Investing and social media. In this quick post I will write about two seemingly unrelated topics. I would like to share with you my concerns when we combine these two.

I believe that I have mentioned previously that I am investing in stocks for more than 15 years. I have some knowledge on the matter. Certainly, I still have a lot more to learn. I am a strong believer that we learn (or at least we should be) throughout our entire life. In terms of this we should have the humility to acknowledge that we don`t have all the answers. I am acknowledging it for sure.

The social media. If I say that I am not the biggest fan of it, it will be a understatement. I didn`t have any social media accounts for a very long period of time. Recently, I created accounts on Threads and X, so I can popularize my blog. I still believe that the social media offers very little value for the content consumers. It may be helpful for the creators. Certainly, my opinion on the matter doesn`t have much value, since it`s a new field for me.

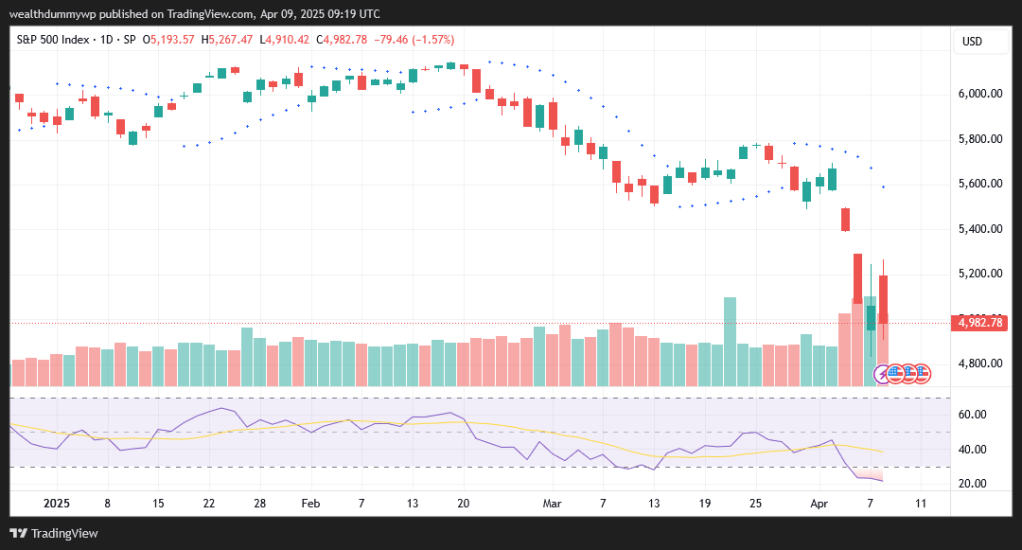

We have discussed the two unrelated topics separately. Now, let me give you some background on what made me write this post. We`ll start with a chart:

I decided to start with this stock market overview, in case you don`t follow it. The chart above represents the movement of the S&P 500 on a daily basis. As you can see there is a significant price decline. The index reached a 52-week high of $6 147.43. The price at the time of writing is $4 982.78. A significant drop. Year to date performance of the S&P 500 is -15.09%. I won`t get into the details of why this happened, since it`s not relevant for the topic that we are about to discuss.

Now, that we have laid out the foundation, we can combine all the things together. As you can imagine the recent market sell-off caused a lot of panic among the investors. I think that it`s a pretty normal reaction of the human brain. It hurts to see your wealth shrinking. Regardless if it`s just a paper loss or a realized one.

I believe that you can also imagine that the financial influencers were all over the social media. I saw a lot of posts saying “buy the dip”, “hold”, “don`t sell”, etc. This is exactly the reason why I decided to write this post. I don`t like the idea that someone would buy or sell a financial instrument just because some random person on social media said so. We are all different in terms of goals, mindset, investing horizon, risk tolerance, etc. So, the chance of some random financial influencer sharing the perfect advice for your personality is pretty low. I am a strong believer that everyone should follow their own investing strategy. In my opinion, taking advice from people fighting for attention is not an option. If you don`t have your own strategy, you should consult a qualified and certified professional. In most cases, a random guy who posted 2-3 screenshots of making some profits, is not a qualified professional.

I`m assuming that this might sound strange coming from me, since I have a blog focused mainly on investing. Please note that I am including myself in the “some random guy on the internet” category. You shouldn`t take any advice from me either. Actually, the idea of my blog is to share my opinion on different finance topics (stocks, personal finance, etc.). I am also sharing what I am doing with my own money. I am hoping that by doing so I am providing some value to the reader. That`s it. No advice, no trading signals. Just my opinion.

To be completely honest, I do believe that there are some good investors on social media who provide a real value. I also believe that they won`t be selling you some get rich quick magic formulas, trading signals, etc. Of course, they will be sharing their ideas and opinion, but the due diligence needs to be done by you.

In order to summarize. I believe that nobody should blindly follow the investing advice of some random person on the internet. Investing is not a game. Real money can be made, real money can be lost. If there is a need for an advice, there are qualified professionals who can provide it. Most probably there aren`t many of them on the social media platforms. For sure, there is a value in the social media. Some very good ideas can be found, but we shouldn`t follow them blindly. These are just opinions and everyone should do its own due diligence.

At the end of the post I will share some thoughts that I truly believe in. Keep the emotions out of the game. Emotions can be a bad advisor when investing. This is true whether we are in a bull market or a bear market. Keep the focus on your own investing strategy in terms of risk tolerance, time horizon, etc. You should feel comfortable with the investments that you make. If it disrupts your good night`s sleep, then something is probably wrong.

“Risk comes from not knowing what you’re doing”

Warren Buffett

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment