Let`s talk about Clear Secure, Inc., ticker YOU on NYSE. In one of my recent posts I mentioned that I have bought shares in the company in the beginning of March. By this post I would like to share my Clear Secure stock analysis, which will explain why I made the purchase.

Before getting into the details of my position let`s have a few words on Clear Secure as a company:

Clear Secure, Inc. is a technology company that specializes in providing a secure identity platform aimed at enhancing the customer experience for various travel and event environments. The company’s core offering is the Clear service, which allows users to verify their identities quickly and securely at airports, stadiums, and other venues using biometric data, such as fingerprints and facial recognition.

Clear’s business model primarily revolves around subscription fees from its users, who pay for expedited access through security checkpoints. The company partners with airports, airlines, sports organizations, and other entities to expand its footprint and improve the efficiency of identity verification processes. By focusing on speed and security, Clear aims to streamline travel and enhance customer satisfaction while also generating revenue through corporate partnerships and service subscriptions.

From the description above we can see that it`s a technology company, which has a secure identity platform and operates on a subscription based model. If you have read some of my previous posts you would know that I am a big fan of subscriptions. I also love technology stocks. And I believe that in the future, the biometric data will play a bigger role in our lives. In terms of this I find the company very attractive. So, I decided to buy some shares. Actually, I discovered the company a few months ago. But I was waiting for a more decent price to join the party.

Now, let’s see what caught my attention in terms of fundamentals. Let me start with the Revenue:

The table above shows the revenues and the respective growth of Clear Secure for the last four years. You can see the amazing growth rate of the company. When I see something like this, I usually assume that the product is good. There is a strong demand for it. Will the growth continue at this rate? It`s difficult to say. It depends on a lot of variables. But I feel comfortable buying a stake in a business that has showed such performance.

Clear Secure became profitable a few years ago, so there isn’t much comparable data for some of the fundamentals. Anyway, let’s check some of them:

Current P/E ratio: 16.14

Current P/S ratio: 6.08

Current P/B ratio: 12.36

Current ratio: 1.03

If you have read any of my other posts you would know that the only thing I like in these metrics is the P/E ratio. From the perspective of a value investor the stock might seem a bit pricey. I am looking at Clear Secure from a GARP perspective (Growth at a reasonable price). So, I have decided to pay less attention to the P/S, P/B and the Current ratios.

Let’s take a look at the profitability of the company.

Gross Margin 2024: 60.07%

Net Profit Margin 2024: 22.02%

Return on Equity 2024: 78.61%

As you can see we have some pretty good looking numbers. Actually, these numbers, combined with the revenue growth is the reason why I liked the stock so much. If the company is able to sustain the growth trajectory and the margins achieved in 2024, the current valuation looks very attractive to me.

Now, let’s try to see what the future holds. Below is a forecast of the expected Earnings per share for the next three years:

The EPS expectations are the following: $1.42 for 2025, $1.76 for 2026 and $1.82 for 2027. The forecast for the company is to become even more profitable. This forecast seems reasonable to me. Especially, having in mind the latest earnings report. If we assume that the EPS projection is correct, my belief is that the company is at least fairly valued. Even if it`s not undervalued, I am OK paying the intrinsic value. I believe that Warren Buffet has a say that it`s better to buy a wonderful company at a fair price than a fair company at a wonderful price. The quote might not be exact, but you get the point.

There is one more thing that I really like about Clear Secure. The company pays dividends. I love dividend paying stocks. For the last 12 months Clear Secure has paid $0.77 in dividends. At the time of writing the stock price is $24.93. This means that the trailing dividend yield is slightly above 3%. In my opinion it`s a very good yield for a growing business. By checking the financial statement of the company we can see that the dividend is well covered. The dividend payout in terms of free cash flow is just 14%. And in terms of profits, it`s 23%. Will the company be able to continue with its dividend policy? It depends on a lot of variables. The time will tell. But even with this uncertainty in mind, I like what I see so far.

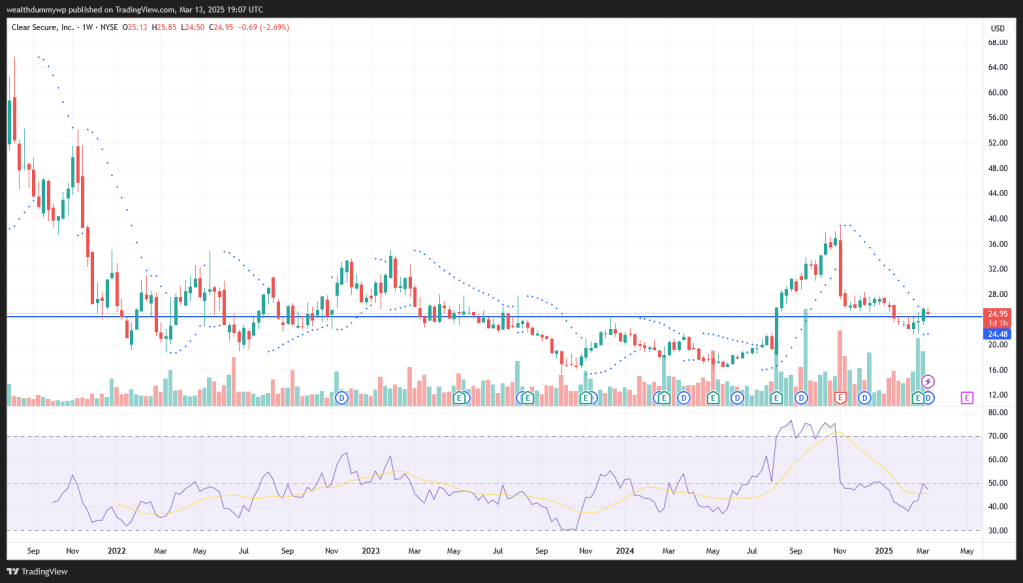

Now, let`s check the stock price chart for some technical analysis:

The chart shows that the price is pretty much between its 52-week low and its 52-week high. By the blue line I have marked my average price of $24.48. My buying price is about 1.8% below the current. We can see that the stock had a very decent performance during the past year. It actually managed to outperform the broader market.

The 52-week high of $38.88 was achieved on 6th of November 2024. Then on 7th of November there was an earnings report. After this earnings miss the stock started its downward movement. I am glad about this price development since I was able to start building a position at a decent price. Then in February the stock reached a good support level at around $22. Unfortunately, I wasn`t able to buy at this price, since I didn`t have available capital to deploy. However, I am happy with my buying level.

I am using two indicators on the chart – RSI and Parabolic SAR. Actually, I am always using this combination. The RSI seems to be in a neutral level. The stock is neither overbought, nor oversold. The Parabolic SAR combined with the near support, gave me confidence that it`s a good moment to start buying.

As usual I will finish my post with my next steps. Even that I like the company, I am not planning to acquire more shares. The current position that I have fits well in my portfolio. I am not planning to sell it soon. I believe that it`s a great company and it`s suitable for a long term investment. However, if the stock price drops below $20 I will definitely buy more.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Data sources: for the fundamentals data (revenue, stock statistics, EPS, etc.) and the chart I have used tradingview.com. The numbers I have posted are taken from the mentioned source at the time of writing.

Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment