This is going to be a quick one. By this post I want to share my investing actions in the beginning of March. I wasn`t able to do it earlier, because I was traveling, but better late than never.

On 5th of March I made three purchases in three different stocks. My March investing budget was allocated as follows: 43% in stock one, 33% in number two and 24% for the third one. Now, let`s get into the details.

The first stock that I bought was FMC Corporation. 33% of the investing budget was dedicated to this purchase. My buying price was $37.76. By this action I have increased my position by 50%. If you would like to read my FMC stock analysis you can do it by visiting this post. There I have explained why I like the stock. I also shared that I am considering buying more of it. Now, let`s have a look at the chart.

The chart is created on TradingView

On this weekly chart, we can see that the stock is still trading far away from its 52-week high. The all-time highs seems to be out of reach at this point. We can see that the RSI is starting to slowly go up from its oversold levels. I will be watching closely if there will be a confirmation from the Parabolic SAR for a trend reversal.

After this purchase my average buying price is $43.16. This level is indicated by the blue line on the chart. As you can see the current price is still below my average. At the time of writing FMC stock is trading at $41.29. This means that I am currently sitting at a 4.33% unrealized loss. If the stock continues to trade below my average I will consider buying more. Especially, if the company shows some results improvement in the future earnings calls.

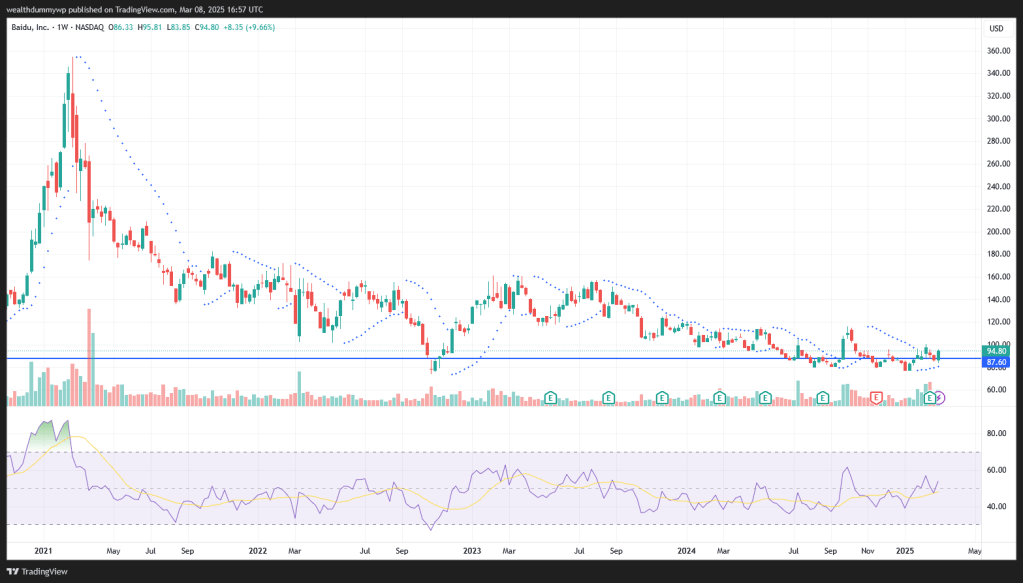

Baidu, Inc was my second buy. 24% percent of my March investing budget was dedicated to this company. My buying price this month was $90.13. I have increased my position by about 50%. Unlike the FMC Corporation, in this case I was averaging up my acquiring price. My Baidu stock analysis can be found in this post. Let`s go to the chart:

On the weekly chart we can see that the price is below the 52-week highs. I won`t even mention the all-time highs. In my view the stock is trading sideways with a slight downtrend. The RSI is in a neutral zone. The Parabolic SAR could be indicating a trend reversal. I will be watching closely the price action.

After my March investment in Baidu, my average price for this position is $87.60. I have indicated the level on the price chart by the blue line. At the time of writing BIDU stock is trading at $94.80. This means a current 8.22% unrealized gain. My plan is to hold the position. Of course, I`ll be watching closely the future earnings calls if there are any significant changes. I am not planning to buy more shares at these price levels. For sure I will post an update if I buy or sell. Feel free to subscribe, so you don`t miss my updates.

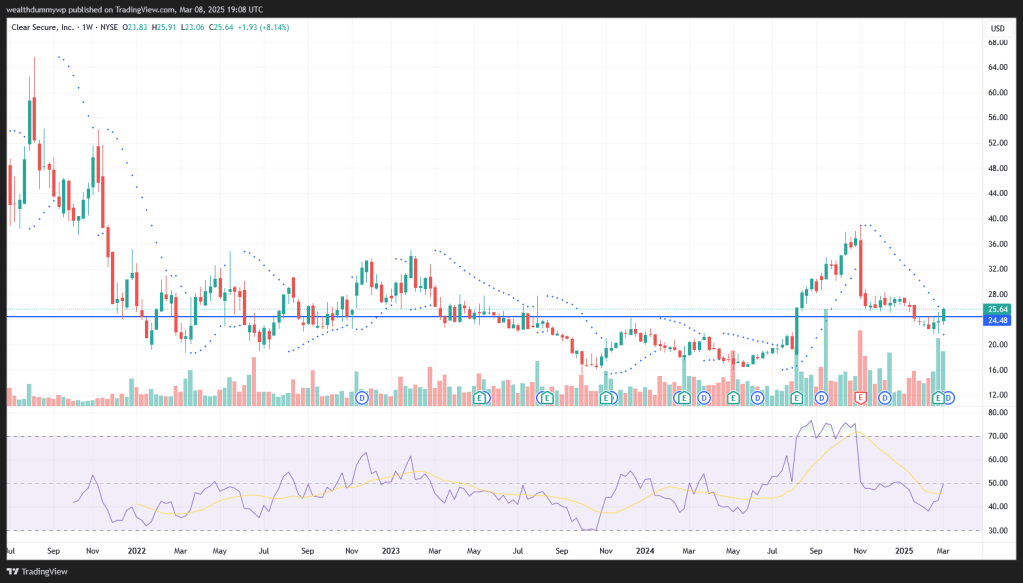

Now we are moving to my third and final stock purchase in March. This is Clear Secure Inc, ticker YOU on NYSE. This is a brand new position for me. My buying price was $24.48. Since it`s my first buy the average price is the same. I will share my thought on the company in a separate post. As of now I just wanted to share that I have started building a position. Let`s have a quick look on the chart:

On the weekly chart I have marked my average price with the blue line. We can see from the chart that my buying price is almost between the 52-week high and the 52-week low. The 52-week high was achieved in November 2024. However, after earnings expectations were missed, the stock experienced a significant selling pressure. On 26th of February there was an earnings call and the results were good. So I have decided to start building a position.

On the weekly chart, we can see that the RSI is in a neutral zone. It is slowly going up from the lower readings. I believe that the stock price has a good support level around $22.50. The Parabolic SAR might hint us that the price is ready to go up. The technical analysis set-up seemed appropriate for me to start buying shares of the company.

The stock price for Clear Secure at the time of writing is $25.64. This compared to my buying price ($24.48) means that I have about 5% unrealized gain. I don`t have any plans to sell soon. If the price falls significantly below $25 I might buy some additional shares. For sure, I`ll post an update if I trade the stock (buy or sell). So, stay tuned.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Leave a comment