Follow me on Threads

AI Summary of the post

- Company Overview: Analysis of Kraft Heinz (KHC), a leading food and beverage company with a strong brand portfolio.

- Current Stock Performance: Trading at $30.43, down 30% from its 52-week high and 12% above its low.

- Valuation Metrics: Undervalued with a P/E ratio of 13.35, and higher-than-average Gross Profit Margin (34.78%).

- Dividend Yield: Offers a stable dividend of $1.60, translating to a yield of 5.26%, highlighting financial stability.

- Future Growth Projections: Analysts forecast modest EPS growth. My price target is $43.80 by 2028, indicating a potential 44% upside.

- Investment Strategy: Plan to start buying shares at or below $32 with a dollar-cost averaging approach despite risks.

The full story

Ketchup. When I think about Kraft Heinz, the first thing that comes to my mind is ketchup. Of course, the company has a lot of other products, but this one is my favorite. In this post I will share with you my Kraft Heinz (ticker KHC) stock analysis. We`ll discuss if it`s a buy or a sell for me.

First, let`s have a proper introduction:

Kraft Heinz, traded under the ticker KHC, is one of the largest food and beverage companies in the world. Formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Company, it boasts a diverse portfolio of iconic brands and products that cater to a wide range of consumer tastes. The company’s business model focuses on leveraging its strong brand recognition, economies of scale, and extensive distribution networks to generate revenue across various segments, including condiments, cheese, and meals.

Among its best-selling products, ketchup stands out as a flagship item, with Heinz Ketchup being a staple in households globally. Other popular offerings include Kraft Macaroni & Cheese, Oscar Mayer meats, and Jello desserts. By continuously innovating and responding to changing consumer preferences, Kraft Heinz aims to maintain its competitive edge in the dynamic food and beverage market.

As we can see, the company is a well established player in the food industry. If you have read some of my previous posts you would know that I am a big fan of the food stocks. I am even a bigger fan of companies that pay a decent dividend. Actually, the dividend was the reason why I decided to take a look at the stock in the first place. But we`ll get to that part a bit later.

Let`s start by checking the KHC`s stock price performance:

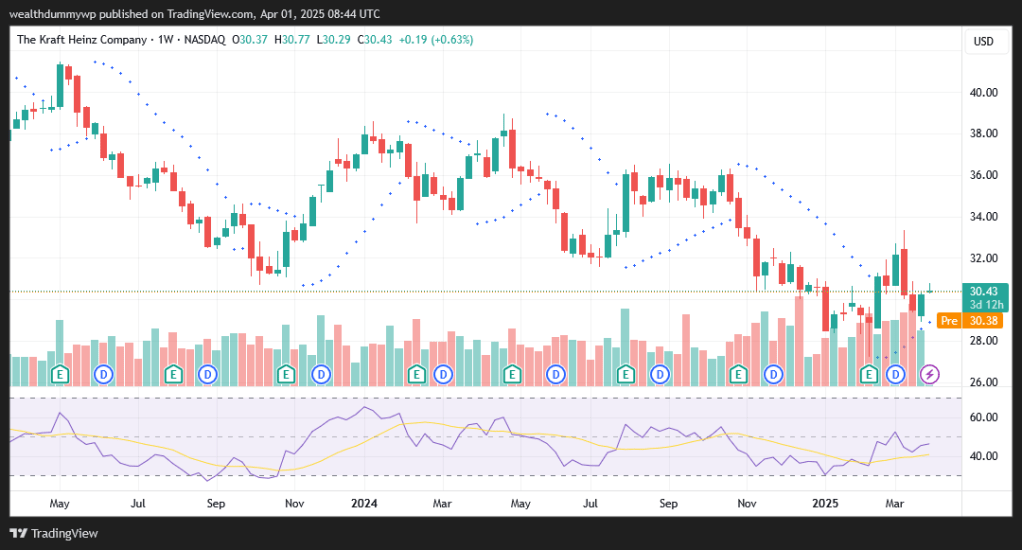

From the price chart we can see that the stock is trading almost at its lowest levels. The 52-week low is at $27.25, reached on 12th of February 2025. At the time of writing the stock price is $30.43. This means that the current level is about 12% above the 52-week low. The 52-week high is $38.96, achieved on 25th of April 2024. We are nearly 30% below this level. On the weekly price chart we can also see that the stock was trading around $41 in May 2023. If compared to the broader market, the company has a better price performance. Year to date the return of KHC is -1.10% and the return of the S&P 500 is -4.37% (both at the time of writing).

In terms of price chart readings. We can see that the RSI is slightly below the neutral level, but the stock is far from oversold. So it doesn`t exactly scream “buy as soon as possible”. The Parabolic SAR might be indicating a beginning of an upside trend. The thing that concerns me in the chart is that recently the stock tested the resistance around $32. From what I see the test wasn`t successful. After this test, there was a significant bearish engulfing bar in the week started on 10th of March. This shows that the sellers had a lot more power than the buyers. Having in mind the recent events I am thinking of the possibility for a test of the 52-week lows.

If we want to have a proper stock analysis, we need to check the fundamentals of the company. Let`s do it:

P/E Ratio: 13.35

P/B Ratio: 0.73

P/S Ratio: 1.41

Current Ratio: 1.06

From the ratios above we can see that the stock can be considered as cheap from a value investing perspective. If compared to its previous valuation levels the company is also cheap. The 3 year average of KHC`s P/E ratio is 21 and the 5 year average is 33.34. We can see that this is significantly higher than the current one. In terms of this we can assume that a valuation expansion on the P/E ratio side could be possible.

In the last 5 years the stock was trading at a P/S ratio always higher than 1.5. The current one is 1.41, so we can assume that the stock is cheap or at least fairly valued according to this metric. The P/B ratio has some fluctuations over the years. Despite that, if we compare the current P/B ratio of 0.73, the stock also looks cheap.

The only metric that I don`t like from this selection is the Current ratio. The reading of 1.06 seems a bit low for me. As a value investor who studied Benjamin Graham I would like to see a Current ratio above 1.50. Of course, I am considering the fact that the times are different. In terms of this, if all the other checks are OK, I can ignore the Current ratio reading. At least I can proceed with caution.

It`s crucial to check the company`s profitability performance. In order to that we will check the Gross Profit margin, the Net Profit margin and the Return on Equity (ROE). At least these are my preferred metrics.

Gross Margin 2024: 34.78%

Net Profit Margin 2024: 10.62%

ROE 2024: 5.56%

Both margins are looking good. Let`s compare that to the industry average. The average Gross Margin for the Packaged Foods Industry is 27.7%. The average Net Profit margin for KHC`s peers is 3.3%. As we can see from this comparison, Kraft Heinz is performing better than the industry average. Looking at the historical values, for the last 5 years the Gross Margin seems to be stable.

The Net Profit margin is a bit more volatile. In 2023 and 2024 the readings are around 10%. This is the best performance of the company in the last 5 years. Before that the Net Profit margin was in single digits. This is something that needs to be considered. It could be some temporary improvement. It could also be some general improvement, which will stabilize the Net margin in the years to come. The time will tell, but for sure this should be closely monitored.

The current ROE is 5.56%, which is not something stellar. I am usually looking for companies with a higher ROE. Anyway, let`s compare that to its peers. The average ROE for the Packaged Food industry is 6.9%. We can see that it`s not much of a difference, but KHC is underperforming the industry. It is also good to have in mind that this reading is one of the best performances in the last 5 years. This is a metric that also needs to be monitored in the future.

Now, let`s talk about the best selling points of the stock.

The thing that I like the most about the stock is the dividend. For the year 2024 the company paid $1.60 in dividends. This compared to the current market price will result in a 5.26% dividend yield. Actually, the dividend amount of $1.60 is the same from 2019 till now. Usually, it is good to see some increase in the payout amount over the years. But the fact that it is stable is also a good sign. Now that the stock is trading at lower levels means that we can capture a higher dividend yield.

The other thing that gives me confidence in the stock is the fact that Warren Buffett keeps it in his portfolio. As a big fan of the Oracle of Omaha I am always checking if I am able to learn something from his actions. I avoid copying his trades, since I don`t know what is in his mind. Despite that, I believe that it is a good thing to check his updates.

Let`s try to see what the future holds for Kraft Heinz:

On the graph above we can see the analysts expectations for the KHC`s Earnings per Share (EPS). We can see that they are expecting pretty stable performance with some limited growth. The forecasts are: an EPS of $2.68 for 2025 and $2.92 for 2028. If the analysts are predicting it right this would result in almost 9% increase in the EPS for the period.

Now let`s play with the numbers. Let`s assume that the analysts are right in their forecasts and the EPS indeed will be $2.92 in 2028. Additional assumption that will need to make is the P/E multiple in 2028. I believe that a P/E of 15 sounds reasonable. Having these forecasts in mind the price of KHC needs to be around $43.80 in 2028. Compared to the current stock price this is about 44% upside. This means that the yearly return in terms of stock price would be almost 11%. Let`s add that to the 5.26% dividend yield. This will result in about 16% return per year for the period. There are also stock buybacks, which also add to the shareholder value creation. Even without taking them into account, the expected return (if the forecasts are correct) seems pretty decent to me.

As usual I will discuss with you my next steps. Having in my everything I said, obviously I will be a buyer of the stock. Yes, there some red flags, which we have discussed. Despite that, the return that I am expecting is able to compensate me for the risks. If the price holds at these levels until Friday I will start buying. Slowly. At the time of writing I don`t own any KHC shares, so this will be the start of a position building. I plan to build a position in the next few months. I will do this by dollar cost averaging. The highest stock price that I am willing to pay is $32. Above that I won`t buy. I believe that below the price $32, the company will be a good add on to my portfolio.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Data sources: for the fundamentals data (stock statistics, EPS, etc.) and the chart I have used tradingview.com. The numbers I have posted are taken from the mentioned source at the time of writing.

Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment