Palantir. I love the company. I love the stock. The valuation…not my favorite. By this post I would to like share my Palantir stock analysis and my view on the company. I`ve been a shareholder, currently I am not. Over the last year the stock was an amazing performer, making its shareholders wealthy. But we`ll get to that a bit later.

As usual, I`ll be starting my post with a brief introduction of the company:

Palantir Technologies Inc. (ticker: PLTR) is a public American software company specializing in big data analytics. Founded in 2003, the company originally focused on serving government agencies, particularly in defense and intelligence. Over time, Palantir has expanded its offerings to include commercial applications. It helps businesses across various sectors harness their data.

Business Model

Palantir’s business model revolves around its two primary platforms: Palantir Gotham and Palantir Foundry.

- Palantir Gotham: This platform is designed for government agencies and is used for data integration, analysis, and operational management. It enables users to identify patterns and relationships within vast amounts of data, facilitating intelligence operations and security initiatives.

- Palantir Foundry: Targeting the commercial sector, Foundry provides organizations with the tools to integrate, manage, and analyze their data. It allows businesses to build customized data applications that help in optimizing operations, enhancing collaboration, and driving insights.

Palantir primarily operates on a subscription-based model, where clients pay for software licenses and support services.

If we need to summarize, Palantir is a company specialized in the big data analytics business. I believe that this industry has a huge potential. It`s expected to grow significantly over the coming years. So, we have a huge growth potential for a specialized company like Palantir. This is one of the reasons why I like the company so much. It has potential. The other thing that I really like is the fact that the company operates on a subscription-based model. I really like seeing a recurring revenue.

Now, let`s go back for a second to my story with the stock. I`ve been a shareholder in the company when the price was single digits. I bought my position in May 2023. My average buying price was about $7.50. Back then it was easy for me to see that the company is clearly undervalued. In June 2023 the price doubled and I have decided to sell the half of my position. For me the price was rising too rapidly. I took out the money that I have invested. I decided to hold the rest of my position. I wanted to see how it will play out.

I held until November 2024. The stock price during that time was around $60. As you might expect the growth was too rapid for me, I was concerned that the rally might end. So, I sold the rest of my position. The average selling price of my position is $37.50. This compared to the current market price sounds incredibly stupid. But I was and I am happy with my decision. It`s a good moment to mention that I am considering myself as a value investor. Worst case scenario a GARP (Growth at a reasonable price) investor. As such, I am closely following metrics like P/E, P/S, P/B, etc. And for me, they were off the charts. Also, in a period, a little longer than a year, I have realized about 400% return. Not so bad performance. I have missed a lot of profits along the way. However, by taking the profits, I was feeling comfortable with my portfolio. I believe that this is really important in the investing world.

Now, let`s check the recent development around the stock:

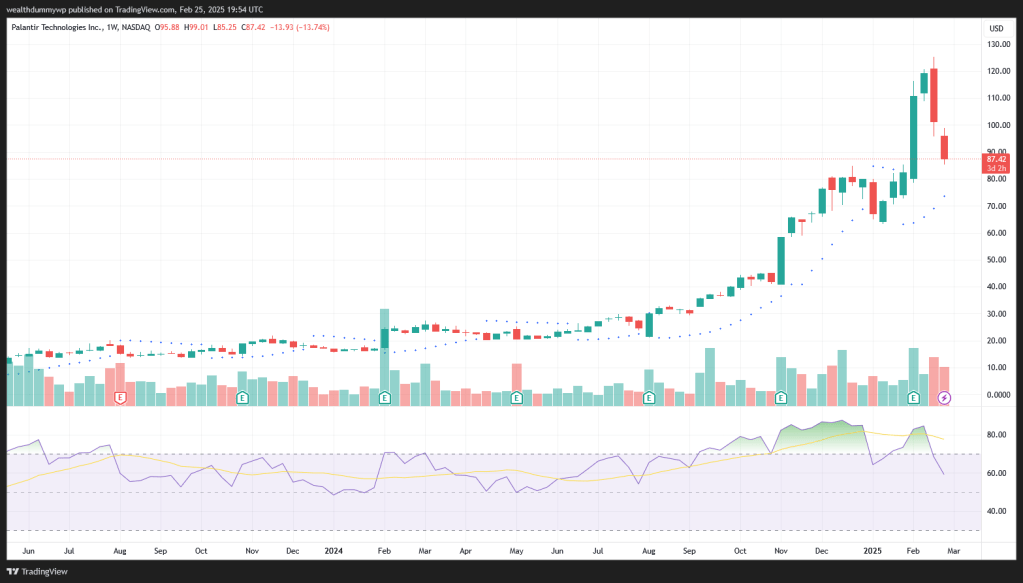

The chart is created on TradingView

On this daily chart, we can see the stock price development. It starts from the beginning of November 2024 and continues until the 24th of February 2025. In the beginning of November 2024 the Palantir stock was trading slightly above $40. After the elections day we can see that the price started to rise gradually. My understanding is that the market was optimistic about the US leadership in the AI space. The trend was continuing (with a slight correction) and on 3rd of February the stock was trading at almost $84. In other words the return for this period was slightly above 100%. Amazing performance.

Then the earnings report came. On 3rd of February after market close, Palantir reported its Q4 earnings. The results were better than expected and there was a strong outlook guidance. On 4th of February the market opened and the stock was trading with a gap up. This trend continued in the following days, reaching a high of $125 on 18th of February. Even greater performance.

And then on 19th of February the stock dropped significantly. The reason was a report saying that the administration would need to cut expenses. Since then there is a significant selling pressure. At the time of writing the Palantir stock is trading around $87. This results in about 30% loss from the high. Pretty wild ride.

So, what to do with this. Will I try to trade it? I might be. I`ll be looking for a very short term buy. If the price continues to drop, I might buy shares, if there is a good support level. I`ll be hoping to sell them for a quick profit. It will be a purely technical analysis play. At the time of writing I am just observing the price action.

Let`s zoom out a bit so we can see the bigger picture:

On a weekly chart the stock price movement looks even more impressive. We can see that the RSI is still close to the overbought range. We can see an engulfing bar, formed during the week started on 17th of February. A bar from this magnitude could be indicating a trend reversal. This still needs to be confirmed by the price action over the coming weeks. Currently, I don`t see a confirmation from the Parabolic SAR for a trend reversal. I`ll definitely keep a close attention on the chart.

Now, let`s go through some fundamental metrics:

- Current P/E Ratio: 535.95

- Current P/S Ratio: 80.01

- Current P/B Ratio: 42.39

- Current Ratio: 5.96

As a value investor these number scream to me “Stay away”. If you have read some of my previous posts, you would know that usually I`m looking for a P/E below 15. Yes, I`m aware that this is a growth stock. As such I am willing to pay a higher P/E multiple. But P/E above 500, it`s too much for me. P/S ratio also seems expensive to me. I do like the current ratio.

The gross margin is looking really good. For 2024 it was 80.25%. This shows an improvement compared to the previous years. The net profit margin for 2024 is 16.13%, which is also an improvement. It`s not that great for such highly valued company, but I`m assuming that it will get better over time. In my opinion the margins are looking good.

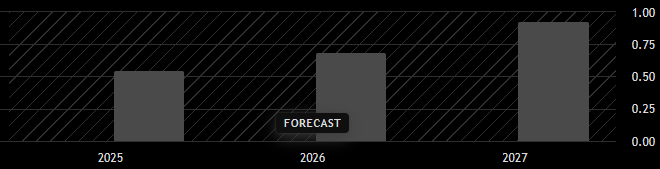

As usual let`s try to see what the future holds:

This is the analysts prediction for the earnings per share over the coming years. It`s expected the EPS for 2027 to come at $0.92. It`s hard for me to pay almost $90 for a share of a company that might generate an EPS of $0.92 in three years time.

So, my next steps. I`ll wait. Patiently. As I have said in the beginning of the post I love the company. I believe that the product is great. I can see the potential in the business model and the total addressable market. The current stock price (even after the drop) isn`t the right one for me. I`m considering the future growth potential, so I won`t be looking for my preferred readings of the multiples. If the stock price ever comes back below the level of $40 I`ll be buying again. If not, I`ll be staying on the sideline, feeling happy that I had a decent return on this stock.

If you enjoy reading my posts and find them useful, please consider subscribing to my blog. This way you`ll be notified as soon as I post something new. If you believe that someone may be interested in the topic, feel free to share the post with them.

Disclaimer:

I am not a financial or investment advisor. The content of this post represents my personal views and is purely informational. It should not be taken as financial or investing advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Details about TradingView affiliate link, according to the partner program:

- There is a $15 bonus for the referred user, which can be used for purchasing a TradingView paid plan

- In order to receive the bonus, you need to be a new user of TradingView

- If you sign up by using my affiliate link and purchase a paid plan through your web browser, I`ll be receiving an affiliate reward, which will help me support my blog

Data sources: for the fundamentals data (stock statistics, EPS, etc.) and the chart I have used tradingview.com. The numbers I have posted are taken from the mentioned source at the time of writing.

Some of the information may be generated by using AI. Always double check the information and do your own research.

Leave a comment