Crypto. An investing niche that made a lot of people millionaires. I am certainly NOT one of them. Despite not being a crypto millionaire, I believe that investing in this asset class can be beneficial. In this post I will share with you my crypto investing experience and a breakdown of my portfolio.

I started investing in cryptocurrency a bit late. I made my first purchase on the 9th of December 2020 (about 11 years after the Bitcoin was created). The first time I heard about this asset class was around 2013. A friend of mine told me that he owns some Bitcoin and that it is going great so for. For some reason I decided that this crypto thing is some sort of scheme. Now, this looks like one of the most stupid assumptions that I`ve ever made. If I remember correctly, back then Bitcoin was trading below $500. At the time of writing the price is $84 150. Let’s say the price was $500 in 2013. The return would be more than 16 000% so far. Not bad. Anyway, since that ship has sailed, we can return to my story.

My first cryptocurrency purchase was XRP, which was trading around $0.56. In the next few months I continued adding more to my XRP position, since the price kept falling down. After that I started buying some other altcoins, in order to have a diversified portfolio. And then, 2 or 3 years later, I stopped investing new capital. Of course, during this period I was trading. Mostly swapping different altcoins. I believe that it`s a good moment to mention that I`m not that specialized in the crypto field. My main focus is the stock market. However, for me as a retail investor, it`s beneficial to have some exposure to crypto. At least I believe so. In terms of this I am keeping a very small percentage of my overall portfolio invested in cryptocurrency.

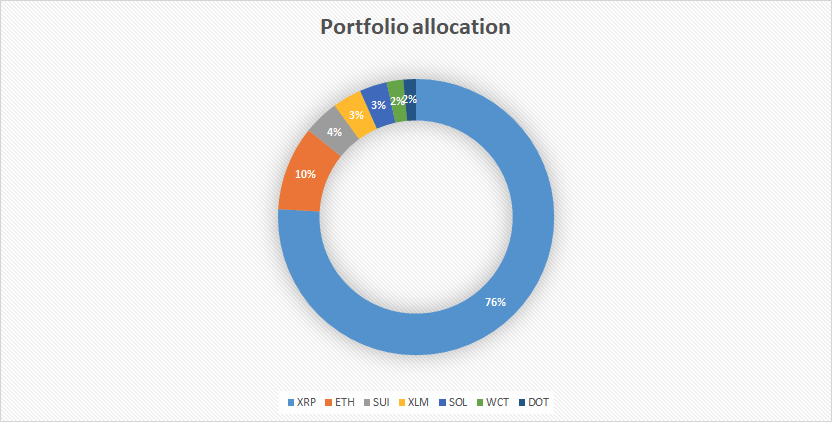

We have already established that I am not specialized in crypto. Also I have a very small percentage of my portfolio invested in this asset class. Now, we can start reviewing my positions one by one. At the end of the post I will discuss with you my portfolio as whole and my future actions. Let`s begin.

1. XRP

Obviously this is my largest position. 76% of my crypto holdings are in XRP. I believe that this is expected, since I started buying it a long time ago. I am still holding around 60% of my original position. I still like XRP and the idea behind it. Let`s have a brief overview of the coin:

XRP is a digital currency created by Ripple Labs Inc., with the primary goal of enabling fast and cost-effective cross-border transactions. Here are some key points about XRP:

- Launch Year: XRP was launched in 2012.

- Purpose: It is designed to facilitate international money transfers and remittances, aiming to provide a more efficient alternative to traditional banking systems.

- Technology: XRP utilizes a unique consensus algorithm instead of the traditional proof-of-work model. This allows for quick transaction settlements, typically within 3 to 5 seconds.

- Supply: The total supply of XRP is capped at 100 billion coins, with a portion held in reserve by Ripple Labs.

- Use Cases: Financial institutions use XRP for liquidity in payment processing and to settle transactions across borders instantly.

- Adoption: XRP has gained significant attention and partnerships with various banks and financial entities, although its regulatory status has led to legal challenges.

Overall, XRP aims to streamline global payments, reduce costs, and provide a stable and efficient method for transferring value across the world.

I like it because it`s built for the institutions and its goal is to be a fast and cost-effective solution. Will it succeed in its purpose? I certainly don`t know. Despite that, this is my largest position as of now. There is one thing that concerns me the most, when it comes to its price potential. It`s the supply. From the description above you can see that the total supply is 100 billion coins. This means that if the price of XRP is $1, the fully-diluted market capitalization will be $100 billion. Of course, the price movement depends on different factors. So, it`s impossible for me to predict if the supply could be limiting it. I just thought that it’s worth mentioning.

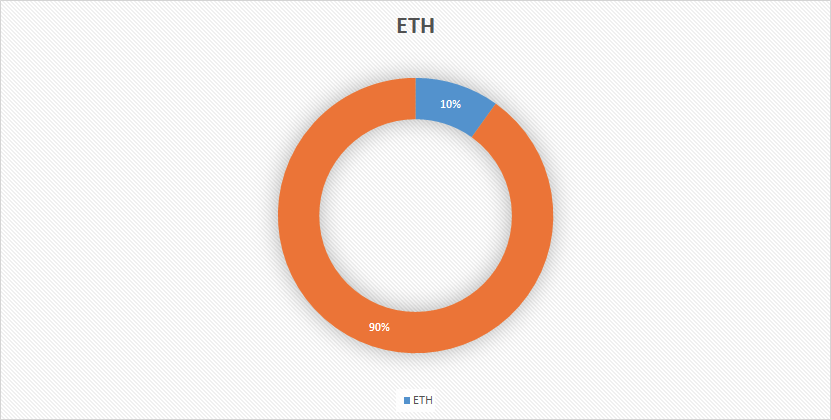

2. ETH

This is my second largest position. Being only 10% of my portfolio, it is significantly smaller than the first one. I`ve acquired my ETH mostly towards the end of 2024. It was a result primarily of me swapping other altcoins for ETH. During the crypto bull market a lot of the altcoins were overbought in my opinion. I had concerns that the market will go down. My idea was that if this happens, the price of ETH will decrease less than the other ones that I had. Let`s have a few words on ETH:

Ethereum (ETH) is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Launched in 2015, it operates on its own blockchain and has become the second-largest cryptocurrency by market capitalization after Bitcoin. Its native currency, Ether (ETH), is used to power these applications and facilitate transactions within the Ethereum network.

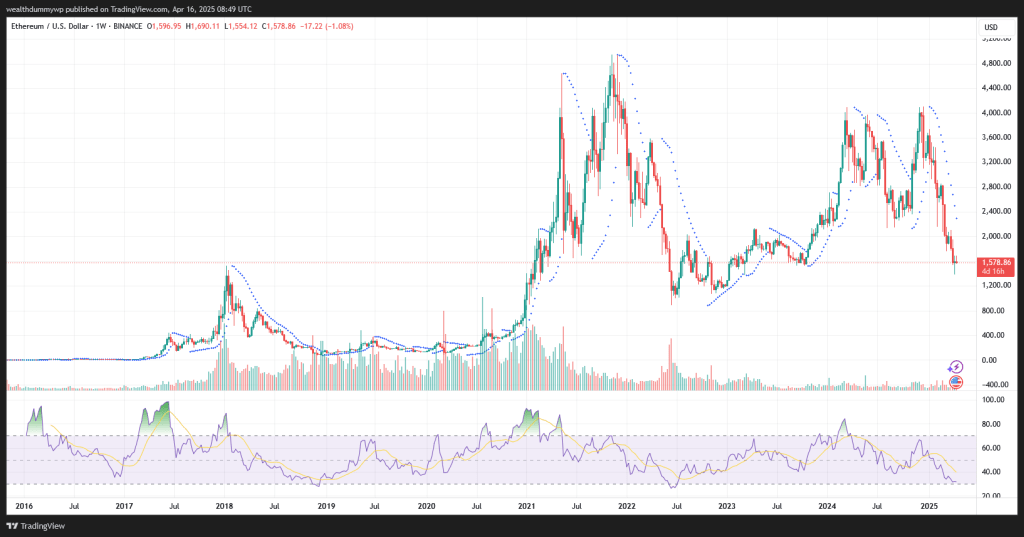

From the description above, I believe that you can understand my reasoning. I thought it would be safer than the other altcoins, since it`s the second largest crypto by market capitalization. Also it has some utility. My assumptions were mostly correct. That is why I am still holding ETH. However, I have some concerns about my position. In order to understand me better, let`s visit the price chart:

This is the weekly chart of ETH. The thing that concerns me is that during the last bull market, ETH wasn`t able to reach its all-time highs. These highs of slightly less than $5 000 were achieved in 2021. In 2024 the highest price was around $4 100 or slightly more. Stay till the end of this post, so I can share with you what I am planning for my ETH position.

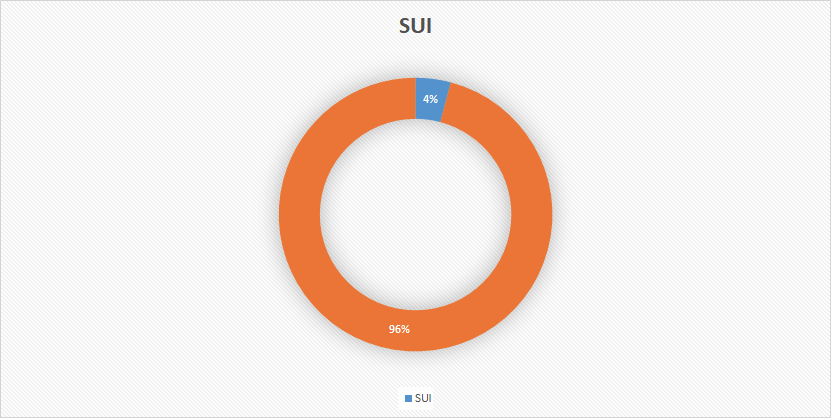

3. SUI

A position that I built in 2024. My average price is $3.40. At the time of writing it`s trading around $2.10, so I`m sitting on an unrealized loss. This position is also a result of swapping other altcoins for SUI. Why I chose it? I watched a podcast where the guest was Raoul Pal. He said nice things about the coin and I decided to make a small investment in it. Of course, this is not a good reasoning, but it`s a small holding, so it`s in my risky bets category. Let`s have an introduction of SUI:

SUI is a layer-1 blockchain designed for high scalability and low latency, developed by Mysten Labs. It aims to enhance the usability of decentralized applications (dApps) by providing a user-friendly platform that supports fast transaction processing. Using a move-based programming language, it allows developers to build applications more efficiently. SUI seeks to address the limitations of existing blockchains by offering improved performance and flexibility for various use cases.

I like the purpose of SUI. Will it be able to fulfill its goals? I certainly don`t know. The time will tell. It`s a rather new cryptocurrency. The ICO (Initial Coin Offering) was in 2023, so it`s too early to be sure. I still find it a good fit in my portfolio.

We have already discussed the three largest positions in my portfolio. I have few others. Their share in my holdings is around 3% or less, so we won`t be discussing them in details. The other coins worthy of mentioning are Stellar (XLM), Solana (SOL), WalletConnect (WCT) and Polkadot (DOT). The rest are too risky bets, with a lot of uncertainty around them.

I believe that it is a good moment to discuss my most recent risky bet. I am talking about the crypto WalletConnect, ticker WCT. I bought a small position on 15th of April 2025, during its launch on the Binance exchange. My average price was $0.3350. At the time of writing it`s trading around $0.48. This means that I am sitting on a 43% unrealized gain. A decent performance for a 24-hour period. Currently, the price is highly volatile, since it`s a new listing. For sure, it`s a risky bet, but I decided that I should join the party.

Now, let`s have a more holistic view of my portfolio and discuss my next steps.

Before sharing with you my plans, let me give you some background. During the bull market in 2024 I sold 1/3 of my crypto portfolio. By doing this, I pretty much took out the money that I`ve invested. In terms of this, the 2/3 that left invested are a result of the capital gains. I believe that I can say that I don`t have much skin in the game. Anyway, let me tell you what my thoughts are.

Obviously, my portfolio isn`t diversified. I will try to fix that. If the XRP reaches new all-time highs, I am thinking of selling some of it. I might also swap it for other coins. It will be a good achievement if I`m able to reduce its share to around 50%. We have already discussed my concerns about ETH. So, I will be looking for a decent price level where I can reduce my position. I am thinking of selling entirely my Polkadot holdings (if possible at a better price). Over the years, this coin didn`t perform well for me. I am also not sure if it will in the future. Of course, I might be wrong, but that`s the way I feel it. I haven`t planned any changes for the rest of my portfolio. Certainly I will try to add some Bitcoin, since I don`t have any exposure to it. Especially, if its price keeps falling down.

In conclusion, I believe that we can say that the crypto market is an appealing asset class. It made a lot of people wealthy. From my story, you can see that it`s possible to make some money, despite missing the early days. For sure, we need to invest in the crypto market cautiously. It`s a relatively new asset class and the prices are volatile. It is really important to remember that we should never follow blindly the opinion of random people on crypto. We always need to do our own due diligence.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog or follow me on social media. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Keywords: crypto investing experience, XRP investment, ETH portfolio, altcoin diversification, cryptocurrency market 2025, personal finance insights, crypto portfolio strategy

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment