

From the chart above, we can observe the growth trajectory of both revenue and net income between 2015 and 2024. In my view, the revenue growth has been very strong. In 2024, the company generated approximately €270 million in revenue. By comparison, at the end of 2015, revenue stood at about €71 million. That’s a remarkable 280% increase over the period.

Now let’s look at net income. In 2024, net income reached €27 million. I’ll compare that to the end of 2016, when net income was €2.9 million. I chose 2016 instead of 2015 because the company posted a loss in 2015. Based on these figures, net income has grown by roughly 830%. What I really like here is that the company hasn’t reported any losses during this period. Instead, we see consistent growth in both revenue and profit – a healthy and sustainable trend.

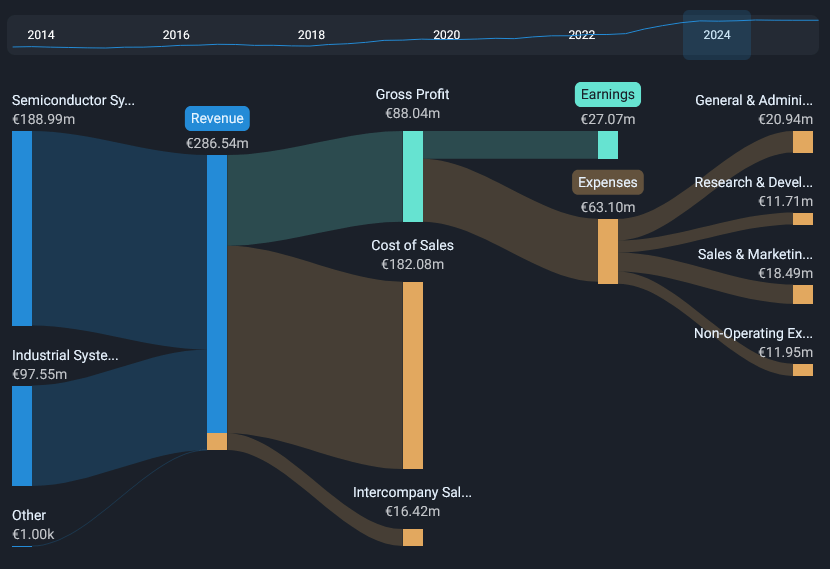

Revenue and Cost Breakdown for 2024

We can see that the majority of the company’s revenue comes from its semiconductor systems segment. In 2024, this segment generated nearly €189 million in revenue. For comparison, in 2016, it brought in about €52 million. That’s more than a threefold increase over the reviewed period.

There’s also respectable growth in the industrial systems segment, though it’s slightly lower than in semiconductors. The chart above also shows that the cost of goods sold (COGS) amounts to approximately 63% of revenue.

Next, let’s talk about profitability ratios.

Profitability Ratios

According to the chart above, PVA TePla AG reported a gross profit margin of 30.70% and a net profit margin of about 10% in 2024. While these numbers may not be extraordinary, they are certainly respectable. Typically, I prefer to invest in companies with higher margins. However, in this case, I decided to make an exception.

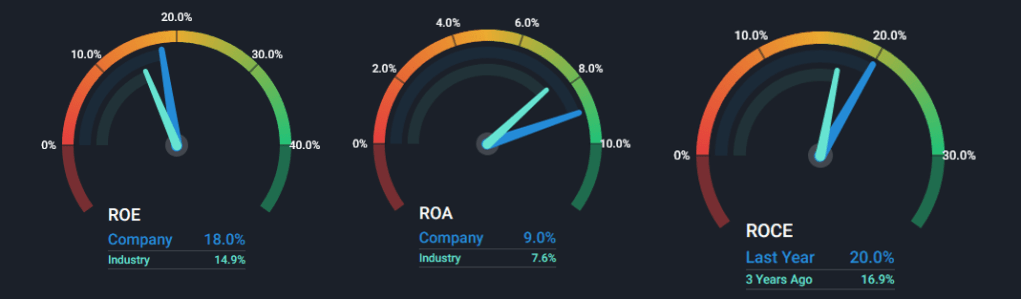

Let’s now examine some of the key ratios. We’ll take a look at return on equity (ROE), return on assets (ROA), and return on capital employed (ROCE).

The latest data reveals that PVA TePla AG’s ROE is 18%. This is above the industry average of 14.9%. The ROA is also better than the sector average – 9.00% for PVA TePla AG compared to 7.6% for the industry. Based on this, we can say the company is performing well relative to its peers.

One ratio I found particularly interesting was ROCE. Over the past year, the company reported a ROCE of 20%, up from 16.9% three years ago. This improvement might suggest that some optimizations are happening and the capital is being used more efficiently. Definitely a positive signal for me.

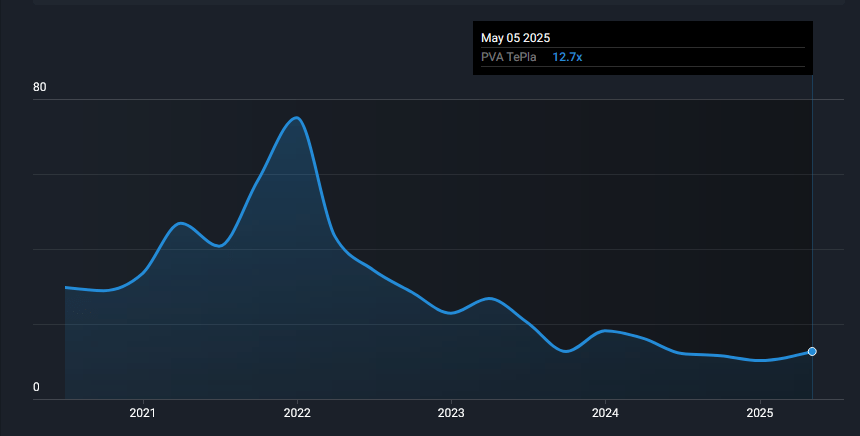

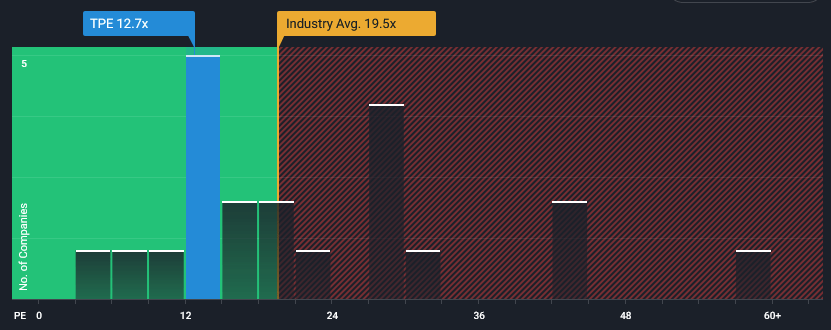

Valuation Metrics

Now let’s take a look at valuation metrics. It’s important to understand what we’re paying for a share in the business.

As we can see from the graph, the price-to-earnings (P/E) ratio is only 12.7. Considering the industry in which the company operates, and its demonstrated growth so far, this could indicate that the stock is currently undervalued by the market. The price-to-sales (P/S) ratio is also at a healthy level.

On the other hand, the price-to-book (P/B) ratio is higher than what I usually look for in a value stock. I typically aim to find companies trading at a P/B of less than 2. However, given the company’s growth track record, I decided this wasn’t a deal-breaker. Let’s see some historical values for the P/E:

The chart above shows that the current P/E ratio is among the lowest seen in the past five years. This could be a sign of an undervalued stock or a potential value trap. Still, based on the company’s solid business performance, I believe the risk of purchasing shares is justified.

It’s a good practice to have an industry comparison:

We can see that the average P/E ratio in the industry is 19.5, while PVA TePla AG trades at 12.7. This indicates that we’re buying into a company that is priced below the industry average. Generally, this is a good sign that we’re not overpaying.

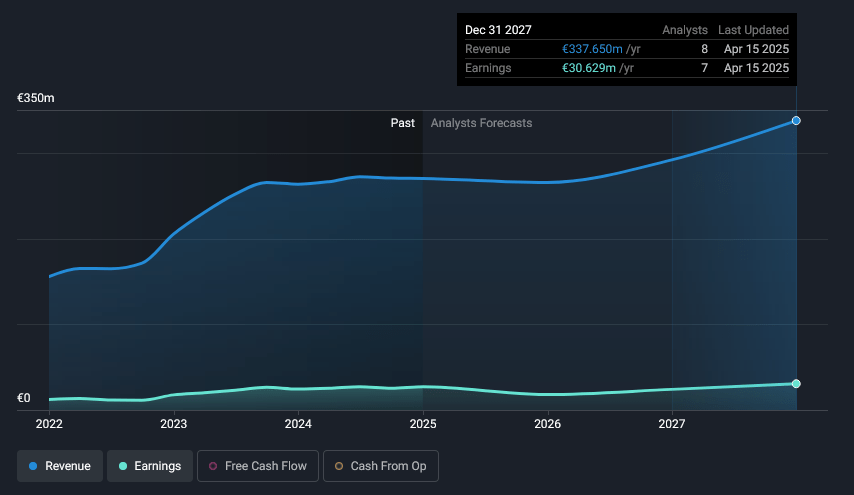

Future Expectations

The chart above displays analysts’ expectations for revenue and net income growth. It shows that net income is projected to reach €30.629 million by 2027. Compared to the current profit of €27 million, this represents an estimated growth of around 13.44% over the next three years.

Clearly, this expected growth is more modest than what the company has achieved historically. However, analysts likely have valid reasons for these projections.

In terms of revenue, growth is still expected. The forecast for 2027 suggests that the revenue will reach €337 million, up from €286 million in 2024. That’s an increase of approximately 17.83%, which is slightly higher than the expected net profit growth.

Interestingly, analysts also predict a slight decline in the net profit margin. While the company posted a 10% margin in 2024, the projection for 2027 is 9.07%. Will these forecasts materialize? Only time will tell.

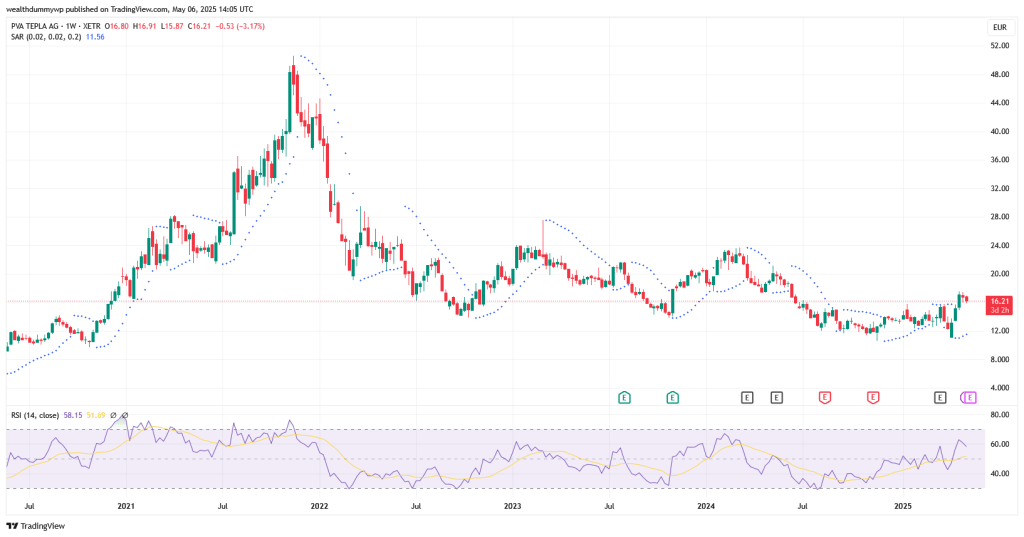

Technical Analysis

Let’s take a quick look at the stock price chart.

From the chart, as I mentioned earlier, it’s likely that now isn’t the best moment to buy. Just a month ago, at the beginning of April, the stock dropped to a low of €11.05. For reference, I bought shares on May 5, 2025, at a price of €16.70. However, as I said in my previous post, I plan to gradually add to my position over time. So I’m not too worried that I didn’t catch the lowest price.

When I look at the chart, I think we might see a slight pullback in price. This pullback could offer a good buying opportunity. The Parabolic SAR indicator may be signaling a potential trend reversal to the upside. In my view, before that happens, we could see the RSI indicator cool off a bit. This cooling might be accompanied by a lower share price.

Of course, only time will tell how things actually play out.

My Position Plans

To make any kind of plan for this position, we need to have some expectations for the company’s future performance. Let’s recall what analysts are forecasting for revenue in 2027: €337 million. Meanwhile, the company itself is targeting €500 million in revenue by 2028.

Let’s assume the reality lands somewhere in the middle – say, €418 million in revenue by 2028. If we apply the analysts’ assumption of a lower net profit margin of 9.07%, this would result in net income of approximately €37.91 million.

To estimate what the company might be worth in 2028, let’s use a P/E multiple of 15. This is slightly higher than the current valuation, but still below historical averages and below the industry mean. Under these assumptions, PVA TePla AG would be worth around €568 million.

Comparing this to the current market cap of about €360 million, we’re looking at a potential 57% return over four years (by 2028). From this perspective, my decision to invest seems justified – even if the current technical setup isn’t ideal.

In any case, if the share price drops significantly (below €15), I plan to increase my position. Conversely, if the price continues to rise and I feel the stock becomes overvalued, I won’t hesitate to sell.

Final Thoughts

I hope you found my analysis of PVA TePla AG useful and enjoyable to read. I’ve shared my expectations for the stock. However, I want to emphasize that these are merely assumptions. They are not guaranteed outcomes. Always conduct your own due diligence. Invest wisely and in line with your personal risk tolerance.

Keywords: PVA TePla stock analysis, German semiconductor companies, small-cap tech stocks, investing in semiconductors, PVA TePla AG forecast, best tech stocks Germany, PVA TePla AG fundamentals, PVA TePla investment potential

If you enjoy reading my posts and find them useful, please consider subscribing to my blog or follow me on social media. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment