The US stock market is going down these days. At the time of writing S&P 500 is down about 3.90% year to date. NASDAQ 100 is down about 6% year to date. The decline in the S&P 500 and the NASDAQ 100 is even bigger if considered from the all time highs. Do we need to worry? It depends. Mostly on the investment time horizon and the general feeling towards the US economy. By this post I would like to share my two cents on the topic.

I would be worried for the current stock market behavior if I am a short term player. To put it in other words if I am trying to trade it by timing it. Usually, it`s difficult to predict the stock market in the short term. To be completely honest I do have a small short term position. If this is interesting for you, you can check my post about my Target trade. I will give you a hint – it isn`t going well for me so far.

Now, let`s get back to the short term perspectives. I do understand why the market behaves like this. There is a lot of uncertainty in the economy. There are a lot of variables that needs to be considered. Tariffs, inflation, interest rates, economy as a whole. These are just some of the points on which we would need more clarity. Is it possible to predict them? Maybe someone can. For sure, I am not able to do it.

It doesn`t give much positive vibes the fact that Warren Buffett holds significant amounts of cash. For me, as an individual investor, this is a bit disturbing. As far as I have studied Warren Buffett`s investment strategy, he usually does that if he thinks that the valuations are extreme. Who am I to question a genius mind? I will be watching his actions. If he continues to hold this amount of cash, there might be more pain incoming.

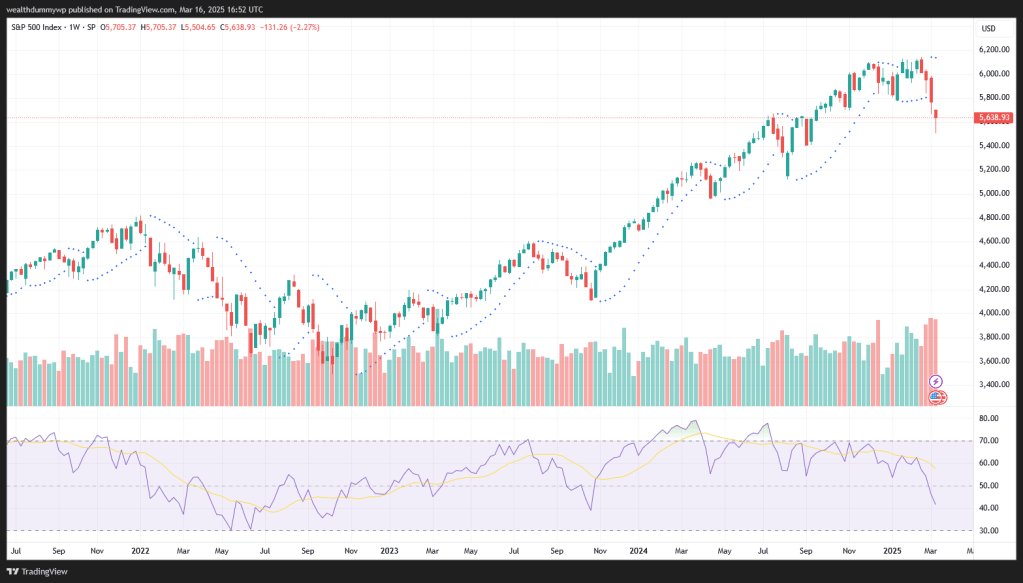

Let`s check how the S&P 500 looks on the charts:

The above is the weekly chart of the S&P 500. To me it seems that the market has reached a decent level of support around $5 630. In terms of weekly RSI we still haven`t visited the oversold zone.

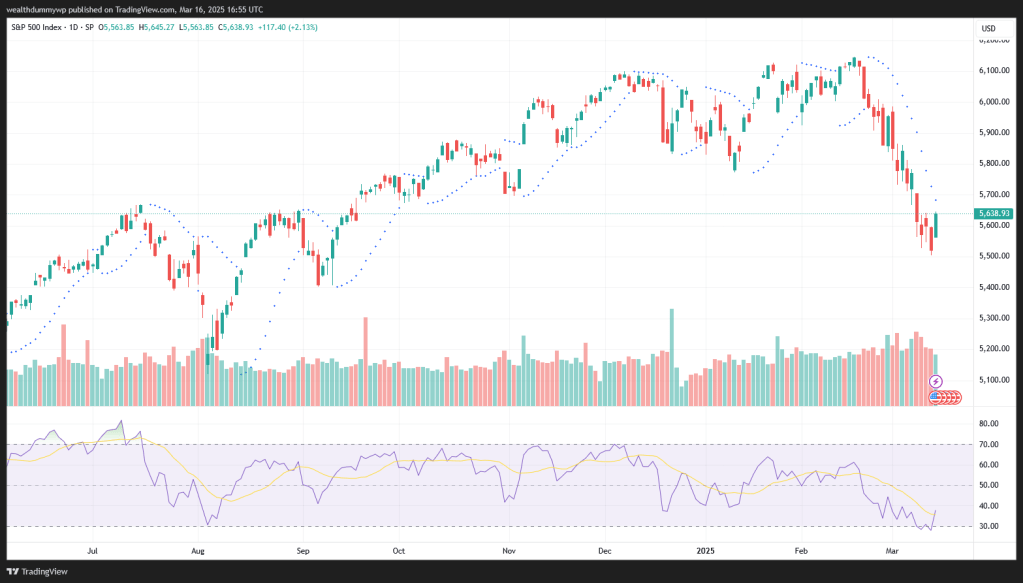

Let`s check the daily chart. We can see that on Thursday the daily RSI was in a oversold zone and now is going back up. There was some recovery on Friday. A good sign is that on Friday the market closed with a good green bar. It might be indicating some market relief.

If I need to guess the next market move, my guess will be that we will see some relief from the selling pressure in the next few days. Having in mind all of the uncertainties, I won`t even try guessing for more than a few days.

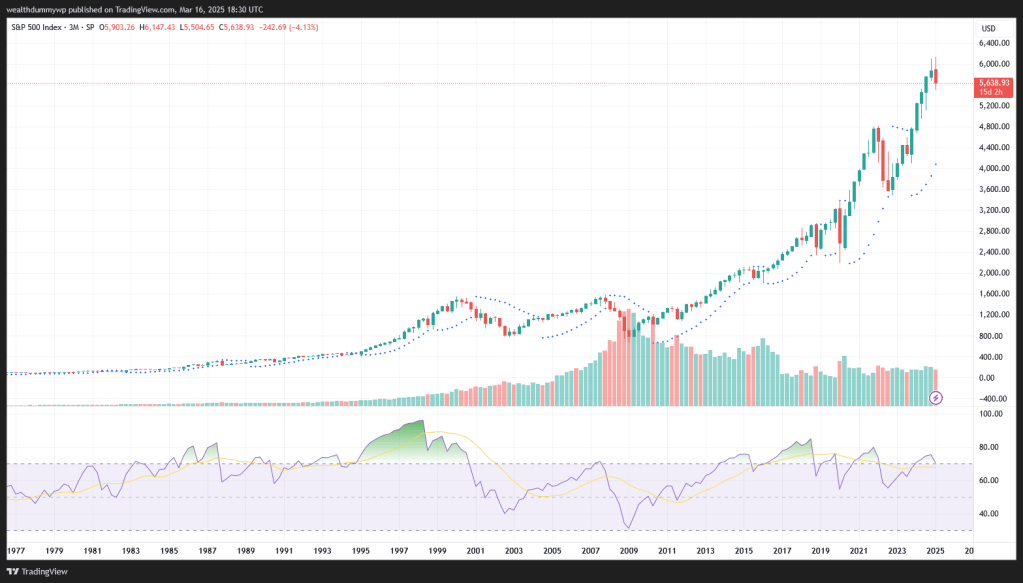

We have discussed the short term horizon. Now let`s focus on the long term. In order to do so, I would like to zoom out from the recent events. The long term focus looks like this:

This is the chart of S&P 500 going back to 1977. We can clearly see the difference between the current price and the price back then. During this period there were a lot of market corrections. Despite these sell-offs the people who stayed focused on the long term game, were rewarded with some nice profits.

So, should we worry about the long term performance of the market? I believe that no one knows what is coming. My belief is that the US stock market has a proven track record for being a value creation tool. So, I am happily staying invested and focused on the long run. My hope is that the history will at least rhyme itself.

Did I take any action during this selling pressure? Actually, yes. In the beginning of March I bought some additional shares in companies that I see as value opportunities. Feel free to check my March Investing update. When it comes to selling – no, I didn`t sell any shares during this period.

Let`s wrap things up. My personal opinion is that despite all of the uncertainties the market is still a great place for creating value. For sure, we should proceed with caution. My personal belief is that we, as individual investors, should not focus on the short term market movements. The focus in my opinion should be on the long term value creation. I will leave you with one of my favorite Ben Graham quotes:

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment