Imagine your car breaks down unexpectedly, and the repair bill is $500. How would that impact your budget this month? Life is unpredictable. There are so many things that we are not able to control. That is why we need to be as secured as possible. At least financially. This is the role of an emergency fund. In this post we`ll discuss the importance and the management of the emergency fund.

Let`s start with a proper definition of this concept:

An emergency fund is a dedicated savings account that is set aside to cover unexpected expenses or financial emergencies, such as medical bills, car repairs, or job loss. It serves as a financial safety net, allowing individuals to manage unforeseen circumstances without resorting to credit cards or loans.

Before going deeper into the knowledge about the emergency fund, I would like to share my personal experience with it. When I started my career I didn`t have such a thing. I was having the “enjoy the moment” type of mindset, so each month my salary was completely spent. I was buying expensive stuff that I don`t need, but they were trendy, so I wanted to have them. Almost every evening I was dining out. This was a great time for my lifestyle and a terrible moment for my budget.

For a certain amount of time everything was going great. I was enjoying my lifestyle choices and I wasn`t worried about not having enough money. There is a thing that I have noticed about myself. The more I spent, the more financially secure I felt. I`m not sure if this is common for everybody, but this was the way I felt. Maybe it was some sort of delusion, based on the fact that I can afford a certain lifestyle. Never mind. As I was saying, it was going great.

And then the bills started coming in. First, my car broke. This is the reason why I started the post with this example. It was crucial for me to repair it, since I needed it, so I can go to work. The repair service cost was slightly above $350. It doesn`t sound like much, but I didn`t have any savings. What I did? I paid it with my credit card. So, I was spending money that I don`t have. This was the beginning of some sort of debt spiral. During this period more unpredictable expenses have occurred. Of course, everything was paid by the credit card. As you can imagine soon my finances became a nightmare.

There was a moment when I said to myself “enough is enough”. I decided that I will fix the issues that my finances had. I cut the unnecessary expenses and I started building my emergency fund. It started really slow. But the emergency fund was my priority and I was dedicated to it. Fast forward to today, I`ve managed to build a decent emergency fund. To be completely honest, this fund won`t be enough to secure me for all of the unexpected expenses. It will be enough in the more common ones. For the unexpected events with a higher impact, there are other financial products, which should be used. The focus in this post is the emergency fund, so we won`t be discussing them.

We have already mentioned the definition of an emergency fund. Now, let`s talk about why it`s important:

In my opinion these are the most crucial when it comes to the importance of an emergency fund. I believe that the first one is pretty obvious. When we have a certain amount set aside we are a lot more secure about our financial situation. When an unexpected expense occurs we will be less stressed, knowing that we have a financial cushion. By reading my story, I`m sure that you can see the importance of having an emergency fund, when it comes to debt avoidance.

I would like to focus a bit on the third benefit. I believe that we all know about the importance of investing. In my opinion we need to invest our money if we would like to achieve some financial success. Here comes the crucial role of the emergency fund. If we have set aside enough as a financial cushion, we won`t need to liquidate some of our investments in case of an unexpected expense. That`s why we need to establish the emergency fund first. After that we can start building our long term investments. At least this is the way I did it.

I believe that the 4th and 5th benefit are pretty obvious. Having an emergency fund gives us more control over our lives and decisions during difficult times, rather than feeling helpless. Also, in the face of job loss or reduced income, this financial cushion can help us maintain our essential expenses.

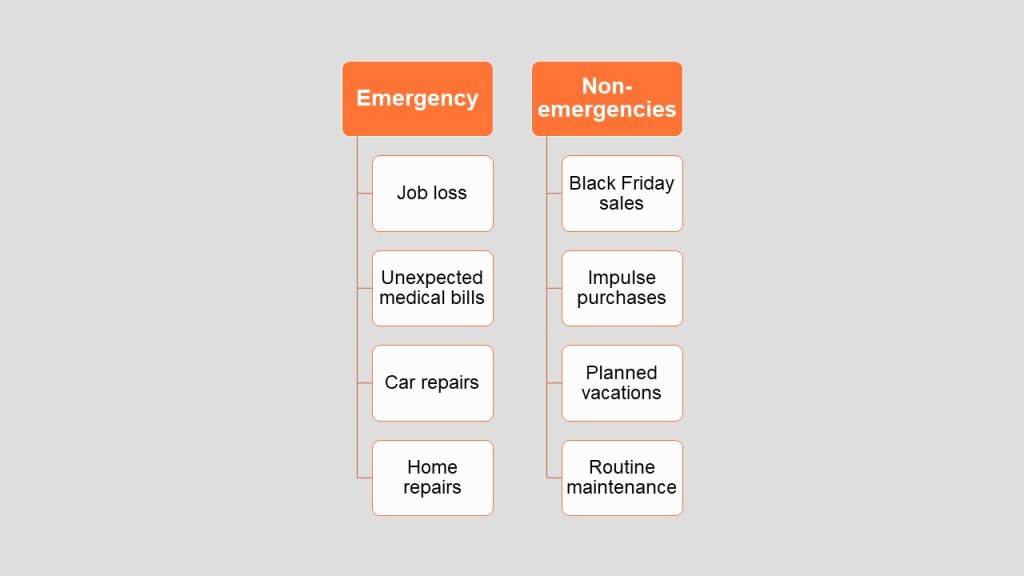

Let`s assume that we have already built our emergency fund. Now, we need to define what is considered “Emergency”.

I believe that the infographic is self-explanatory on what the emergency fund can be used for. If we need to summarize it, an emergency expense should be unexpected and necessary. If the expense classifies as such, we can use the funds from our financial cushion. It`s important to replenish the used amount as soon as possible. This way we`ll keep our safety net intact for any future events.

After going through all the basics, I believe that it`s important to share with you my steps for establishing an emergency fund:

- How much is needed: Most experts recommend saving 3-6 months’ worth of essential living expenses. This number depends greatly on individual factors. Examples include job security, number of dependents, health status and insurance coverage, income stability, etc.

- Set a Savings Goal: Setting a savings goal within our budget is the first step. Make it tangible and track your progress. I am trying to add at least 20% of my monthly income to my emergency fund.

- Automate Savings: Set up regular transfers from your checking account to your emergency fund. I believe that this step is making the process substantially easier. There is no risk of forgetting it and it also shows a commitment.

- Cut Unnecessary Expenses: Identify areas where you can reduce spending and allocate those funds to your emergency fund. This was exactly the first thing that I did when I started building my financial cushion.

- Allocate Windfalls: Transfer bonuses or unexpected income towards your emergency fund.

- Start Small and Be Consistent: Even small, regular contributions add up over time.

- Review and Adjust: Periodically review your emergency fund goal as your circumstances change.

I am using all of the steps described above. In my opinion, they are good general guidelines and they offer a lot of value if followed consistently. Of course, anyone can adapt them, but they are a good place to start.

I believe that we have covered the most important topics when it comes to the emergency fund. I am certain that by the end of this post you are completely aware of the significance of having a financial cushion. If you already have it – Great! I am happy for you. Keep up the good work. If you still haven`t established an emergency fund, please consider doing so, as soon as possible. I am sure that it can be a bit discouraging in the beginning. If you feel that way, take small steps every day and be consistent. It will add up over time. As the saying goes “Rome wasn’t built in a day“.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer on the use of AI: Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment